Estimated Value: $283,000 - $308,000

3

Beds

3

Baths

1,779

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 709 Fortanini Cir Unit 150, Ocoee, FL 34761 and is currently estimated at $296,016, approximately $166 per square foot. 709 Fortanini Cir Unit 150 is a home located in Orange County with nearby schools including Prairie Lake Elementary School, Lakeview Middle, and Ocoee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 21, 2013

Sold by

Axelsson Rauni M and Ogden Ritva K Valentina Axelsson

Bought by

Greater Orlando Investments Llc

Current Estimated Value

Purchase Details

Closed on

Oct 10, 2012

Sold by

Lynn Wynston R and Lynn Patricia J

Bought by

Axelsson Rauni M and Ogden Ritva K Valentina Axelsson

Purchase Details

Closed on

Feb 18, 2011

Sold by

Federal National Mortgage Association

Bought by

Lynn Wynston R and Lynn Patricia J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,809

Interest Rate

4.76%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 16, 2010

Sold by

Delgado Jenny Vivas

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Apr 27, 2007

Sold by

Eh/Transeastern Llc

Bought by

Delgado Jenny Vivas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,800

Interest Rate

6.12%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Greater Orlando Investments Llc | -- | Attorney | |

| Axelsson Rauni M | $95,000 | Treasure Title Insurance Age | |

| Lynn Wynston R | $99,900 | Servicelink | |

| Federal National Mortgage Association | -- | None Available | |

| Delgado Jenny Vivas | $237,800 | Universal Land Title Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lynn Wynston R | $90,809 | |

| Previous Owner | Delgado Jenny Vivas | $225,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,424 | $266,320 | $50,000 | $216,320 |

| 2024 | $4,081 | $266,320 | $50,000 | $216,320 |

| 2023 | $4,081 | $249,995 | $50,000 | $199,995 |

| 2022 | $3,629 | $209,976 | $42,000 | $167,976 |

| 2021 | $3,382 | $189,203 | $42,000 | $147,203 |

| 2020 | $3,060 | $177,115 | $42,000 | $135,115 |

| 2019 | $2,954 | $158,149 | $35,000 | $123,149 |

| 2018 | $2,968 | $154,896 | $35,000 | $119,896 |

| 2017 | $2,846 | $151,707 | $35,000 | $116,707 |

| 2016 | $2,608 | $129,143 | $16,000 | $113,143 |

| 2015 | $2,440 | $116,404 | $11,000 | $105,404 |

| 2014 | $2,346 | $111,550 | $11,000 | $100,550 |

Source: Public Records

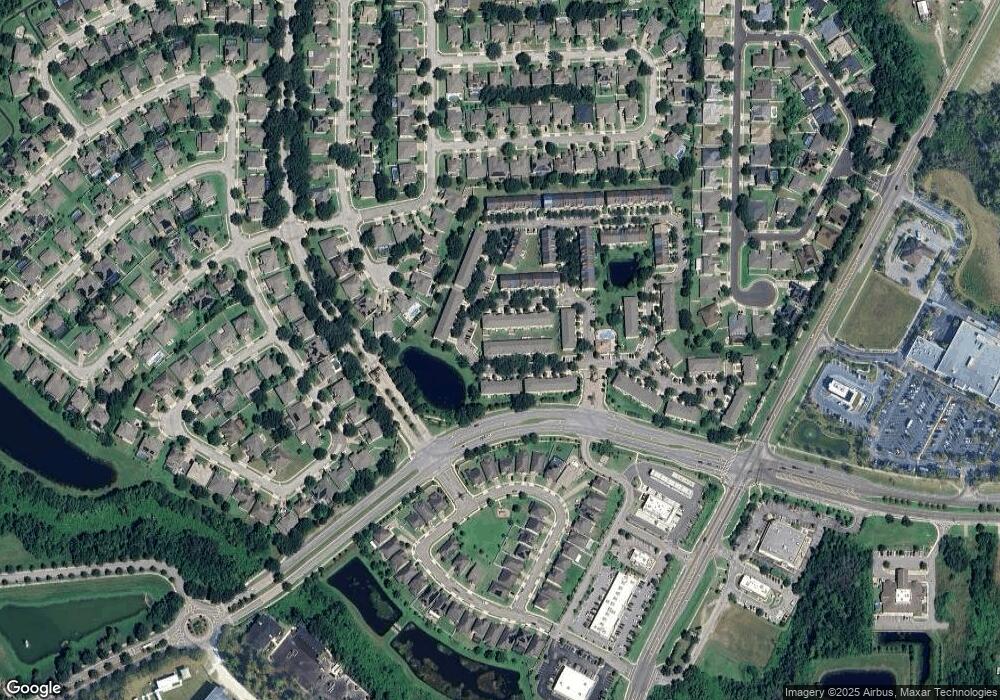

Map

Nearby Homes

- 670 Fortanini Cir

- 613 Fortanini Cir

- 2545 Azzurra Ln

- 616 Cimarosa Ct

- 1641 Regal River Cir

- 2556 Cabernet Cir

- 566 Palio Ct

- 2724 Westyn Cove Ln

- 2100 West Rd

- 651 Westyn Bay Blvd

- 0 Fountains Blvd W

- 1873 Donahue Dr

- 3127 Piccolo Ct

- 3010 Stonegate Dr

- 3519 Briarwood Grove Dr

- 2353 Coachwood Dr

- 2434 Magnolia Reserve Rd

- 2442 Magnolia Reserve Rd

- 2438 Magnolia Reserve Rd

- 2430 Magnolia Reserve Rd

- 709 Fortanini Cir

- 705 Fortanini Cir

- 713 Fortanini Cir

- 721 Fortanini Cir

- 744 Fortanini Cir

- 725 Fortanini Cir

- 720 Fortanini Cir Unit 123

- 720 Fortanini Cir

- 717 Fortanini Cir

- 711 Marotta Loop

- 715 Marotta Loop

- 719 Marotta Loop

- 703 Marotta Loop

- 729 Fortanini Cir

- 712 Fortanini Cir

- 716 Fortanini Cir

- 704 Fortanini Cir

- 733 Fortanini Cir

- 727 Marotta Loop