715 San Conrado Terrace Unit 2 Sunnyvale, CA 94085

Snail NeighborhoodEstimated Value: $585,269 - $903,000

1

Bed

1

Bath

784

Sq Ft

$900/Sq Ft

Est. Value

About This Home

This home is located at 715 San Conrado Terrace Unit 2, Sunnyvale, CA 94085 and is currently estimated at $705,317, approximately $899 per square foot. 715 San Conrado Terrace Unit 2 is a home located in Santa Clara County with nearby schools including Bishop Elementary School, Columbia Middle School, and Fremont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2025

Sold by

Shiraishi Nobuko

Bought by

Shiraishi 2025 Revocable Trust and Shiraishi

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2010

Sold by

Grizzard Deborah

Bought by

Shiraishi Nobuko

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

4.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 16, 2002

Sold by

Gardner Glenn D

Bought by

Grizzard Deborah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

5.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 3, 1999

Sold by

Pfeifer David J

Bought by

Gardner Glenn D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,200

Interest Rate

6.7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shiraishi 2025 Revocable Trust | -- | None Listed On Document | |

| Shiraishi Nobuko | $280,000 | First American Title Company | |

| Grizzard Deborah | $255,000 | Financial Title Company | |

| Gardner Glenn D | $176,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shiraishi Nobuko | $224,000 | |

| Previous Owner | Grizzard Deborah | $200,000 | |

| Previous Owner | Gardner Glenn D | $167,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,308 | $361,416 | $180,708 | $180,708 |

| 2024 | $4,308 | $354,330 | $177,165 | $177,165 |

| 2023 | $4,308 | $347,384 | $173,692 | $173,692 |

| 2022 | $4,209 | $340,574 | $170,287 | $170,287 |

| 2021 | $4,170 | $333,898 | $166,949 | $166,949 |

| 2020 | $4,118 | $330,476 | $165,238 | $165,238 |

| 2019 | $4,031 | $323,998 | $161,999 | $161,999 |

| 2018 | $3,953 | $317,646 | $158,823 | $158,823 |

| 2017 | $3,904 | $311,418 | $155,709 | $155,709 |

| 2016 | $3,750 | $305,312 | $152,656 | $152,656 |

| 2015 | $3,771 | $300,726 | $150,363 | $150,363 |

| 2014 | $3,700 | $294,836 | $147,418 | $147,418 |

Source: Public Records

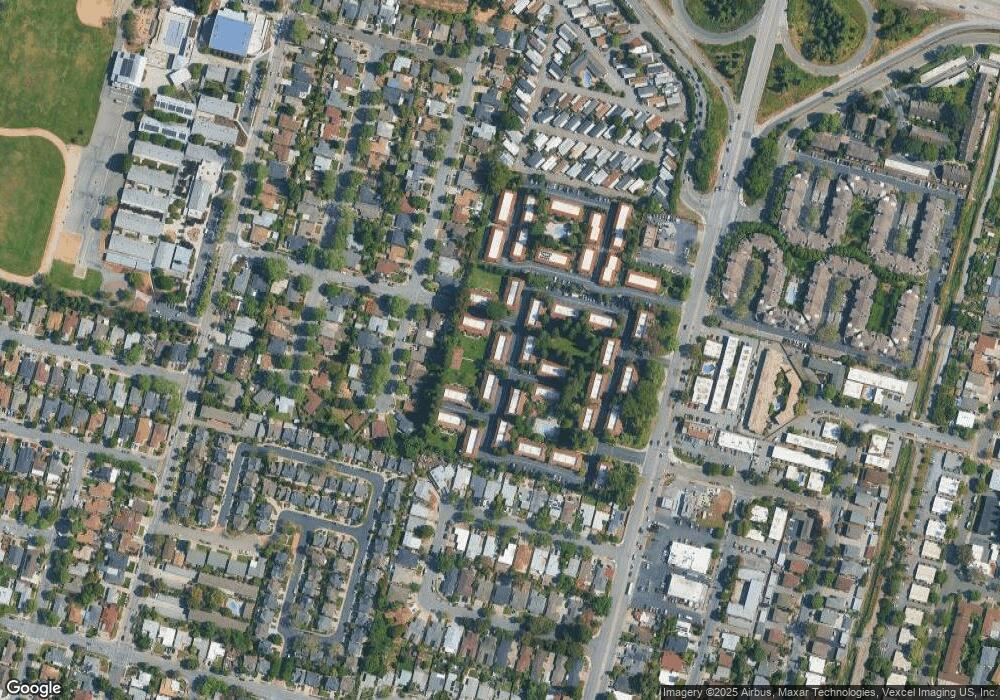

Map

Nearby Homes

- 761 N Fair Oaks Ave Unit 6

- 758 Georgia Ave

- 601 Arcadia Terrace Unit 103

- 605 Arcadia Terrace Unit 106

- 622 N Ahwanee Terrace

- 646 S Ahwanee Terrace

- 237 E Ferndale Ave

- 775 E Duane Ave

- 659 San Miguel Ave

- 782 Manzanita Ave

- 155 W Duane Ave

- 584 Compton Terrace

- 552 Borregas Ave

- 810 Cotati Terrace Unit 5

- 417 Santo Domingo Terrace

- 756 San Ramon Ave

- 560 Madrone Ave

- 1050 Borregas Ave Unit 69

- 1050 Borregas Ave Unit 92

- 1050 Borregas Ave Unit 1

- 715 San Conrado Terrace Unit 8

- 715 San Conrado Terrace Unit 7

- 715 San Conrado Terrace Unit 6

- 715 San Conrado Terrace Unit 5

- 715 San Conrado Terrace Unit 4

- 715 San Conrado Terrace Unit 3

- 715 San Conrado Terrace Unit 1

- 714 San Conrado Terrace Unit 8

- 714 San Conrado Terrace Unit 7

- 714 San Conrado Terrace Unit 6

- 714 San Conrado Terrace Unit 5

- 714 San Conrado Terrace Unit 4

- 714 San Conrado Terrace Unit 3

- 714 San Conrado Terrace Unit 2

- 714 San Conrado Terrace Unit 1

- 713 San Conrado Terrace Unit 8

- 713 San Conrado Terrace Unit 7

- 713 San Conrado Terrace Unit 6

- 713 San Conrado Terrace Unit 5

- 713 San Conrado Terrace Unit 4