716 San Conrado Terrace Unit 7 Sunnyvale, CA 94085

Snail NeighborhoodEstimated Value: $759,545 - $1,117,000

2

Beds

2

Baths

996

Sq Ft

$862/Sq Ft

Est. Value

About This Home

This home is located at 716 San Conrado Terrace Unit 7, Sunnyvale, CA 94085 and is currently estimated at $858,386, approximately $861 per square foot. 716 San Conrado Terrace Unit 7 is a home located in Santa Clara County with nearby schools including Bishop Elementary School, Columbia Middle School, and Fremont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2005

Sold by

Sheu Philip

Bought by

Ellingwood Brian A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,500

Interest Rate

5.72%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Mar 12, 1998

Sold by

Willock Nancy A and Willock William L

Bought by

Sheu Philip

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,000

Interest Rate

7.02%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ellingwood Brian A | $465,000 | Financial Title Company | |

| Sheu Philip | $208,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Ellingwood Brian A | $46,500 | |

| Open | Ellingwood Brian A | $372,000 | |

| Previous Owner | Sheu Philip | $158,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,468 | $648,150 | $324,075 | $324,075 |

| 2024 | $7,468 | $635,442 | $317,721 | $317,721 |

| 2023 | $7,399 | $622,984 | $311,492 | $311,492 |

| 2022 | $7,287 | $610,770 | $305,385 | $305,385 |

| 2021 | $7,218 | $598,796 | $299,398 | $299,398 |

| 2020 | $7,126 | $592,658 | $296,329 | $296,329 |

| 2019 | $6,968 | $581,038 | $290,519 | $290,519 |

| 2018 | $6,830 | $569,646 | $284,823 | $284,823 |

| 2017 | $6,742 | $558,478 | $279,239 | $279,239 |

| 2016 | $6,478 | $547,528 | $273,764 | $273,764 |

| 2015 | $6,514 | $539,304 | $269,652 | $269,652 |

| 2014 | $5,726 | $473,000 | $236,500 | $236,500 |

Source: Public Records

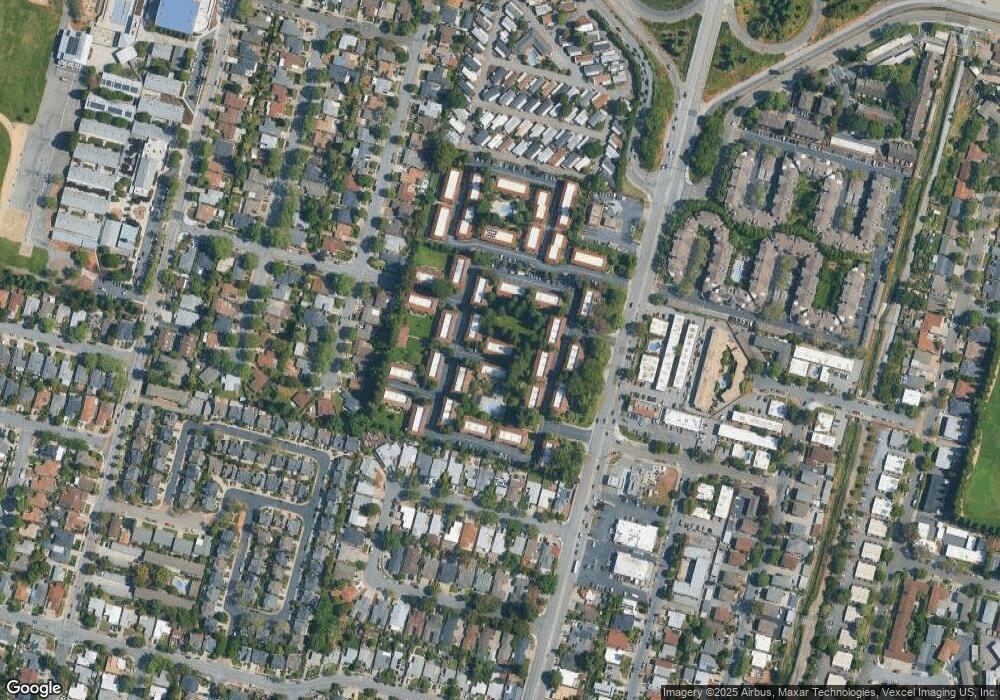

Map

Nearby Homes

- 761 N Fair Oaks Ave Unit 6

- 601 Arcadia Terrace Unit 103

- 605 Arcadia Terrace Unit 106

- 758 Georgia Ave

- 622 N Ahwanee Terrace

- 646 S Ahwanee Terrace

- 775 E Duane Ave

- 659 San Miguel Ave

- 237 E Ferndale Ave

- 584 Compton Terrace

- 810 Cotati Terrace Unit 5

- 782 Manzanita Ave

- 756 San Ramon Ave

- 417 Santo Domingo Terrace

- 155 W Duane Ave

- 552 Borregas Ave

- 542 Santa Maria Terrace Unit 5

- 600 E Weddell Dr Unit 71

- 600 E Weddell Dr Unit 244

- 600 E Weddell Dr

- 716 San Conrado Terrace

- 716 San Conrado Terrace Unit 8

- 716 San Conrado Terrace Unit 6

- 716 San Conrado Terrace Unit 5

- 716 San Conrado Terrace Unit 4

- 716 San Conrado Terrace Unit 3

- 716 San Conrado Terrace Unit 2

- 716 San Conrado Terrace Unit 1

- 615 San Conrado Terrace - 8

- 615 San Conrado Terrace

- 615 San Conrado Terrace

- 615 San Conrado Terrace Unit 8

- 615 San Conrado Terrace Unit 7

- 615 San Conrado Terrace Unit 6

- 615 San Conrado Terrace Unit 5

- 615 San Conrado Terrace Unit 4

- 615 San Conrado Terrace Unit 3

- 615 San Conrado Terrace Unit 2

- 615 San Conrado Terrace Unit 1

- 714 San Conrado Terrace Unit 8