722 W Sheridan Rd Unit 7223S Chicago, IL 60613

Lakeview East NeighborhoodEstimated Value: $230,000 - $287,000

--

Bed

--

Bath

--

Sq Ft

0.54

Acres

About This Home

This home is located at 722 W Sheridan Rd Unit 7223S, Chicago, IL 60613 and is currently estimated at $266,437. 722 W Sheridan Rd Unit 7223S is a home located in Cook County with nearby schools including Brennemann Elementary School, Senn High School, and Bernard Zell Anshe Emet Day School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 20, 2022

Sold by

Kingston Jonathan M

Bought by

Crisologo Nereide Y and Adrianzen Luzmila B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,834

Outstanding Balance

$212,131

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$54,306

Purchase Details

Closed on

Sep 12, 2018

Sold by

Goland Gary

Bought by

Kingston Jonathan M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,360

Interest Rate

5.12%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 9, 2012

Sold by

Melgard Ann Marie

Bought by

Goland Gary

Purchase Details

Closed on

Apr 18, 2002

Sold by

Fox Partners Lp

Bought by

Melgard Ann Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,500

Interest Rate

5.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Crisologo Nereide Y | $230,000 | Chicago Title | |

| Kingston Jonathan M | $188,000 | Chicago Title | |

| Goland Gary | $98,500 | Fidelity National Title | |

| Melgard Ann Marie | $172,000 | Prairie Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crisologo Nereide Y | $225,834 | |

| Previous Owner | Kingston Jonathan M | $182,360 | |

| Previous Owner | Melgard Ann Marie | $165,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,586 | $20,075 | $4,589 | $15,486 |

| 2023 | $2,793 | $17,000 | $4,106 | $12,894 |

| 2022 | $2,793 | $17,000 | $4,106 | $12,894 |

| 2021 | $2,748 | $16,998 | $4,105 | $12,893 |

| 2020 | $3,272 | $14,689 | $2,563 | $12,126 |

| 2019 | $3,253 | $16,189 | $2,563 | $13,626 |

| 2018 | $3,198 | $16,189 | $2,563 | $13,626 |

| 2017 | $3,223 | $14,971 | $2,256 | $12,715 |

| 2016 | $3,133 | $15,642 | $2,256 | $13,386 |

| 2015 | $2,866 | $15,642 | $2,256 | $13,386 |

| 2014 | $2,533 | $13,653 | $1,743 | $11,910 |

| 2013 | $2,483 | $13,653 | $1,743 | $11,910 |

Source: Public Records

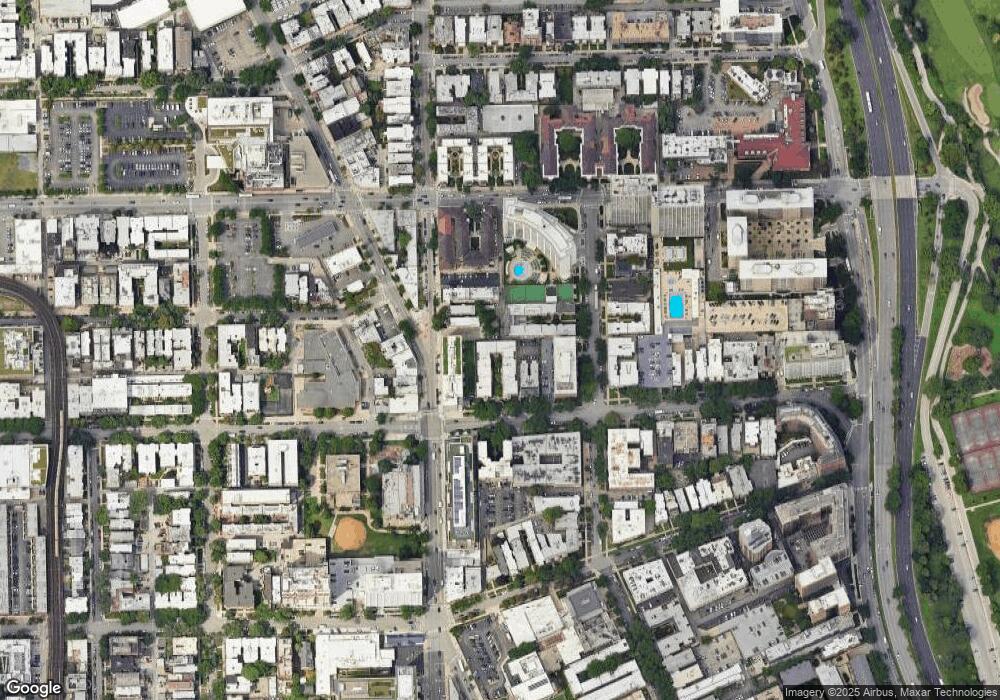

Map

Nearby Homes

- 3900 N Pine Grove Ave Unit 405

- 3900 N Pine Grove Ave Unit 910

- 3930 N Pine Grove Ave Unit 1002

- 3930 N Pine Grove Ave Unit 1109

- 3930 N Pine Grove Ave Unit 805

- 3930 N Pine Grove Ave Unit 1606

- 3930 N Pine Grove Ave Unit 2313

- 3930 N Pine Grove Ave Unit 2010

- 3930 N Pine Grove Ave Unit 2912

- 3930 N Pine Grove Ave Unit 2405

- 725 W Sheridan Rd Unit 10E

- 655 W Irving Park Rd Unit B70

- 655 W Irving Park Rd Unit 5104

- 655 W Irving Park Rd Unit 1911

- 655 W Irving Park Rd Unit 3704

- 655 W Irving Park Rd Unit B-54

- 655 W Irving Park Rd Unit 4711

- 655 W Irving Park Rd Unit 1808

- 655 W Irving Park Rd Unit 3509

- 655 W Irving Park Rd Unit 2713

- 722 W Sheridan Rd Unit 7221N

- 722 W Sheridan Rd Unit 7222N

- 722 W Sheridan Rd Unit 7221S

- 722 W Sheridan Rd Unit 7222S

- 722 W Sheridan Rd Unit 7223N

- 722 W Sheridan Rd Unit 3S

- 722 W Sheridan Rd Unit 2S

- 722 W Sheridan Rd Unit 2-N

- 722 W Sheridan Rd Unit 3NEK

- 724 W Sheridan Rd Unit 7241S

- 724 W Sheridan Rd Unit 7242N

- 724 W Sheridan Rd Unit 7242S

- 724 W Sheridan Rd Unit 7243S

- 724 W Sheridan Rd Unit 7243N

- 724 W Sheridan Rd Unit 7241N

- 724 W Sheridan Rd Unit 2N

- 724 W Sheridan Rd Unit 3S

- 724 W Sheridan Rd Unit 1N

- 724 W Sheridan Rd Unit 1S

- 724 W Sheridan Rd Unit 2S