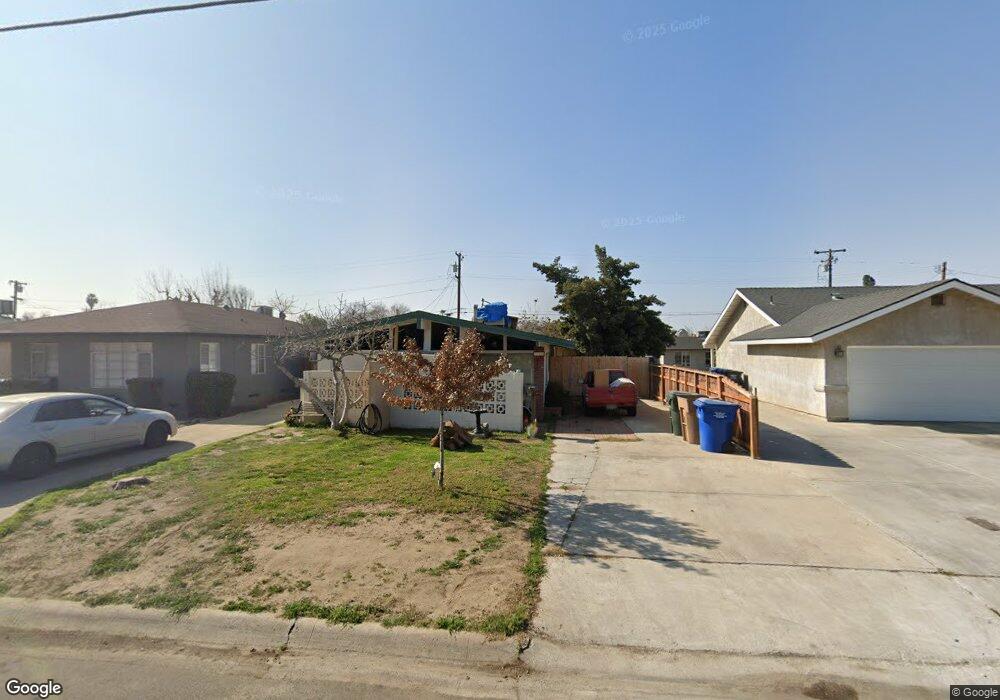

719 Houchin Rd Unit A/B Bakersfield, CA 93304

Benton Park NeighborhoodEstimated Value: $230,000 - $317,000

4

Beds

2

Baths

1,542

Sq Ft

$176/Sq Ft

Est. Value

About This Home

This home is located at 719 Houchin Rd Unit A/B, Bakersfield, CA 93304 and is currently estimated at $271,612, approximately $176 per square foot. 719 Houchin Rd Unit A/B is a home located in Kern County with nearby schools including Evergreen Elementary School, Curran Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2009

Sold by

Sanchez Jesus M and Sanchez Victoria Perez

Bought by

Romo Laura and Romo Felipe

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,435

Outstanding Balance

$56,072

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$215,540

Purchase Details

Closed on

Jun 27, 2005

Sold by

Sanchez Jesus M and Sanchez Victoria Perez

Bought by

Sanchez Jesus M and Sanchez Victoria Perez

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

5.65%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 17, 1996

Sold by

Jones Robert C and Jones Sharon D

Bought by

Sanchez Jesus M and Sanchez Victoria Perez

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,876

Interest Rate

8.09%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romo Laura | $85,000 | Chicago Title Company | |

| Sanchez Jesus M | $67,500 | Stewart Title | |

| Sanchez Jesus M | $58,500 | American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Romo Laura | $83,435 | |

| Previous Owner | Sanchez Jesus M | $135,000 | |

| Previous Owner | Sanchez Jesus M | $58,876 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,348 | $109,704 | $25,809 | $83,895 |

| 2024 | $2,262 | $107,553 | $25,303 | $82,250 |

| 2023 | $2,262 | $105,445 | $24,807 | $80,638 |

| 2022 | $2,080 | $103,378 | $24,321 | $79,057 |

| 2021 | $1,920 | $101,352 | $23,845 | $77,507 |

| 2020 | $1,835 | $100,314 | $23,601 | $76,713 |

| 2019 | $1,799 | $100,314 | $23,601 | $76,713 |

| 2018 | $1,738 | $96,421 | $22,686 | $73,735 |

| 2017 | $1,719 | $94,532 | $22,242 | $72,290 |

| 2016 | $1,606 | $92,679 | $21,806 | $70,873 |

| 2015 | $1,604 | $91,288 | $21,479 | $69,809 |

| 2014 | $1,521 | $85,000 | $15,000 | $70,000 |

Source: Public Records

Map

Nearby Homes

- 809 Caylor St

- 821 Oleander Ave

- 801 S Oleander Ave

- 1901 Terrace Way

- 1728 Terrace Way

- 2212 Bradford St

- 909 Butler Rd

- 1901 Rose Marie Dr

- 1206 S Oleander Ave

- 201 Haybert Ct

- 1900 La France Dr

- 2207 Ellen Way

- 0 Baldwin Rd

- 2403 Belle Terrace

- 1925 La France Dr

- 1221 El Rancho Dr

- 1212 S F St

- 1811 Radiance Dr

- 2396 Brite St

- 2602 Urbano Dr