730 Laurel Chase SW Marietta, GA 30064

Southwestern Marietta NeighborhoodEstimated Value: $475,000 - $531,000

4

Beds

3

Baths

2,372

Sq Ft

$213/Sq Ft

Est. Value

About This Home

This home is located at 730 Laurel Chase SW, Marietta, GA 30064 and is currently estimated at $504,281, approximately $212 per square foot. 730 Laurel Chase SW is a home located in Cobb County with nearby schools including Hickory Hills Elementary School, Marietta Sixth Grade Academy, and Marietta Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2018

Sold by

Garcia Flores Lisa Taylor

Bought by

Garcia Flores Lisa Taylor

Current Estimated Value

Purchase Details

Closed on

Mar 4, 2016

Sold by

Young Adelbert R and Delores M Young Liv T

Bought by

Flores Lisa Taylor Garcia

Purchase Details

Closed on

Apr 16, 2012

Sold by

Taylor Lisa Young

Bought by

Young Dolores M Ttee Living Tr

Purchase Details

Closed on

Jul 16, 2007

Sold by

Young Dolores M

Bought by

Young Dolores M and Taylor Lisa

Purchase Details

Closed on

Feb 27, 2003

Sold by

Rowell Laura A

Bought by

Giberson David and Giberson Barbara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,200

Interest Rate

5.89%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 29, 1999

Sold by

Miller Gerald L and Miller Gwynneth J

Bought by

Rowell Laura A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,800

Interest Rate

6.85%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Flores Lisa Taylor | -- | -- | |

| Flores Lisa Taylor Garcia | -- | -- | |

| Young Dolores M Ttee Living Tr | -- | -- | |

| Young Dolores M | -- | -- | |

| Young Dolores M | $270,000 | -- | |

| Giberson David | $229,000 | -- | |

| Rowell Laura A | $196,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Giberson David | $183,200 | |

| Previous Owner | Rowell Laura A | $156,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $660 | $175,604 | $52,000 | $123,604 |

| 2024 | $660 | $175,604 | $52,000 | $123,604 |

| 2023 | $508 | $151,648 | $40,000 | $111,648 |

| 2022 | $660 | $112,028 | $32,000 | $80,028 |

| 2021 | $675 | $112,028 | $32,000 | $80,028 |

| 2020 | $674 | $106,628 | $32,000 | $74,628 |

| 2019 | $674 | $106,628 | $32,000 | $74,628 |

| 2018 | $756 | $88,032 | $28,000 | $60,032 |

| 2017 | $607 | $88,032 | $28,000 | $60,032 |

| 2016 | $430 | $72,004 | $19,200 | $52,804 |

| 2015 | $469 | $72,004 | $19,200 | $52,804 |

| 2014 | $485 | $72,004 | $0 | $0 |

Source: Public Records

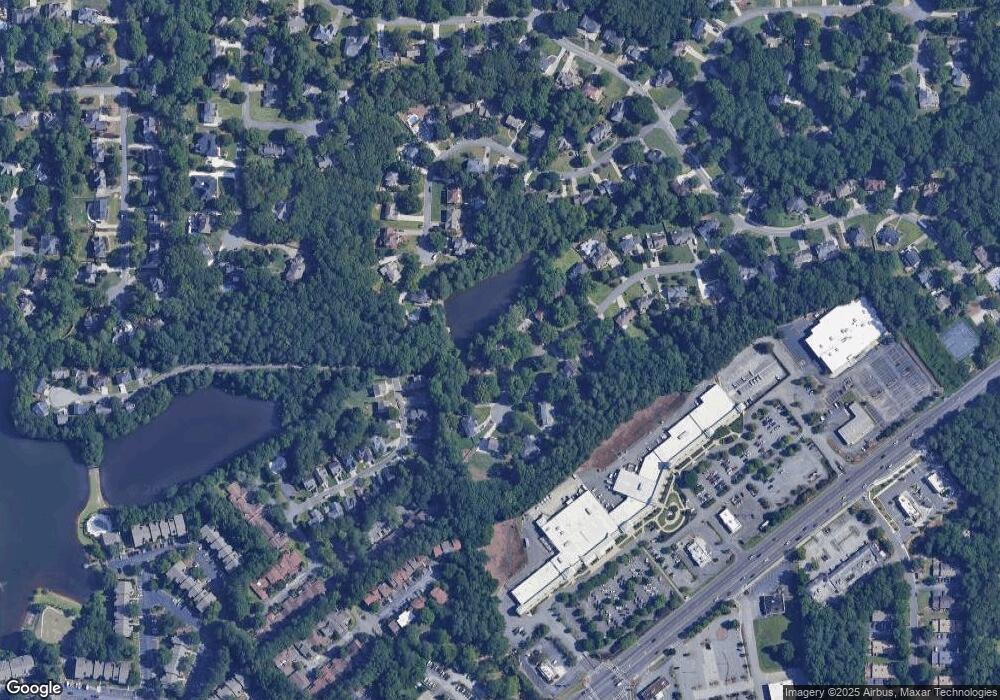

Map

Nearby Homes

- 959 Laurel Springs Ln SW

- 766 Reeves Lake Dr SW

- 836 Lake Hollow Blvd SW Unit 38

- 952 Laurel Springs Ln SW

- 893 Lake Hollow Blvd SW

- 841 Lake Hollow Blvd SW Unit 9

- 730 Reeves Lake Dr SW

- 803 Chestnut Hill Rd SW

- 963 Bolingbrook Dr SW

- 651 Chestnut Hill Rd SW

- 852 Hickory Dr SW

- 1038 Arden Dr SW

- 994 Powder Springs St

- 840 Hickory Dr SW

- 745 Cedar Pointe Ct SW

- 827 Hickory Dr SW

- 701 Springhollow Ln SW

- 1010 Wesley Park Dr SW

- 726 Laurel Chase SW

- 732 Laurel Chase SW

- 734 Laurel Chase SW

- 729 Laurel Chase SW Unit 2

- 1068 Laurel Valley Dr SW

- 720 Laurel Chase SW Unit 2

- 751 Reeves Lake Dr SW

- 1059 Laurel Valley Dr SW

- 736 Laurel Chase SW Unit 2

- 0 Reeves Lake Unit 8718875

- 753 Reeves Lake Dr SW Unit 1

- 753 Reeves Lake Dr SW

- 733 Laurel Chase SW

- 725 Laurel Chase SW

- 755 Reeves Lake Dr SW

- 716 Laurel Chase SW

- 721 Laurel Chase SW

- 740 Laurel Chase SW

- 1060 Laurel Valley Dr SW Unit 11

- 757 Reeves Lake Dr SW Unit 1