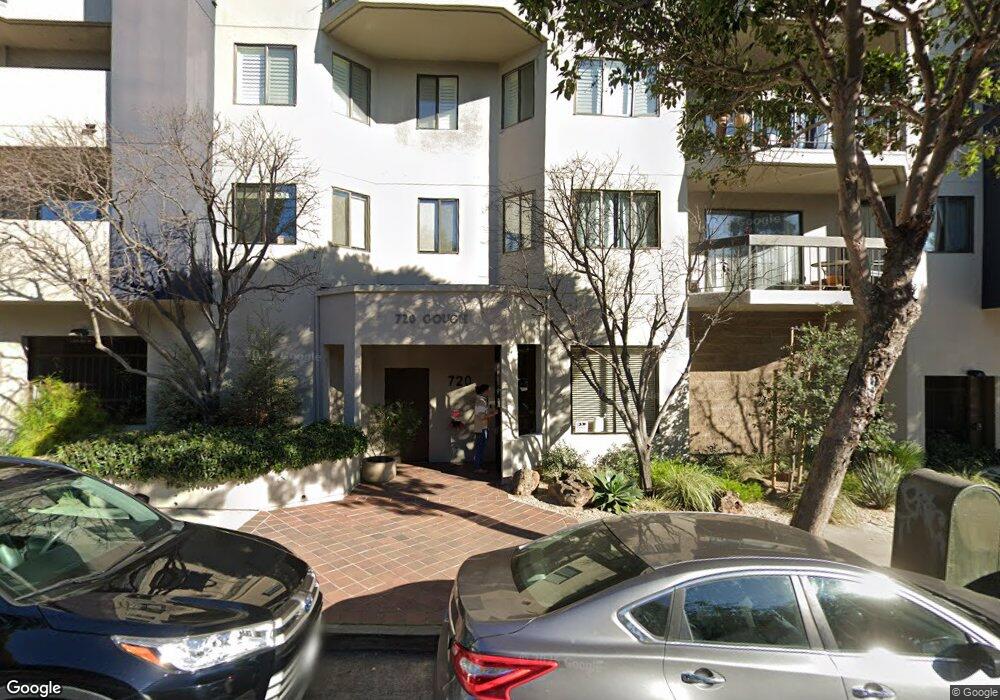

720 Gough St Unit 23 San Francisco, CA 94102

Van Ness/Civic Center NeighborhoodEstimated Value: $878,000 - $1,022,000

2

Beds

2

Baths

1,500

Sq Ft

$635/Sq Ft

Est. Value

About This Home

This home is located at 720 Gough St Unit 23, San Francisco, CA 94102 and is currently estimated at $952,902, approximately $635 per square foot. 720 Gough St Unit 23 is a home located in San Francisco County with nearby schools including Rosa Parks Elementary, Presidio Middle School, and French American International School + International High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2010

Sold by

Anderson Ellis Ross and Marilyn M Baxter 1987 Trust

Bought by

Baxter Jennifer

Current Estimated Value

Purchase Details

Closed on

Dec 7, 2006

Sold by

Brown Marilyn M Baxter

Bought by

Brown Marilyn M Baxter and The Marilyn M Baxter 1987 Trus

Purchase Details

Closed on

Aug 27, 2003

Sold by

Brown Marilyn Baxter

Bought by

Brown Leonard C and Brown Marilyn M Baxter

Purchase Details

Closed on

Oct 1, 2001

Sold by

Franco Franklin A and Franco Trust

Bought by

Franco Franklin A and Franco Trust

Purchase Details

Closed on

Sep 19, 2000

Sold by

Brown Leonard

Bought by

Brown Marilyn Baxter

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,000

Interest Rate

8%

Purchase Details

Closed on

Sep 18, 2000

Sold by

Callaghan Dan

Bought by

Baxter Jennifer G and Brown Marilyn Baxter

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,000

Interest Rate

8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baxter Jennifer | -- | None Available | |

| Brown Marilyn M Baxter | -- | None Available | |

| Brown Leonard C | -- | -- | |

| Franco Franklin A | -- | -- | |

| Brown Marilyn Baxter | -- | Fidelity National Title Co | |

| Baxter Jennifer G | $417,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Baxter Jennifer G | $297,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,036 | $628,296 | $314,148 | $314,148 |

| 2024 | $8,036 | $615,980 | $307,990 | $307,990 |

| 2023 | $7,895 | $603,904 | $301,952 | $301,952 |

| 2022 | $7,732 | $592,064 | $296,032 | $296,032 |

| 2021 | $7,593 | $580,456 | $290,228 | $290,228 |

| 2020 | $7,690 | $574,508 | $287,254 | $287,254 |

| 2019 | $7,382 | $563,244 | $281,622 | $281,622 |

| 2018 | $7,136 | $552,200 | $276,100 | $276,100 |

| 2017 | $6,754 | $541,376 | $270,688 | $270,688 |

| 2016 | $6,626 | $530,764 | $265,382 | $265,382 |

| 2015 | $6,543 | $522,792 | $261,396 | $261,396 |

| 2014 | $6,372 | $512,552 | $256,276 | $256,276 |

Source: Public Records

Map

Nearby Homes

- 388 Fulton St Unit 208

- 388 Fulton St Unit 603

- 388 Fulton St Unit 404

- 368 Elm St Unit 407

- 601 Van Ness Ave Unit 812

- 601 Van Ness Ave Unit 750

- 601 Van Ness Ave Unit 67

- 601 Van Ness Ave Unit 847

- 601 Van Ness Ave Unit 71

- 601 Van Ness Ave Unit 1047

- 601 Van Ness Ave Unit 35

- 601 Van Ness Ave Unit 1102

- 615-617 Octavia St

- 555 Fulton St Unit 518

- 555 Fulton St Unit 427

- 555 Fulton St Unit 322

- 342 Hayes St Unit M

- 450 Hayes St Unit 3H

- 430 Hayes St Unit 201

- 750 Van Ness Ave Unit V502

- 720 Gough St Unit 35

- 720 Gough St Unit 57

- 720 Gough St Unit 38

- 720 Gough St Unit 39

- 720 Gough St Unit 36

- 720 Gough St Unit 27

- 720 Gough St Unit 26

- 720 Gough St Unit 21

- 720 Gough St

- 720 Gough St Unit 58

- 720 Gough St Unit 47

- 720 Gough St Unit 42

- 720 Gough St Unit 37

- 720 Gough St Unit 70

- 720 Gough St Unit 69

- 720 Gough St Unit 68

- 720 Gough St Unit 64

- 720 Gough St Unit 63

- 720 Gough St Unit 62

- 720 Gough St Unit 61