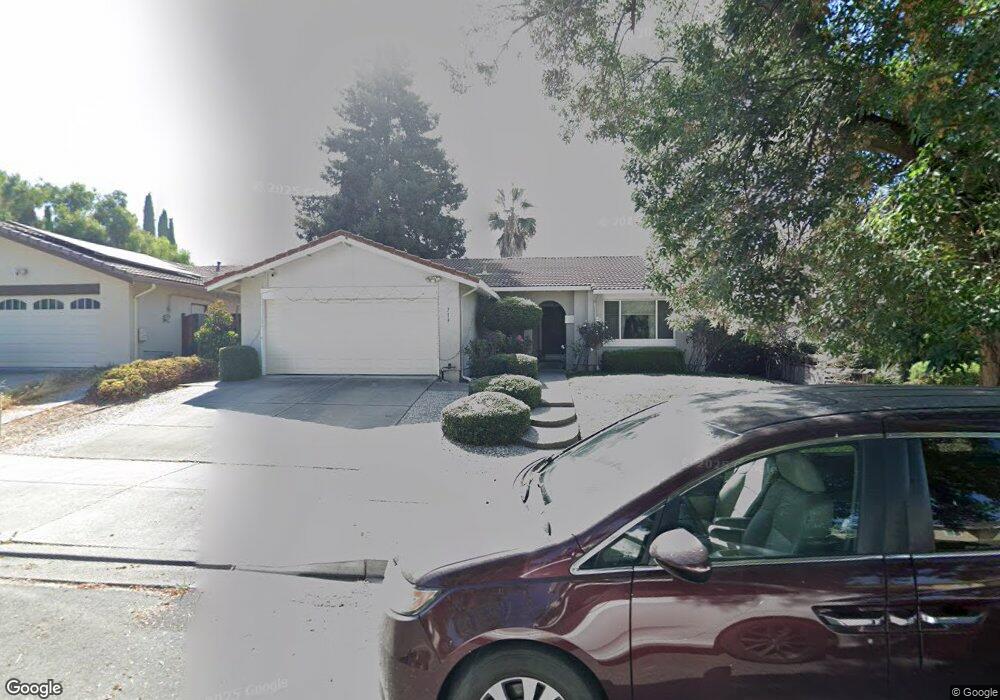

713 Iroquois Way Fremont, CA 94539

Warm Springs NeighborhoodEstimated Value: $1,850,850 - $2,094,000

3

Beds

2

Baths

1,542

Sq Ft

$1,250/Sq Ft

Est. Value

About This Home

This home is located at 713 Iroquois Way, Fremont, CA 94539 and is currently estimated at $1,927,213, approximately $1,249 per square foot. 713 Iroquois Way is a home located in Alameda County with nearby schools including James Leitch Elementary School, Warm Springs Elementary School, and John M. Horner Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 7, 2013

Sold by

Bayley Mylinh D and Duong Mylinh

Bought by

Ponakanti Praveen K and Ponakanti Kalpana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$555,000

Outstanding Balance

$367,391

Interest Rate

2.37%

Mortgage Type

New Conventional

Estimated Equity

$1,559,822

Purchase Details

Closed on

May 26, 2007

Sold by

Duong Mylinh and Duong Francis

Bought by

Duong Mylinh

Purchase Details

Closed on

Apr 30, 2003

Sold by

Tam Raymond On and Tam Katherine Ka Man

Bought by

Duong Mylinh and Duong Francis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 14, 1993

Sold by

Tam Raymond and Tam Ka Man

Bought by

Tam Raymond On and Tam Ka Man

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$141,000

Interest Rate

6.81%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ponakanti Praveen K | $759,000 | Chicago Title Company | |

| Duong Mylinh | -- | None Available | |

| Duong Mylinh | $493,000 | American Title Company | |

| Tam Raymond On | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ponakanti Praveen K | $555,000 | |

| Previous Owner | Duong Mylinh | $320,000 | |

| Previous Owner | Tam Raymond On | $141,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,124 | $927,371 | $280,262 | $654,109 |

| 2024 | $11,124 | $909,052 | $274,767 | $641,285 |

| 2023 | $10,828 | $891,092 | $269,380 | $628,712 |

| 2022 | $10,690 | $873,488 | $264,100 | $616,388 |

| 2021 | $10,427 | $856,225 | $258,922 | $604,303 |

| 2020 | $10,466 | $854,377 | $256,268 | $598,109 |

| 2019 | $10,346 | $837,631 | $251,245 | $586,386 |

| 2018 | $10,144 | $821,211 | $246,320 | $574,891 |

| 2017 | $9,889 | $805,109 | $241,490 | $563,619 |

| 2016 | $9,723 | $789,326 | $236,756 | $552,570 |

| 2015 | $9,595 | $777,473 | $233,201 | $544,272 |

| 2014 | $9,431 | $762,244 | $228,633 | $533,611 |

Source: Public Records

Map

Nearby Homes

- 47131 Yucatan Dr

- 47236 Cavanaugh Common

- 281 Hackamore Common

- 136 Hackamore Ln Unit 18

- 524 E Warren Ave

- 114 Hackamore Ln Unit 14

- 46985 Ocotillo Ct

- 47768 Wabana St

- 46869 Fernald Common Unit 38

- 47252 Mission Falls Ct

- 47222 Mission Falls Ct

- 642 Mcduff Ave

- 46925 Aloe Ct

- 472 Mayten Way

- 130 Kootenai Dr

- 296 Kansas Way

- 270 Tuolumne Dr

- 1485 Deschutes Place

- 1748 Kilowatt Way Unit 301

- 2250 Kilowatt Way Unit 214

- 733 Iroquois Way

- 703 Iroquois Way

- 745 Covina Way

- 757 Covina Way

- 753 Iroquois Way

- 691 Iroquois Way

- 769 Covina Way

- 734 Iroquois Way

- 714 Iroquois Way

- 773 Iroquois Way

- 671 Iroquois Way

- 721 Covina Way

- 754 Iroquois Way

- 704 Iroquois Way

- 781 Covina Way

- 774 Iroquois Way

- 682 Iroquois Way

- 793 Iroquois Way

- 793 Covina Way

- 794 Iroquois Way