710 Walter Morris Rd Lebanon, TN 37087

Estimated Value: $501,000 - $827,773

--

Bed

2

Baths

2,206

Sq Ft

$301/Sq Ft

Est. Value

About This Home

This home is located at 710 Walter Morris Rd, Lebanon, TN 37087 and is currently estimated at $664,387, approximately $301 per square foot. 710 Walter Morris Rd is a home located in Smith County with nearby schools including Union Heights Elementary School, Smith County Middle School, and Smith County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 25, 2022

Sold by

Jennifer Tayse Kathryn

Bought by

Restrepo Elizabeth and Restrepo Carlos

Current Estimated Value

Purchase Details

Closed on

Feb 3, 2022

Sold by

Jennifer Tayse Kathryn

Bought by

Sloan Daniel F and Sloan Ashlie E

Purchase Details

Closed on

Dec 2, 2020

Sold by

Tayse Kathryn Jennifer and Purnell Houston Victor

Bought by

Houston Victor Purnell

Purchase Details

Closed on

Nov 2, 2020

Sold by

Tayse Kathryn Jennifer and Purnell Houston Victor

Bought by

Tayse Kathryn Jennifer

Purchase Details

Closed on

Mar 27, 2019

Sold by

Houston Kathryn

Bought by

Purnell Houston Victor

Purchase Details

Closed on

Mar 21, 1986

Bought by

Houston Herbert F & Kathryn

Purchase Details

Closed on

Sep 1, 1978

Purchase Details

Closed on

Jan 26, 1971

Purchase Details

Closed on

Dec 30, 1955

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Restrepo Elizabeth | -- | Donoho Taylor & Taylor | |

| Sloan Daniel F | $200,000 | Bellar & Winkler Pllc | |

| Houston Victor Purnell | -- | None Available | |

| Tayse Kathryn Jennifer | -- | None Available | |

| Purnell Houston Victor | -- | None Available | |

| Houston Herbert F & Kathryn | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,586 | $91,500 | $34,925 | $56,575 |

| 2023 | $1,586 | $91,500 | $0 | $0 |

| 2022 | $2,030 | $117,125 | $42,025 | $75,100 |

| 2021 | $3,763 | $151,750 | $107,775 | $43,975 |

| 2020 | $4,181 | $151,750 | $107,775 | $43,975 |

| 2019 | $4,181 | $151,750 | $107,775 | $43,975 |

| 2018 | $3,277 | $153,150 | $108,750 | $44,400 |

| 2017 | $3,276 | $153,150 | $108,750 | $44,400 |

| 2016 | $3,199 | $137,875 | $97,350 | $40,525 |

| 2015 | $3,199 | $137,875 | $97,350 | $40,525 |

| 2014 | $3,199 | $137,875 | $97,350 | $40,525 |

Source: Public Records

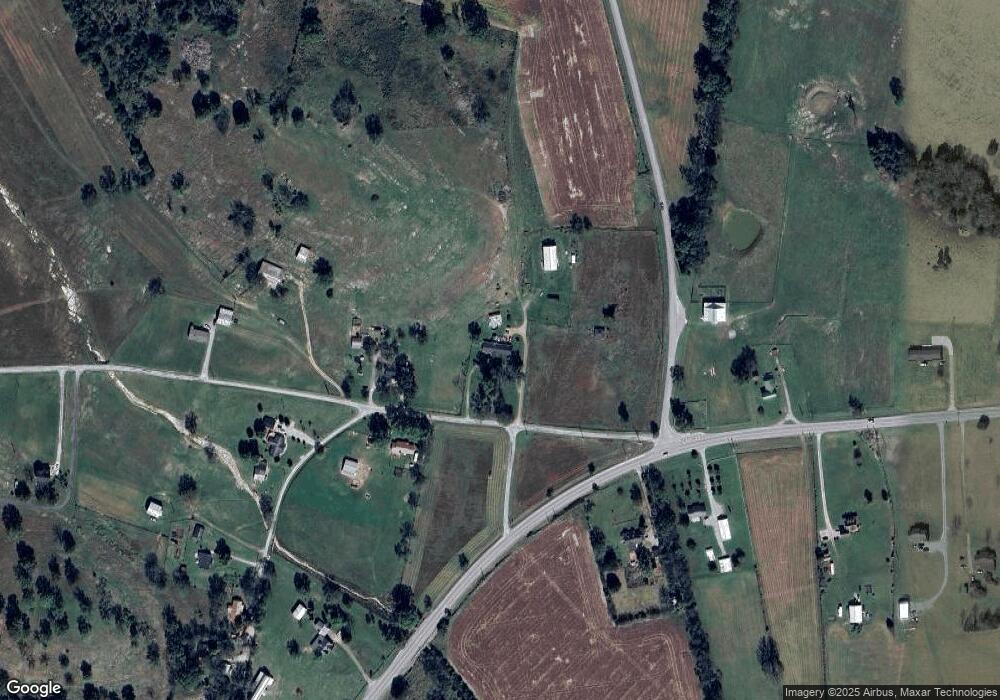

Map

Nearby Homes

- 763 Lebanon Hwy

- 142 Hiwassee Rd

- 97 Whitefield Ln

- 0 Whitefield Ln

- 42 Paradise Hills Ln

- 0 Swindell Hollow Rd

- 0 Rawls Creek Rd

- 1416 Swindell Hollow Rd

- 2980 Swindell Hollow Rd

- 185 Bellwood Rd

- 3104 Swindell Hollow Rd

- 6442 Brandy Ln

- 424 Hiwassee Rd

- 0 Lovells Island Unit RTC2990756

- 0 Lovells Island Unit RTC2971031

- 6 Badger Ln

- 14 Coomer Ln

- 0 Badger Ln

- 121 Lock Seven Ln

- 0 Bob Moore Ln

- 716 Walter Morris Rd

- 1 Walter Morris Rd

- 715 Walter Morris Rd

- 6 Shady Trail

- 875 Lebanon Hwy

- 724 Walter Morris Rd

- 866 Lebanon Hwy

- 894 Lebanon Hwy

- 894 Lebanon Hwy

- 12 Shady Trail

- 14 Shady Trail

- 1 Holland Ln

- 16 Shady Trail

- 856 Lebanon Hwy

- 863 Lebanon Hwy

- 900 Lebanon Hwy

- 737 Walter Morris Rd

- 857 Lebanon Hwy

- 739 Walter Morris Rd

- 853 Lebanon Hwy