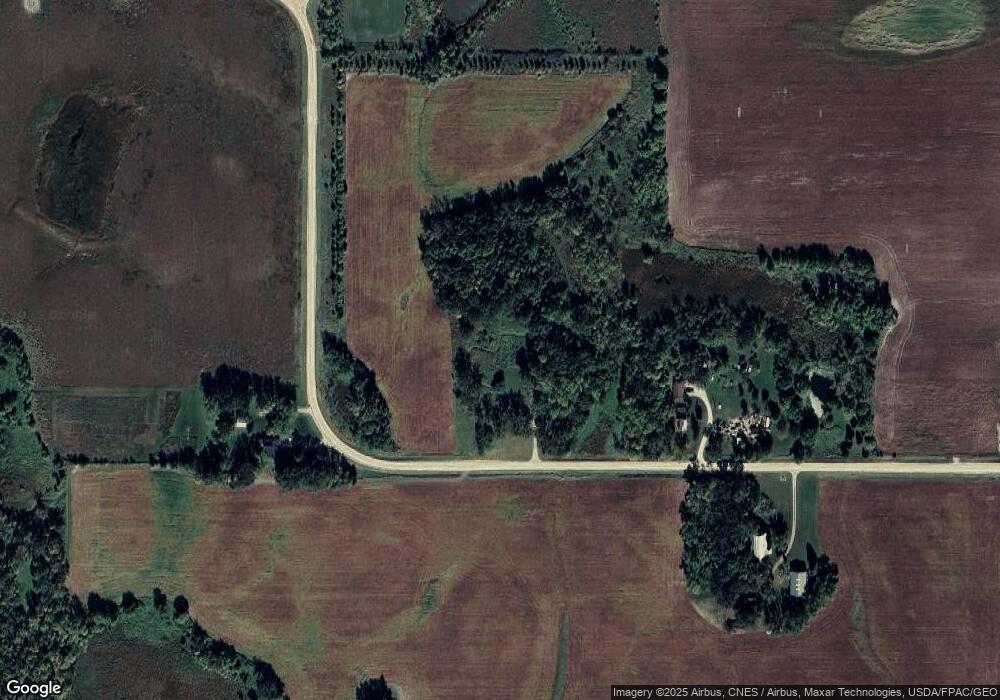

71808 154th St Albert Lea, MN 56007

Estimated Value: $222,000 - $293,000

3

Beds

2

Baths

1,296

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 71808 154th St, Albert Lea, MN 56007 and is currently estimated at $253,740, approximately $195 per square foot. 71808 154th St is a home located in Freeborn County with nearby schools including Glenville Emmons Elementary School and Glenville-Emmons Secondary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 29, 2022

Sold by

Nelson Kyle and Nelson Tricia

Bought by

Schone Darren and Schone Sydney

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$182,032

Interest Rate

5.78%

Mortgage Type

New Conventional

Estimated Equity

$71,708

Purchase Details

Closed on

Feb 16, 2021

Sold by

Nelson Kyle J and Nelson Tricia R

Bought by

Nelson Kyle J and Nelson Trust

Purchase Details

Closed on

May 16, 2017

Bought by

Nelson Kyle Kyle and Nelson Tricia Tricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,950

Interest Rate

3.97%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schone Darren | $190,000 | -- | |

| Nelson Kyle J | -- | None Available | |

| Nelson Kyle Kyle | $150,000 | -- | |

| Nelson Kyle | $150,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schone Darren | $190,000 | |

| Previous Owner | Nelson Kyle | $124,950 | |

| Previous Owner | Nelson Kyle Kyle | $149,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,046 | $211,800 | $211,800 | $0 |

| 2024 | $2,112 | $218,300 | $218,300 | $0 |

| 2023 | $1,586 | $201,800 | $201,800 | $0 |

| 2022 | $1,006 | $159,500 | $159,500 | $0 |

| 2021 | $1,298 | $110,000 | $110,000 | $0 |

| 2020 | $1,234 | $128,100 | $126,800 | $1,300 |

| 2019 | $1,138 | $128,100 | $126,800 | $1,300 |

| 2018 | $1,700 | $0 | $0 | $0 |

| 2016 | $1,794 | $0 | $0 | $0 |

| 2015 | $762 | $0 | $0 | $0 |

| 2014 | $870 | $0 | $0 | $0 |

| 2012 | $852 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 15592 720th Ave

- 15742 675th Ave

- 2313 W 9th St

- 2330 W 9th St

- 2334 W 9th St

- 2200 W 9th St

- 1432 Regency Ln

- 1429 Spartan Ave

- 1614 Gateway Dr

- 1810 Michaelle Ln

- 2405 Ethel Ave Unit Lot 98

- State Line Rd

- 801 E 18 1 2 St Unit Lot 90

- 1104 E 18 1/2 St

- 1115 Swanhill Dr

- 2201 Gene Ave

- 1704 Plainview Ln

- 1006 Rosehill Dr

- 1608 Plainview Ln

- 2418 W Main St