7147 Clay Ct E Inver Grove Heights, MN 55076

Estimated Value: $411,000 - $462,000

4

Beds

3

Baths

3,188

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 7147 Clay Ct E, Inver Grove Heights, MN 55076 and is currently estimated at $439,947, approximately $138 per square foot. 7147 Clay Ct E is a home located in Dakota County with nearby schools including Hilltop Elementary School, Inver Grove Heights Middle School, and Simley Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2008

Sold by

Washington Mutual Bank

Bought by

Hu Bao

Current Estimated Value

Purchase Details

Closed on

Feb 2, 2006

Sold by

Pieper Jeanne H

Bought by

Geier Matthew G and Geier Christine

Purchase Details

Closed on

Feb 26, 2002

Sold by

Arnt Patricia E

Bought by

Pieper Jeanne H

Purchase Details

Closed on

Nov 21, 1997

Sold by

Allen Bruce W and Allen Cynthia L

Bought by

Arnt Ralph M and Arnt Patricia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hu Bao | $200,000 | -- | |

| Geier Matthew G | $260,000 | -- | |

| Pieper Jeanne H | $219,500 | -- | |

| Arnt Ralph M | $155,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,674 | $459,800 | $75,200 | $384,600 |

| 2023 | $4,674 | $449,500 | $73,300 | $376,200 |

| 2022 | $4,116 | $438,700 | $73,200 | $365,500 |

| 2021 | $3,988 | $370,100 | $63,600 | $306,500 |

| 2020 | $3,916 | $353,700 | $60,600 | $293,100 |

| 2019 | $3,862 | $346,500 | $57,700 | $288,800 |

| 2018 | $3,521 | $320,300 | $55,000 | $265,300 |

| 2017 | $3,283 | $292,400 | $52,400 | $240,000 |

| 2016 | $3,279 | $270,300 | $49,900 | $220,400 |

| 2015 | $3,216 | $249,212 | $46,182 | $203,030 |

| 2014 | -- | $239,402 | $44,239 | $195,163 |

| 2013 | -- | $210,190 | $40,464 | $169,726 |

Source: Public Records

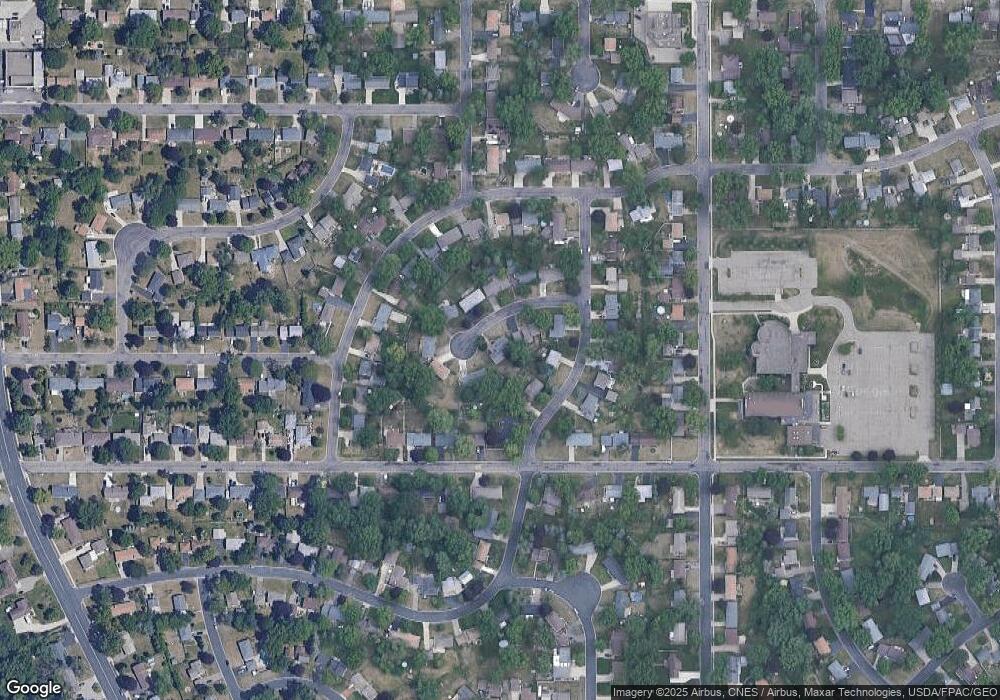

Map

Nearby Homes

- 7169 Clay Ave

- 7393 Clayton Ave

- 6951 Clay Ave

- 7447 Cloman Way

- 3650 75th St E

- 3580 68th St E

- 7614 Connie Ln

- 3617 76th Ln E

- 3085 Upper 76th St E

- 3548 Cloman Way

- 6931 Crosby Ave

- 3861 Conroy Trail

- 7944 Charles Way

- 3901 Conroy Trail

- 3907 Conroy Trail

- 7344 Degrio Way

- 4049 75th St E

- TBD 65th St E

- Virginia Plan at Eagles Landing

- Cottonwood II Plan at Eagles Landing