7243 Creekview Dr Unit 5 Cincinnati, OH 45247

Estimated Value: $111,727 - $124,000

2

Beds

2

Baths

880

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 7243 Creekview Dr Unit 5, Cincinnati, OH 45247 and is currently estimated at $118,182, approximately $134 per square foot. 7243 Creekview Dr Unit 5 is a home located in Hamilton County with nearby schools including Colerain Elementary School, Colerain Middle School, and Colerain High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2020

Sold by

Briskman Real Estate Llc

Bought by

Day John A and Flammer Angela M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,400

Outstanding Balance

$51,881

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$66,301

Purchase Details

Closed on

May 15, 2020

Sold by

Wuest Rahn A and Amerifirst Financial Corporati

Bought by

Briskman Real Estate Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,400

Outstanding Balance

$51,881

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$66,301

Purchase Details

Closed on

Jun 13, 2011

Sold by

Masson Mark A

Bought by

Wuest Rahn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,681

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 30, 1997

Sold by

Geiger Anne and Geiger Anne M

Bought by

Masson Mark A and Anne M Geiger Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Day John A | $73,000 | None Available | |

| Briskman Real Estate Llc | $47,200 | None Available | |

| Wuest Rahn A | $52,000 | Attorney | |

| Masson Mark A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Day John A | $58,400 | |

| Previous Owner | Wuest Rahn A | $50,681 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,367 | $25,550 | $2,800 | $22,750 |

| 2023 | $1,375 | $25,550 | $2,800 | $22,750 |

| 2022 | $1,435 | $21,763 | $1,680 | $20,083 |

| 2021 | $1,423 | $21,763 | $1,680 | $20,083 |

| 2020 | $1,438 | $21,763 | $1,680 | $20,083 |

| 2019 | $938 | $13,216 | $1,400 | $11,816 |

| 2018 | $842 | $13,216 | $1,400 | $11,816 |

| 2017 | $798 | $13,216 | $1,400 | $11,816 |

| 2016 | $790 | $12,926 | $2,611 | $10,315 |

| 2015 | $798 | $12,926 | $2,611 | $10,315 |

| 2014 | $799 | $12,926 | $2,611 | $10,315 |

| 2013 | $1,069 | $18,200 | $3,675 | $14,525 |

Source: Public Records

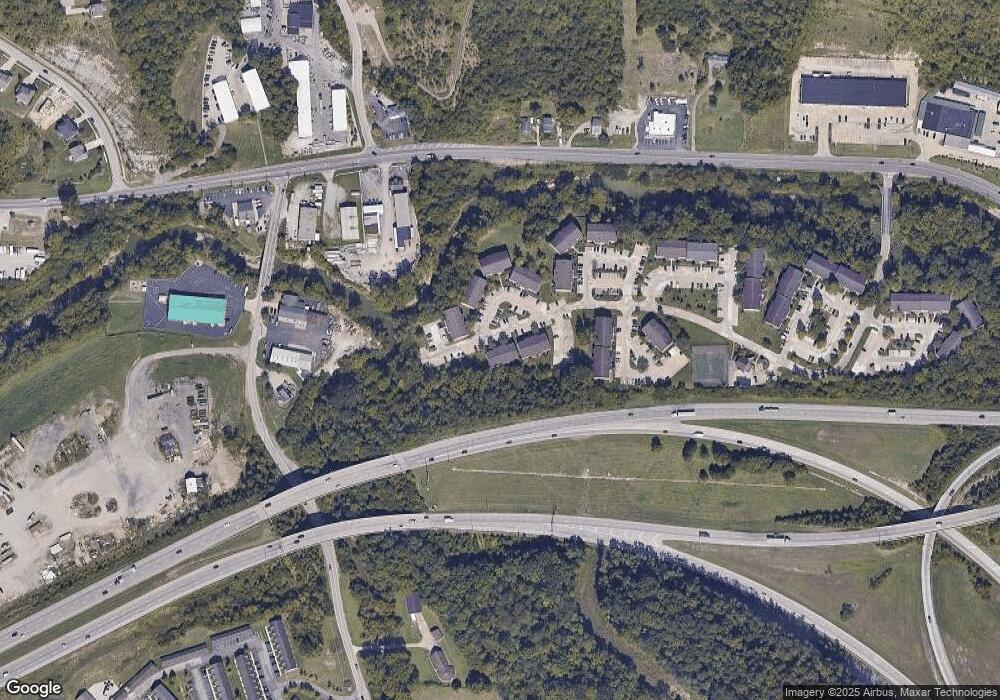

Map

Nearby Homes

- 7238 Creekview Dr

- 7234 Creekview Dr

- 7212 Creekview Dr

- 7298 Harrison Ave

- 7146 Althaus Rd

- 6994 Mullen Rd

- 7390 E Miami River Rd

- 7981 Oakbridge Way

- 7970 Eagle Creek Rd

- 5360 E Miami River Rd

- 7787 Skyview Cir

- 7664 Bridge Point Dr

- 7601 Skyview Cir

- 6998 Harrison Ave

- 8434 Forest Valley Dr

- 7780 E Miami River Rd

- 6764 Verde Ridge Dr Unit 19A

- 5891 Snyder Rd

- 5414 Jamies Oak Ct

- 8576 Forest Valley Dr

- 7243 Creekview Dr Unit X1K

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr Unit XIF

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr

- 7243 Creekview Dr Unit XIM

- 7243 Creekview Dr Unit 1

- 7243 Creekview Dr Unit 3

- 7243 Creekview Dr Unit 6

- 7243 Creekview Dr Unit 4

- 7243 Creekview Dr Unit 11

- 7243 Creekview Dr Unit 9

- 7243 Creekview Dr Unit 10

- 7243 Creekview Dr Unit 12