7100 General Gage Ct Brandywine, MD 20613

Estimated Value: $645,000 - $683,000

Studio

1

Bath

3,414

Sq Ft

$194/Sq Ft

Est. Value

About This Home

This home is located at 7100 General Gage Ct, Brandywine, MD 20613 and is currently estimated at $662,500, approximately $194 per square foot. 7100 General Gage Ct is a home located in Prince George's County with nearby schools including Brandywine Elementary School, Gwynn Park Middle School, and Gwynn Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 14, 2024

Sold by

Johns Arthur J and Thompson Tamika

Bought by

Johns Arthur J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$675,640

Interest Rate

6.44%

Mortgage Type

VA

Purchase Details

Closed on

Nov 9, 2015

Sold by

Johns Arthur J

Bought by

Johns Arthur J and Johns Tamika Thompson

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$404,300

Interest Rate

3.79%

Mortgage Type

VA

Purchase Details

Closed on

Oct 24, 2014

Sold by

K Hovnanian Homes Of Maryland I Llc

Bought by

Johns Arthur J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$410,634

Interest Rate

4.18%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johns Arthur J | -- | None Listed On Document | |

| Johns Arthur J | -- | None Listed On Document | |

| Johns Arthur J | -- | Lawyers Trust Title Company | |

| Johns Arthur J | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johns Arthur J | $675,640 | |

| Previous Owner | Johns Arthur J | $404,300 | |

| Previous Owner | Johns Arthur J | $410,634 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,890 | $629,300 | $125,600 | $503,700 |

| 2024 | $5,890 | $579,467 | -- | -- |

| 2023 | $398 | $529,633 | $0 | $0 |

| 2022 | $398 | $479,800 | $100,600 | $379,200 |

| 2021 | $398 | $459,400 | $0 | $0 |

| 2020 | $398 | $439,000 | $0 | $0 |

| 2019 | $6,543 | $418,600 | $100,300 | $318,300 |

| 2018 | $6,373 | $408,200 | $0 | $0 |

| 2017 | $6,244 | $397,800 | $0 | $0 |

| 2016 | -- | $387,400 | $0 | $0 |

| 2015 | $269 | $384,500 | $0 | $0 |

| 2014 | $269 | $18,700 | $0 | $0 |

Source: Public Records

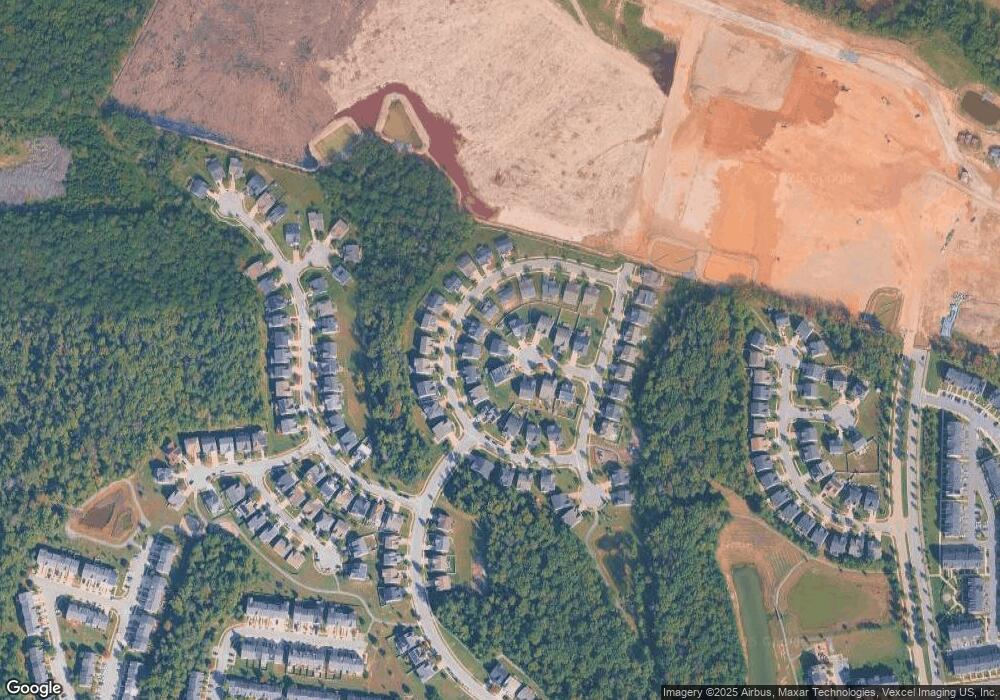

Map

Nearby Homes

- 7024 Commander Howe Terrace

- 15407 Pulaski Rd

- 15407 Gideon Gilpin St

- 15005 Douglas Fir Ln

- 15420 Kennett Square Way

- 15012 General Lafayette Blvd

- 15001 Douglas Fir Ln

- 15411 Chaddsford Lake Dr

- 15511 Wylie Rd

- 7407 Four Gardens Rd

- 7404 Calm Retreat Blvd

- 7414 Calm Retreat Blvd

- 7424 Calm Retreat Blvd

- 7005 Chadds Ford Dr

- 15622 Chadsey Ln

- 15440 General Lafayette Blvd

- 7130 Britens Way

- 14934 Ring House Rd

- 14910 Townshend Terrace Ave

- 14801 Mattawoman Dr

- 7114 Battle Field Loop

- 7102 General Gage Ct

- 7101 General Gage Ct

- 7116 Battle Field Loop

- 7110 Battle Field Loop

- 7120 Battle Field Loop

- 7104 General Gage Ct

- 7103 General Gage Ct

- 7124 Battle Field Loop

- 7108 Battle Field Loop

- 7106 Battle Field Loop

- 7126 Battle Field Loop

- 7105 General Gage Ct

- 7106 General Gage Ct

- 7115 Battle Field Loop

- 7117 Battle Field Loop

- 7113 Battle Field Loop

- 7104 Battle Field Loop

- 7111 Battle Field Loop

- 7128 Battle Field Loop

Your Personal Tour Guide

Ask me questions while you tour the home.