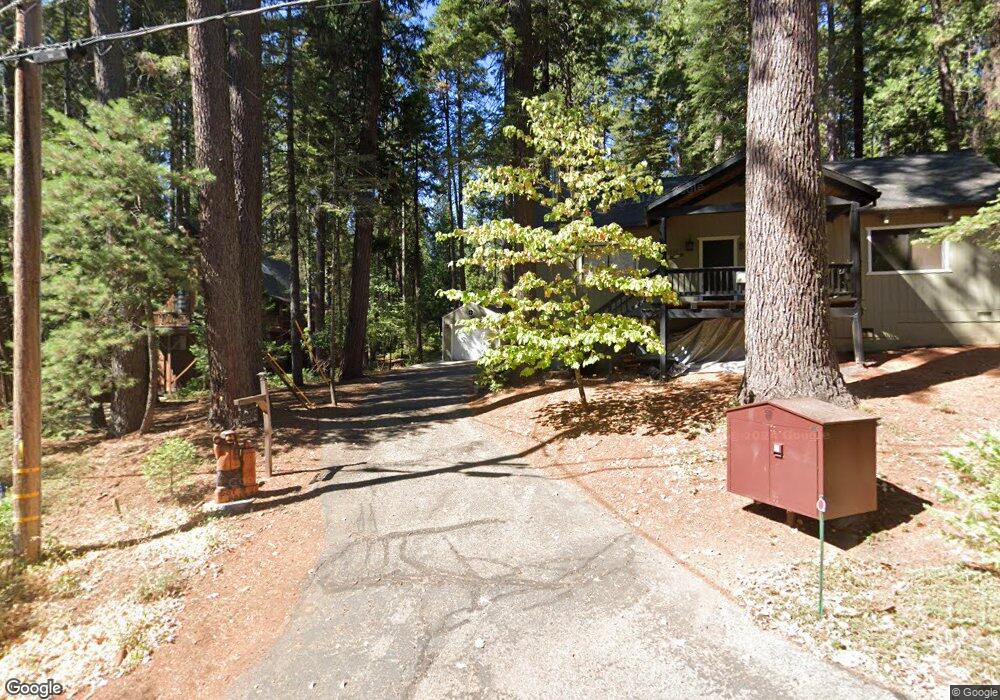

722 Marilyn Way Arnold, CA 95223

Estimated Value: $410,000 - $424,000

3

Beds

2

Baths

1,356

Sq Ft

$307/Sq Ft

Est. Value

About This Home

This home is located at 722 Marilyn Way, Arnold, CA 95223 and is currently estimated at $415,835, approximately $306 per square foot. 722 Marilyn Way is a home with nearby schools including Bret Harte Union High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 1, 2013

Sold by

Love Maureen

Bought by

Love Maureen and Love Jesshill E

Current Estimated Value

Purchase Details

Closed on

Sep 6, 2004

Sold by

Utter Bruce and Utter Linda M

Bought by

Love Maureen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$74,611

Interest Rate

5.94%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$341,224

Purchase Details

Closed on

Jun 26, 2001

Sold by

Fox Randal G and Fox Annette Marie

Bought by

Utter Bruce and Utter Linda M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,600

Interest Rate

7.14%

Purchase Details

Closed on

Feb 7, 2001

Sold by

Fox Randy and Fox Annette

Bought by

Fox Randal G and Fox Annette Marie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Love Maureen | -- | None Available | |

| Love Maureen | $336,000 | First American Title Company | |

| Utter Bruce | $189,500 | The Sterling Title Company | |

| Fox Randal G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Love Maureen | $150,000 | |

| Previous Owner | Utter Bruce | $151,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,187 | $431,330 | $30,000 | $401,330 |

| 2023 | $5,236 | $431,930 | $30,000 | $401,930 |

| 2022 | $4,542 | $380,100 | $30,000 | $350,100 |

| 2021 | $3,856 | $312,000 | $30,000 | $282,000 |

| 2020 | $3,627 | $292,000 | $30,000 | $262,000 |

| 2019 | $3,570 | $285,000 | $30,000 | $255,000 |

| 2018 | $3,260 | $271,000 | $30,000 | $241,000 |

| 2017 | $3,018 | $251,000 | $30,000 | $221,000 |

| 2016 | $2,764 | $224,000 | $30,000 | $194,000 |

| 2015 | -- | $224,000 | $30,000 | $194,000 |

| 2014 | -- | $210,000 | $30,000 | $180,000 |

Source: Public Records

Map

Nearby Homes

- 723 Marilyn Way

- 729 Dawyn Dr

- 646 Dean Way

- 459 Dean Way

- 923 Bear Run Way

- 1430 Gloria Dr

- 845 Honey Ct

- 1578 Gloria Dr

- 1109 Wawona Way

- 210 David Lee Rd

- 1413 Gertrude Way

- 1856 Anna Lee Way

- 791 Highway 4

- 1567 2nd St

- 1115 Meadow Dr

- 2534 Middle Dr

- 1262 Pebble Beach Way

- 1648 2nd St

- 1027 Ponderosa Way

- 1748 Cypress Point Dr

Your Personal Tour Guide

Ask me questions while you tour the home.