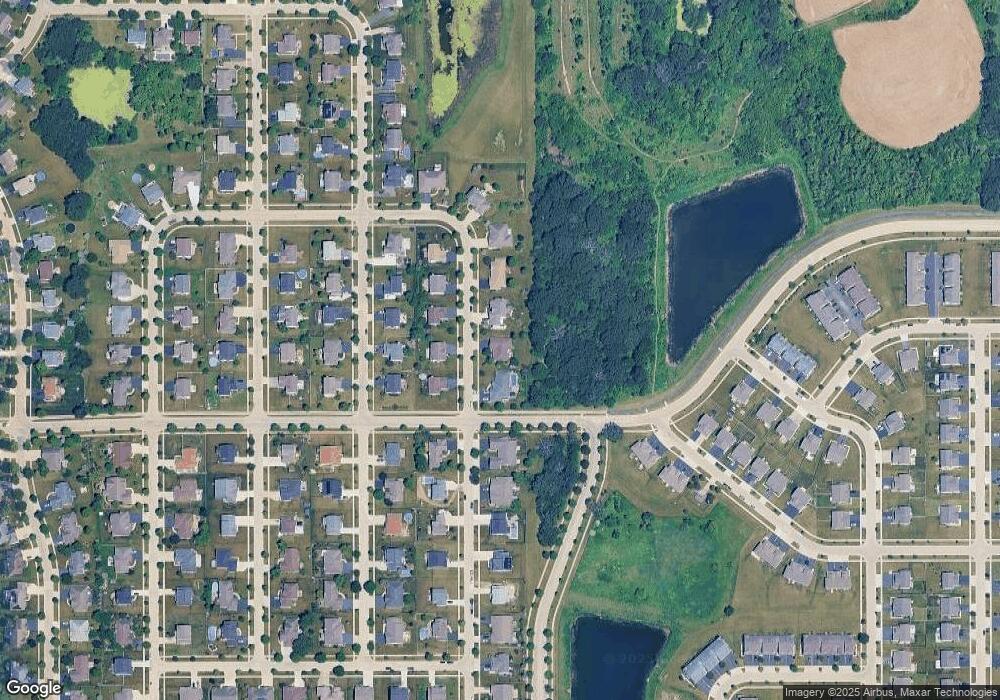

729 Karen Dr Hampshire, IL 60140

Estimated Value: $457,882 - $544,000

3

Beds

3

Baths

2,322

Sq Ft

$209/Sq Ft

Est. Value

About This Home

This home is located at 729 Karen Dr, Hampshire, IL 60140 and is currently estimated at $485,721, approximately $209 per square foot. 729 Karen Dr is a home located in Kane County with nearby schools including Hampshire Elementary School, Hampshire Middle School, and Hampshire High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2012

Sold by

Thurow Robert L and Thurow Coleen K

Bought by

Thurow Robert L and Trust 101

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2012

Sold by

Swalwell William R and Swalwell Kerry

Bought by

Thurow Robert and Thurow Colleen

Purchase Details

Closed on

Dec 21, 2007

Sold by

Citizens First National Bank Of Princeto

Bought by

Swalwell William R and Swalwell Kerry

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Interest Rate

6.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 30, 2005

Sold by

Lennar Chicago Inc

Bought by

Heritage Builders Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thurow Robert L | -- | None Available | |

| Thurow Robert | $235,000 | First United Title Svcs Inc | |

| Swalwell William R | $405,000 | First American Title | |

| Heritage Builders Inc | $519,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Swalwell William R | $324,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,667 | $130,427 | $35,001 | $95,426 |

| 2023 | $7,975 | $117,322 | $31,484 | $85,838 |

| 2022 | $5,518 | $107,823 | $28,935 | $78,888 |

| 2021 | $5,573 | $99,626 | $27,295 | $72,331 |

| 2020 | $5,666 | $96,456 | $26,549 | $69,907 |

| 2019 | $5,803 | $93,302 | $25,681 | $67,621 |

| 2018 | $6,029 | $87,209 | $24,264 | $62,945 |

| 2017 | $6,116 | $83,758 | $23,304 | $60,454 |

| 2016 | $6,425 | $85,392 | $28,564 | $56,828 |

| 2015 | -- | $79,368 | $26,549 | $52,819 |

| 2014 | -- | $76,751 | $25,674 | $51,077 |

| 2013 | -- | $81,659 | $27,316 | $54,343 |

Source: Public Records

Map

Nearby Homes

- 720 James Dr

- 808 James Dr

- 730 Bruce Dr

- 431 Patricia Ln

- 1655 Windsor Rd

- 1053 Marcello Dr

- 1284 Olive Ln

- Lot 124 Meadowdale Cir W

- 318 Old Mill Ln

- 651 Olive Ln

- 263 E Jackson Ave

- 190 Grove Ave

- 895 S State St

- 862 Briar Glen Ct

- 804 Briar Glen Ct

- 820 Briar Glen Ct

- 704 S State St

- 125 Mill Ave

- 120 Jack Dylan Dr

- 1411 Oakfield Ln