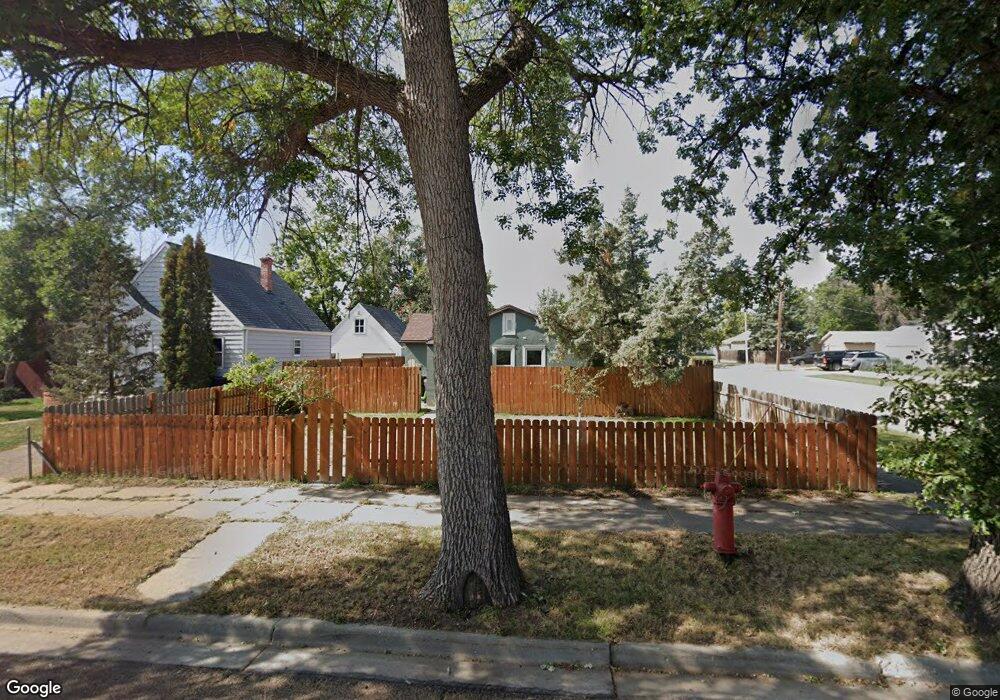

723 2nd Ave W Williston, ND 58801

Estimated Value: $360,000 - $414,149

Studio

--

Bath

--

Sq Ft

0.31

Acres

About This Home

This home is located at 723 2nd Ave W, Williston, ND 58801 and is currently estimated at $384,787. 723 2nd Ave W is a home located in Williams County with nearby schools including Williston High School, St. Joseph Elementary School, and St. Josephs Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 17, 2019

Sold by

Nelson Jean Ann

Bought by

Winje Laura M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,250

Outstanding Balance

$191,102

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$193,685

Purchase Details

Closed on

Dec 12, 2013

Sold by

507 Reclamation Drive Llc

Bought by

Nelson Jean Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,653

Interest Rate

4%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 19, 2008

Sold by

Solheim Robin

Bought by

Guenther Curtis

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Winje Laura M | $225,000 | North Dakota Guaranty & Ttl | |

| Nelson Jean Ann | -- | None Available | |

| Guenther Curtis | $131,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Winje Laura M | $218,250 | |

| Previous Owner | Nelson Jean Ann | $235,653 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,956 | $197,775 | $38,440 | $159,335 |

| 2023 | $3,642 | $184,835 | $0 | $0 |

| 2022 | $3,519 | $172,660 | $0 | $0 |

| 2021 | $3,365 | $164,905 | $38,440 | $126,465 |

| 2020 | $3,428 | $171,050 | $38,450 | $132,600 |

| 2019 | $3,751 | $176,350 | $54,800 | $121,550 |

| 2018 | $3,269 | $150,800 | $33,700 | $117,100 |

| 2017 | $3,257 | $148,700 | $31,600 | $117,100 |

| 2016 | $3,016 | $164,550 | $31,600 | $132,950 |

| 2012 | -- | $89,900 | $13,850 | $76,050 |

Source: Public Records

Map

Nearby Homes

- 913 Main St

- 505 4th Ave W

- 810 1st Ave E

- Tbd Lambert St SW

- 508 12th St W

- 802 8th Ave W

- Tbd N Dakota 1804

- 711 8th Ave W

- 413 3rd Ave E

- 409 3rd Ave E

- 1015 8th Ave W

- 613 W Broadway

- Tbd 4th St W

- 901 6th St W

- 1401 6th Ave W

- 1010 10th Ave W

- 1519 4th Ave W

- 1215 University Ave

- 815 14th St W

- 1321 University Ave