7166 N Fruit Ave Unit 137 Fresno, CA 93711

Bullard NeighborhoodEstimated Value: $262,000 - $2,315,459

2

Beds

2

Baths

1,224

Sq Ft

$635/Sq Ft

Est. Value

About This Home

This home is located at 7166 N Fruit Ave Unit 137, Fresno, CA 93711 and is currently estimated at $777,615, approximately $635 per square foot. 7166 N Fruit Ave Unit 137 is a home located in Fresno County with nearby schools including Nelson Elementary School, Kastner Intermediate School, and Clovis West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2022

Sold by

Youssef and Dina

Bought by

Jones Randall Douglas and Jones Ann Marie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$840,000

Outstanding Balance

$792,429

Interest Rate

4.67%

Mortgage Type

New Conventional

Estimated Equity

-$14,814

Purchase Details

Closed on

Jan 10, 2017

Sold by

7166 North Fruit Llc

Bought by

Orion Royal Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

4.08%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Mar 26, 2012

Sold by

Tuscany Villas Llc

Bought by

7166 North Fruit Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Randall Douglas | $1,960,000 | Chicago Title | |

| Orion Royal Inc | $575,000 | Fidelity National Title Co | |

| 7166 North Fruit Llc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Randall Douglas | $840,000 | |

| Previous Owner | Orion Royal Inc | $300,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,754 | $230,811 | $57,304 | $173,507 |

| 2023 | $2,702 | $221,850 | $55,080 | $166,770 |

| 2022 | $1,550 | $125,765 | $31,713 | $94,052 |

| 2021 | $1,507 | $123,300 | $31,092 | $92,208 |

| 2020 | $1,501 | $122,037 | $30,774 | $91,263 |

| 2019 | $1,473 | $119,645 | $30,171 | $89,474 |

| 2018 | $1,441 | $117,300 | $29,580 | $87,720 |

| 2017 | $848 | $68,180 | $16,233 | $51,947 |

| 2016 | $820 | $66,844 | $15,915 | $50,929 |

| 2015 | $808 | $65,840 | $15,676 | $50,164 |

| 2014 | $793 | $64,551 | $15,369 | $49,182 |

Source: Public Records

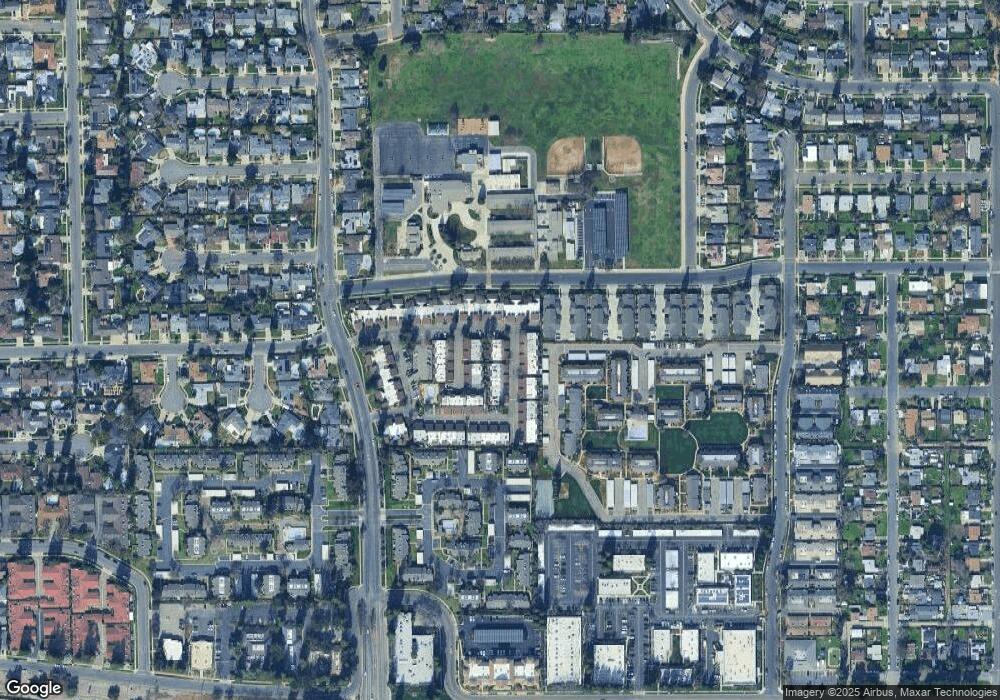

Map

Nearby Homes

- 7166 N Fruit Ave Unit 160

- 7166 N Fruit Ave Unit 132

- 7178 N Fruit Ave Unit 108

- 7166 N Fruit Ave Unit 127

- 1419 W Chennault Ave

- 1547 W Fir Ave

- 1067 W Minarets Ave

- 1188 W Pinedale Ave

- 7334 N Teilman Ave

- 1389 W Warner Ave

- 7047 N Teilman Ave Unit 101

- 7047 N Teilman Ave Unit 102

- 6737 N Harrison Ave

- 6658 N Thorne Ave

- 7258 N Channing Way

- 1418 W Palo Alto Ave

- 1110 W Bedford Ave

- 1 Palm Ave

- 6594 N Farris Ave

- 6671 N Channing Way

- 7166 N Fruit Ave Unit 130

- 7166 N Fruit Ave

- 7166 N Fruit Ave Unit 119

- 7166 N Fruit Ave Unit 150

- 7166 N Fruit Ave Unit 167

- 7178 N Fruit Ave Unit 7122

- 7178 N Fruit Ave Unit 103

- 7178 N Fruit Ave Unit 102

- 7178 N Fruit Ave Unit 118

- 7178 N Fruit Ave Unit 122

- 7178 N Fruit Ave Unit 113

- 7178 N Fruit Ave Unit 116

- 7178 N Fruit Ave Unit 109

- 7178 N Fruit Ave Unit 131

- 7178 N Fruit Ave Unit 107

- 7178 N Fruit Ave Unit 132

- 7178 N Fruit Ave Unit 130

- 7178 N Fruit Ave Unit 128

- 7178 N Fruit Ave Unit 111

- 7178 N Fruit Ave Unit 126