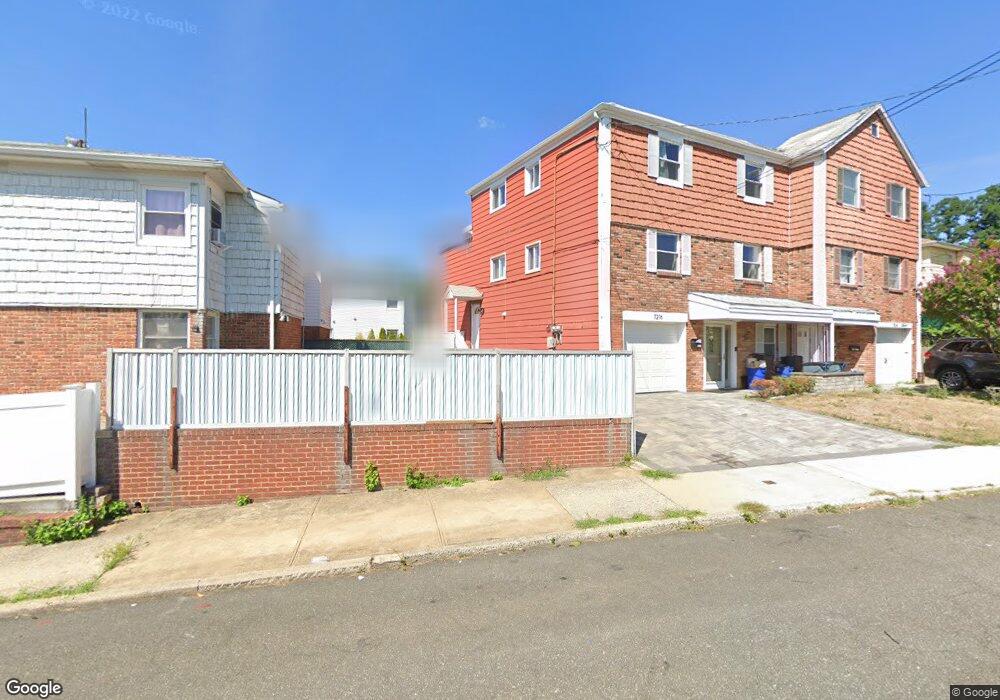

72-16 244th St Flushing, NY 11362

Douglaston NeighborhoodEstimated Value: $1,324,486 - $1,612,000

3

Beds

2

Baths

3,003

Sq Ft

$506/Sq Ft

Est. Value

About This Home

This home is located at 72-16 244th St, Flushing, NY 11362 and is currently estimated at $1,518,622, approximately $505 per square foot. 72-16 244th St is a home located in Queens County with nearby schools including P.S. 221Q The North Hills School, Louis Pasteur Middle School 67, and Benjamin N Cardozo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2021

Sold by

Moon Eliza Joo Kyung and Moon Samuel

Bought by

Lin Xin Rong and Zhang Jianping

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$700,000

Outstanding Balance

$636,948

Interest Rate

2.8%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$881,674

Purchase Details

Closed on

Jan 31, 2014

Sold by

Moon Kyung Hwan and Moon Young Ok

Bought by

Moon Eliza J and Moon Samuel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$532,000

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 7, 2008

Sold by

Moon Kyung Hwan and Moon Young Ok

Bought by

Moon Kyung Hwan and Moon Young Ok

Purchase Details

Closed on

Jul 23, 2001

Sold by

Song Kwang S and Moon Kyung Hwan

Bought by

Moon Kyung Hwan and Moon Young Ok

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,707

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lin Xin Rong | $1,350,000 | -- | |

| Moon Eliza J | $665,000 | -- | |

| Moon Kyung Hwan | -- | -- | |

| Moon Kyung Hwan | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lin Xin Rong | $700,000 | |

| Previous Owner | Moon Eliza J | $532,000 | |

| Previous Owner | Moon Kyung Hwan | $104,707 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,961 | $71,798 | $11,833 | $59,965 |

| 2024 | $13,961 | $69,511 | $12,526 | $56,985 |

| 2023 | $13,171 | $65,578 | $10,792 | $54,786 |

| 2022 | $12,729 | $79,200 | $13,320 | $65,880 |

| 2021 | $13,051 | $74,400 | $13,320 | $61,080 |

| 2020 | $12,369 | $81,780 | $13,320 | $68,460 |

| 2019 | $11,825 | $85,980 | $13,320 | $72,660 |

| 2018 | $10,842 | $54,648 | $10,387 | $44,261 |

| 2017 | $10,532 | $53,136 | $10,943 | $42,193 |

| 2016 | $10,256 | $53,136 | $10,943 | $42,193 |

| 2015 | $5,826 | $49,860 | $14,820 | $35,040 |

| 2014 | $5,826 | $48,272 | $14,348 | $33,924 |

Source: Public Records

Map

Nearby Homes

- 2-42 Oak Park Dr Unit 99A

- 24188 Oak Park Dr Unit 188

- 73-30 244th St

- 24321 73rd Ave

- 241-43B Oak Park Dr

- 241-43B Oak Park Dr Unit TH

- 243-17 72nd Ave

- 2-40 Oak Park Dr

- 24054 Oak Park Dr Unit 41C

- 7157 Douglaston Pkwy

- 6909 242nd St Unit 42C

- 240-22 70th Ave Unit 9B

- 240-02 70th Ave Unit 1C

- 68-09 242nd St Unit 33A

- 68-05 242nd St Unit 31A

- 245-31 76th Ave Unit 31B

- 240-47 68th Ave

- 251-5 71st Rd Unit 5

- 245-44 76th Ave Unit 1st fl

- 240-29 68th Ave Unit 14

- 7216 244th St

- 72-14 244th St Unit 2

- 7214 244th St

- 24317 73rd Ave

- 24321 73rd Ave

- 24315 73rd Ave

- 24315 73rd Ave Unit 2

- 243-15 73rd Ave Unit 2

- 24311 73rd Ave

- 243-28 72nd Ave

- 24328 72nd Ave

- 24324 72nd Ave

- 24332 72nd Ave

- 24332 72nd Ave

- 24332 72nd Ave Unit 2

- 24324 72nd Ave

- 24309 73rd Ave

- 243-09 73rd Ave Unit 2

- 24401 73rd Ave

- 24320 72nd Ave