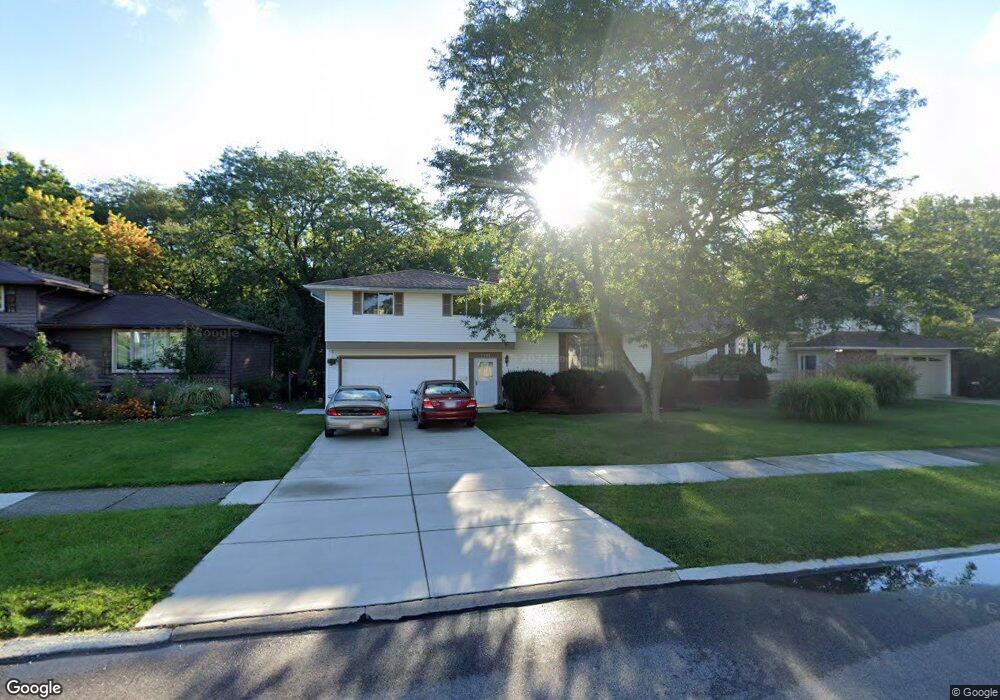

7323 Meadow Ln Cleveland, OH 44134

Estimated Value: $236,160 - $269,000

3

Beds

1

Bath

1,264

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 7323 Meadow Ln, Cleveland, OH 44134 and is currently estimated at $258,540, approximately $204 per square foot. 7323 Meadow Ln is a home located in Cuyahoga County with nearby schools including Dentzler Elementary School, Normandy High School, and Hillside Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2013

Sold by

Weber Magdalena

Bought by

Less Marita and Less Vance

Current Estimated Value

Purchase Details

Closed on

Jul 5, 2006

Sold by

Weber Christian and Weber Magdalena

Bought by

Weber Christian and Weber Magdalena

Purchase Details

Closed on

May 16, 1989

Sold by

Myeress Marita

Bought by

Weber Christian

Purchase Details

Closed on

May 18, 1987

Sold by

Robert R Myeress

Bought by

Myeress Marita

Purchase Details

Closed on

Apr 11, 1985

Sold by

Klimczak Edward David

Bought by

Robert R Myeress

Purchase Details

Closed on

Jul 23, 1984

Sold by

Connors Debra A

Bought by

Klimczak Edward David

Purchase Details

Closed on

Dec 1, 1982

Sold by

Klimczak Olga

Bought by

Connors Debra A

Purchase Details

Closed on

Aug 15, 1979

Sold by

Gaj Randall V and L F

Bought by

Klimczak Olga

Purchase Details

Closed on

Jan 1, 1975

Bought by

Gaj Randall and L F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Less Marita | -- | None Available | |

| Weber Christian | -- | Attorney | |

| Weber Christian | -- | -- | |

| Myeress Marita | -- | -- | |

| Robert R Myeress | $66,000 | -- | |

| Klimczak Edward David | -- | -- | |

| Connors Debra A | -- | -- | |

| Klimczak Olga | $68,000 | -- | |

| Gaj Randall | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,656 | $68,985 | $13,510 | $55,475 |

| 2023 | $3,736 | $51,670 | $11,100 | $40,570 |

| 2022 | $3,703 | $51,660 | $11,100 | $40,570 |

| 2021 | $3,815 | $51,660 | $11,100 | $40,570 |

| 2020 | $3,614 | $43,400 | $9,310 | $34,090 |

| 2019 | $3,474 | $124,000 | $26,600 | $97,400 |

| 2018 | $3,497 | $43,400 | $9,310 | $34,090 |

| 2017 | $3,436 | $39,870 | $8,580 | $31,290 |

| 2016 | $3,415 | $39,870 | $8,580 | $31,290 |

| 2015 | $3,351 | $39,870 | $8,580 | $31,290 |

| 2014 | $3,351 | $41,100 | $8,860 | $32,240 |

Source: Public Records

Map

Nearby Homes

- 2644 Nottingham Dr

- 7180 Marko Ln

- 3200 Dentzler Rd

- 1881 W Pleasant Valley Rd

- 2800 Bonny Blvd

- 2838 Marda Dr

- 3195 Marda Dr

- 3262 Marda Dr

- 7558 Pleasant View Dr

- 3011 Klusner Ave

- 2830 Brian Dr

- 3610 Jeanne Dr

- 375 Hillside Rd

- 1658 Winterpark Dr

- 2406 Park Dr

- 7030 Lyle Ave

- 2410 Park Dr

- 7744 Cecelia Dr

- 1030 Guadalupe Dr

- 7004 Broadview Rd