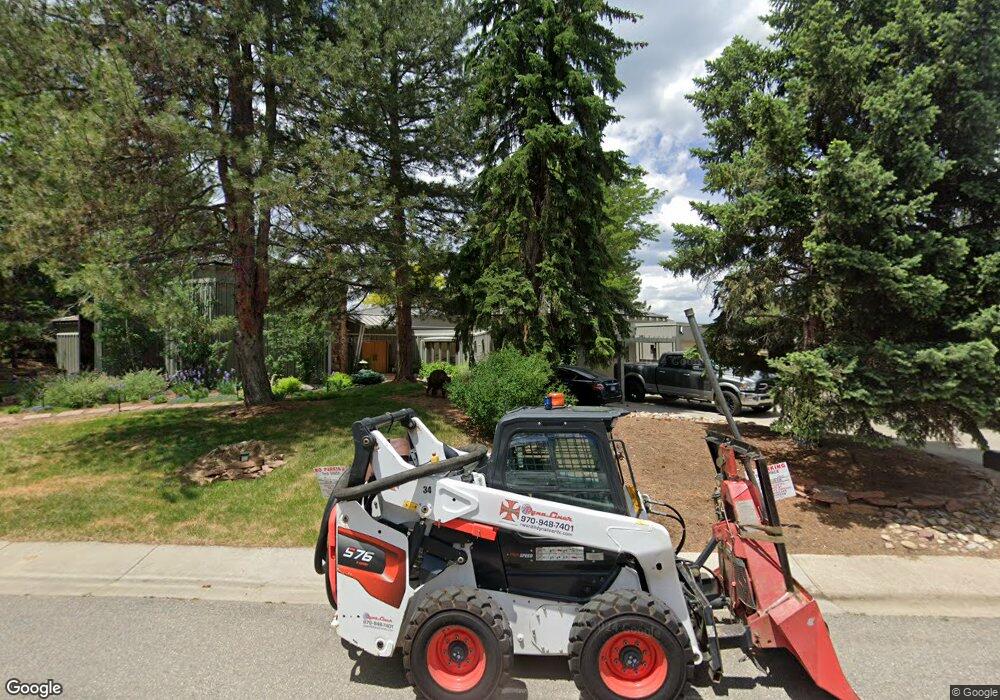

7135 Rustic Trail Boulder, CO 80301

Gunbarrel NeighborhoodEstimated Value: $2,262,000 - $2,609,796

3

Beds

3

Baths

3,813

Sq Ft

$631/Sq Ft

Est. Value

About This Home

This home is located at 7135 Rustic Trail, Boulder, CO 80301 and is currently estimated at $2,405,449, approximately $630 per square foot. 7135 Rustic Trail is a home located in Boulder County with nearby schools including Heatherwood Elementary School, Nevin Platt Middle School, and Boulder High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2022

Sold by

Bickham Bradley S

Bought by

Bickham Bradley S and Bickham Dana S

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2015

Sold by

Gold Gordon T and Gold Cindy L

Bought by

Bickham Bradley S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

3.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 15, 1998

Sold by

Coffman Mary R and Coffman Mary R

Bought by

Gold Gordon T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$464,000

Interest Rate

7.18%

Purchase Details

Closed on

Apr 9, 1996

Sold by

Coffman Melvin J

Bought by

Coffman Mary R

Purchase Details

Closed on

Oct 9, 1990

Bought by

Bickham Bradley S and Bickham Dana S

Purchase Details

Closed on

Jun 24, 1986

Bought by

Bickham Bradley S and Bickham Dana S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bickham Bradley S | -- | None Listed On Document | |

| Bickham Bradley S | $1,250,000 | First American Title Ins Co | |

| Gold Gordon T | $595,500 | -- | |

| Coffman Mary R | -- | -- | |

| Bickham Bradley S | $320,000 | -- | |

| Bickham Bradley S | $380,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bickham Bradley S | $1,000,000 | |

| Previous Owner | Gold Gordon T | $464,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,180 | $151,344 | $71,675 | $79,669 |

| 2024 | $14,180 | $151,344 | $71,675 | $79,669 |

| 2023 | $13,946 | $153,805 | $77,151 | $80,340 |

| 2022 | $11,609 | $119,387 | $56,754 | $62,633 |

| 2021 | $11,068 | $122,823 | $58,387 | $64,436 |

| 2020 | $9,554 | $104,848 | $50,193 | $54,655 |

| 2019 | $9,412 | $104,848 | $50,193 | $54,655 |

| 2018 | $9,404 | $103,622 | $42,840 | $60,782 |

| 2017 | $9,123 | $114,560 | $47,362 | $67,198 |

| 2016 | $8,087 | $89,184 | $38,765 | $50,419 |

| 2015 | $7,677 | $78,636 | $42,904 | $35,732 |

| 2014 | -- | $78,636 | $42,904 | $35,732 |

Source: Public Records

Map

Nearby Homes

- 7028 Indian Peaks Trail

- 6987 Sweetwater Ct

- 4848 Idylwild Trail

- 4862 Silver Sage Ct

- 4872 Country Club Way

- 7088 Indian Peaks Trail

- 4803 Briar Ridge Ct

- 4788 Briar Ridge Trail

- 7401 Park Cir

- 4953 Clubhouse Ct

- 4822 Brandon Creek Dr

- 4656 Tanglewood Trail

- 4993 Clubhouse Ct

- 4311 Pali Way

- 4936 Clubhouse Cir

- 7264 Siena Way Unit C

- 4667 Ashfield Dr

- 7430 Clubhouse Rd

- 4945 Twin Lakes Rd Unit 39

- 7309 Windsor Dr

- 7115 Rustic Trail

- 7145 Rustic Trail

- 7134 Rustic Trail

- 7095 Rustic Trail

- 7114 Rustic Trail

- 7164 Rustic Trail

- 7084 Rustic Trail

- 7143 Old Post Rd

- 7153 Old Post Rd

- 7075 Rustic Trail

- 7163 Old Post Rd

- 7123 Old Post Rd

- 7175 Rustic Trail

- 7065 Rustic Trail

- 7173 Old Post Rd

- 7054 Rustic Trail

- 7185 Rustic Trail

- 7142 Old Post Rd

- 7152 Old Post Rd

- 7055 Rustic Trail