721 County Street 2884 Tuttle, OK 73089

Estimated Value: $316,000 - $387,586

3

Beds

2

Baths

2,801

Sq Ft

$124/Sq Ft

Est. Value

About This Home

This home is located at 721 County Street 2884, Tuttle, OK 73089 and is currently estimated at $348,397, approximately $124 per square foot. 721 County Street 2884 is a home located in Grady County with nearby schools including Tuttle Intermediate School, Tuttle Elementary School, and Tuttle Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2023

Sold by

Benton Gary Lynn

Bought by

Benton Gary Lynn and Taulbee Madalyn Sue

Current Estimated Value

Purchase Details

Closed on

Jan 8, 2018

Sold by

Lou Douglas Everett Alan and Lou Douglas Mary

Bought by

Benton Jason Micheal and Benton Shonda Dione

Purchase Details

Closed on

Oct 26, 2011

Sold by

Connock John W and Connock Vivian H

Bought by

Douglas Everett Alan and Douglas Mary Lou

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,000

Interest Rate

4.13%

Mortgage Type

Unknown

Purchase Details

Closed on

Nov 23, 2007

Sold by

Skalsky James A and Skalsky Carol A

Bought by

Coppock John W and Coppock Vivian H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,000

Interest Rate

6.3%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Benton Gary Lynn | -- | None Listed On Document | |

| Benton Gary Lynn | -- | None Listed On Document | |

| Benton Jason Micheal | $145,000 | None Available | |

| Douglas Everett Alan | $150,000 | Washita Valley Abstract Comp | |

| Coppock John W | $185,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Douglas Everett Alan | $145,000 | |

| Previous Owner | Coppock John W | $148,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,817 | $28,010 | $8,638 | $19,372 |

| 2024 | $2,938 | $27,194 | $8,386 | $18,808 |

| 2023 | $2,938 | $26,402 | $8,608 | $17,794 |

| 2022 | $2,667 | $25,634 | $9,057 | $16,577 |

| 2021 | $2,587 | $24,887 | $7,900 | $16,987 |

| 2020 | $2,553 | $24,363 | $6,617 | $17,746 |

| 2019 | $2,481 | $23,655 | $5,528 | $18,127 |

| 2018 | $2,104 | $21,342 | $5,763 | $15,579 |

| 2017 | $2,093 | $20,722 | $5,094 | $15,628 |

| 2016 | $2,066 | $20,118 | $3,870 | $16,248 |

| 2015 | $1,946 | $19,532 | $3,022 | $16,510 |

| 2014 | $1,946 | $19,991 | $972 | $19,019 |

Source: Public Records

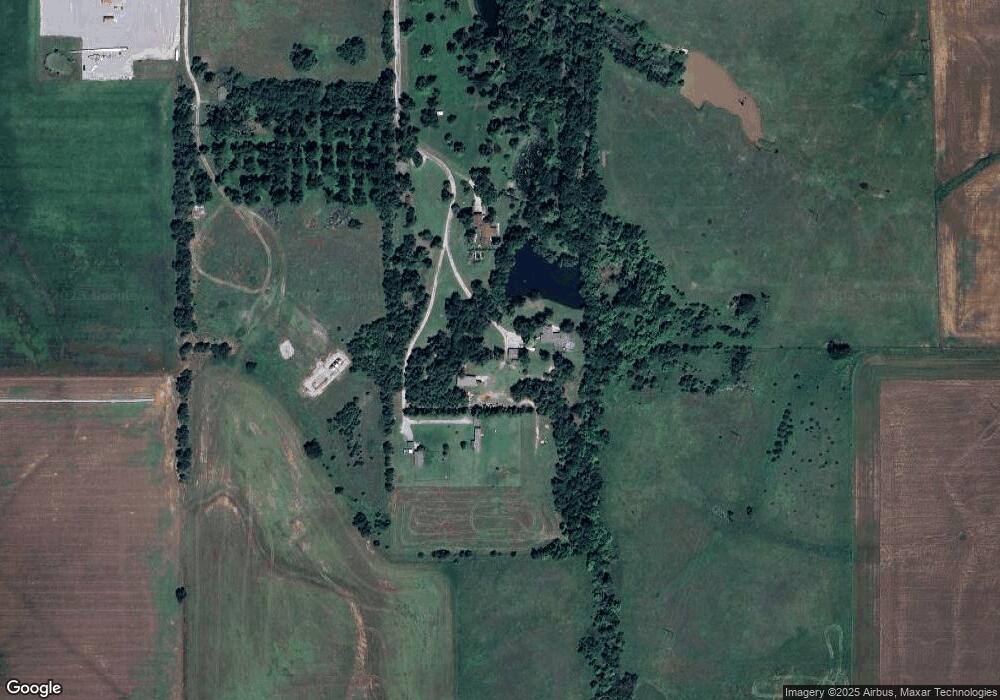

Map

Nearby Homes

- 2 NW 6th St

- 304 SW 5th St

- 401 SW 4th St

- 605 SW 4th St

- 972 Old Farm Rd

- 1630 Big Sky Dr

- 975 Hadley Ln

- 508 Kings Ct

- 509 Cantebury Dr

- 973 Hadley Ln

- 00 Chad Dr

- 1636 Big Sky Dr

- 516 Kings Ct

- 978 Hadley Ln

- 975 Rylee Lane 4a Ln

- 1637 Big Sky Dr

- 977 Rylee Ln

- 1720 County Road 1213

- 2029 E Rock Creek Rd

- 2025 E Rock Creek Rd

- 715 County Street 2884

- 712 County Street 2884

- 1460 County Road 1190

- 1462 County Road 1190

- 1456 County Road 1190

- 1420 County Road 1190

- 1472 County Road 1190

- 1476 County Road 1190

- 680 County Street 2886

- 1416 County Road 1190

- 1480 County Road 1190

- 685 County Street 2886

- 1473 County Road 1189

- 1477 County Road 1189

- 686 County Street 2886

- 1458 County Road 1188

- 1472 County Road 1189

- 1493 County Road 1190

- 1484 County Road 1190

- 1476 County Road 1189