723 Dasher Rd Unit 1190 Bristol, GA 31518

Estimated Value: $448,000

Studio

2

Baths

2,435

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 723 Dasher Rd Unit 1190, Bristol, GA 31518 and is currently estimated at $448,000, approximately $183 per square foot. 723 Dasher Rd Unit 1190 is a home located in Wayne County with nearby schools including Screven Elementary School, Arthur Williams Middle School, and Wayne County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2021

Sold by

Murphy Cleve

Bought by

Milton Jacob

Current Estimated Value

Purchase Details

Closed on

Nov 22, 2021

Sold by

Murphy Christopher H

Bought by

Murphy Elizabeth Ann

Purchase Details

Closed on

Nov 1, 2021

Sold by

Murphy Cleve

Bought by

Murphy Jeffery Alan

Purchase Details

Closed on

Aug 20, 2021

Sold by

Murphy Cleve

Bought by

Molly John Land Co Llc

Purchase Details

Closed on

Aug 4, 2021

Sold by

Murphy Cleve J

Bought by

Molly John Land Co Llc

Purchase Details

Closed on

Dec 1, 1997

Sold by

Murphy Murphy C and Murphy Nora M

Bought by

Murphy Cleve

Purchase Details

Closed on

Jul 1, 1979

Bought by

Murphy Murphy C and Murphy Nora M

Purchase Details

Closed on

Feb 1, 1977

Purchase Details

Closed on

Mar 1, 1973

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Milton Jacob | -- | -- | |

| Murphy Elizabeth Ann | -- | -- | |

| Murphy Christopher Harold | -- | -- | |

| Murphy Jeffery Alan | -- | -- | |

| Murphy Christopher Harold | -- | -- | |

| Milton Joshua Remington | -- | -- | |

| Molly John Land Co Llc | $400,000 | -- | |

| Molly John Land Co Llc | $400,000 | -- | |

| Murphy Cleve | -- | -- | |

| Murphy Murphy C | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $328 | $41,334 | $41,334 | $0 |

| 2024 | $328 | $41,334 | $41,334 | $0 |

| 2023 | $466 | $45,174 | $41,334 | $3,840 |

| 2022 | $694 | $41,334 | $41,334 | $0 |

| 2021 | $2,565 | $299,999 | $208,996 | $91,003 |

| 2020 | $2,612 | $248,830 | $157,827 | $91,003 |

| 2019 | $2,734 | $248,830 | $157,827 | $91,003 |

| 2018 | $2,702 | $248,830 | $157,827 | $91,003 |

| 2017 | $1,926 | $248,830 | $157,827 | $91,003 |

| 2016 | $1,639 | $260,406 | $169,403 | $91,003 |

| 2014 | $1,609 | $260,406 | $169,403 | $91,003 |

| 2013 | -- | $91,003 | $0 | $91,003 |

Source: Public Records

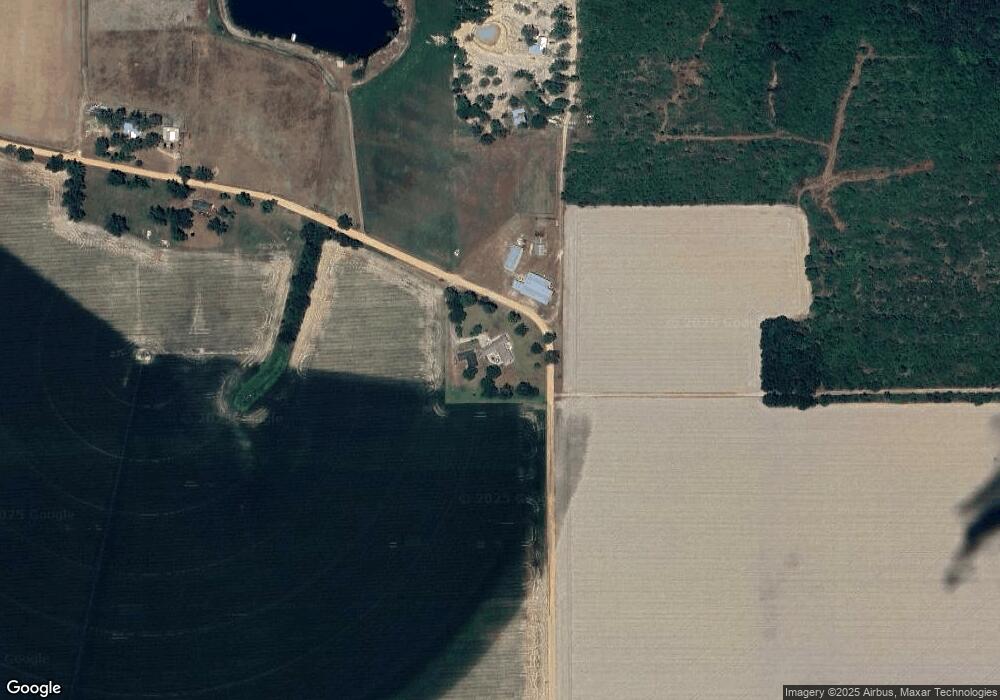

Map

Nearby Homes

- 59 Enoch Moody Rd

- 0 Jimmy Ree Ln

- 362 Crosby Ln

- 4866 Kville Rd

- 1517 Granny Crosby Rd

- 0 Kville Rd Unit 10596074

- 0 Kville Rd

- 6005 Chancey Rd

- 2114 Mill Creek Rd

- 0 Ward Boyette Rd

- 540 Freddy Rd

- 6959 Oak Crossing Rd

- 885 Odum Screven Rd

- 0 Metts-Overstreet Rd

- 1435 E Lake Dr

- 109 Joyner St

- 102 Highsmith Ave

- 391 S Forks Rd

- 868 Broadhurst Rd W

- 0 Dale Mill Rd

- 1190 Dasher Rd

- 726 Dasher Rd

- 1010 Dasher Rd

- 211 Clyde Wasdin Rd

- 960 Clyde Wasdin Rd

- 199 Dasher Rd

- 75 Dasher Rd

- 125 Dasher Rd

- 707 Clyde Wasdin Rd

- 923 Crystal Rd

- 2535 Mikell Lake Rd Unit 2763

- 1315 Mikell Lake Rd

- 2965 Mikell Lake Rd

- 1201 Mikell Lake Rd

- 3211 Mikell Lake Rd

- 1200 Mikell Lake Rd

- 0 Clyde Wasdin Rd Unit 1561585

- 818 Mikell Lake Rd

Your Personal Tour Guide

Ask me questions while you tour the home.