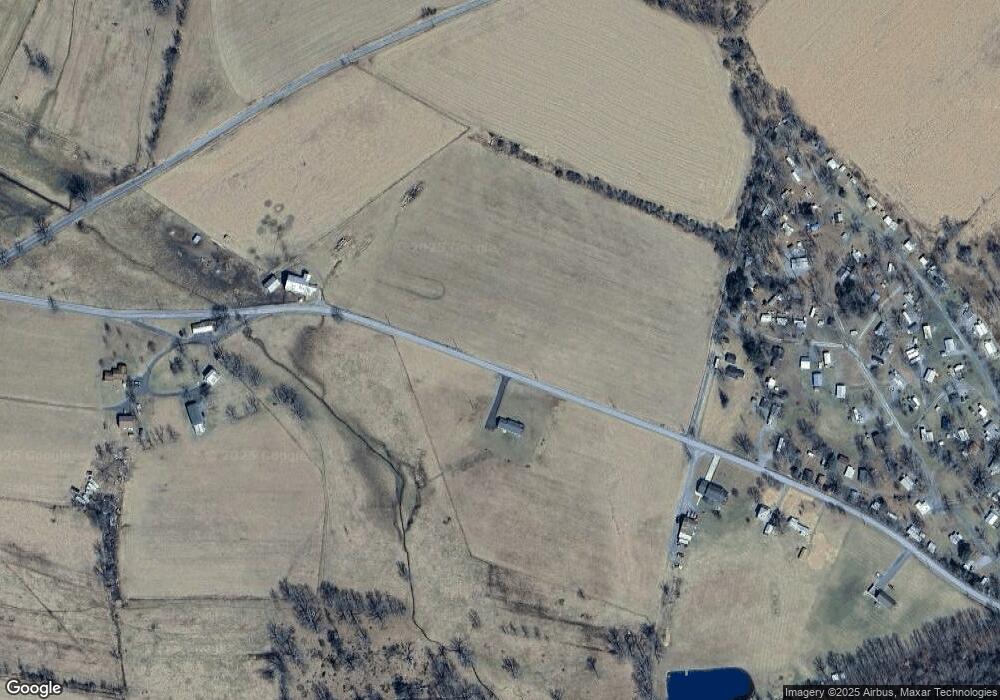

734 Hillegass Rd Schellsburg, PA 15559

Estimated Value: $416,000 - $660,345

Studio

--

Bath

1,752

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 734 Hillegass Rd, Schellsburg, PA 15559 and is currently estimated at $506,115, approximately $288 per square foot. 734 Hillegass Rd is a home located in Bedford County with nearby schools including Chestnut Ridge Central Elementary School, Chestnut Ridge Middle School, and Chestnut Ridge Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2025

Sold by

Hillegass Wayne S and Hillegass Loraine

Bought by

Winding Creek Cattle And Equipment Company Ll

Current Estimated Value

Purchase Details

Closed on

Dec 30, 2021

Sold by

Hillegass Wayne S and Hillegass Loraine

Bought by

Hillegass Kaitlin

Purchase Details

Closed on

Aug 27, 2020

Sold by

Hillegass Wayne S and Hillegass Loraine

Bought by

Hillegass Wayne S and Hillegass Loraine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$407,000

Interest Rate

3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 10, 2016

Sold by

Hillegass Wayne S

Bought by

Hillegass Wayne S and Hillegass Loraine

Purchase Details

Closed on

Sep 1, 1962

Bought by

Hillegass Clarence and Hillegass Clara

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Winding Creek Cattle And Equipment Company Ll | -- | None Listed On Document | |

| Hillegass Kaitlin | -- | None Available | |

| Hillegass Wayne S | -- | None Available | |

| Hillegass Wayne S | -- | None Available | |

| Hillegass Clarence | $8,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hillegass Wayne S | $407,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,052 | $149,290 | $89,090 | $60,200 |

| 2024 | $2,035 | $149,290 | $89,090 | $60,200 |

| 2023 | $5,108 | $149,290 | $89,090 | $60,200 |

| 2022 | $5,359 | $149,290 | $89,090 | $60,200 |

| 2021 | $5,136 | $158,110 | $97,910 | $60,200 |

| 2020 | $4,879 | $141,510 | $97,910 | $43,600 |

| 2019 | $4,598 | $141,510 | $97,910 | $43,600 |

| 2018 | $4,598 | $141,510 | $97,910 | $43,600 |

| 2017 | $4,478 | $141,510 | $97,910 | $43,600 |

| 2016 | -- | $141,510 | $97,910 | $43,600 |

| 2014 | -- | $124,690 | $81,090 | $43,600 |

Source: Public Records

Map

Nearby Homes

- 1597 Market St

- 3789 Pitt St

- 4402 Allegheny Rd

- 3880 Pitt St

- Lot 1 Anderson Rd

- 1187 Winegardner Rd

- 1996 Allegheny Rd

- 855 Lincoln Hwy

- Off Mountain View Dr

- 5620 Milligans Cove Rd

- 8971 Hyndman Rd

- 2860 Lincoln Hwy

- 0 Club Rd

- 209 Peacock Ln

- 0 Laurel Dr Unit 86,87

- #86,87 Laurel Dr

- 1540 Shaffer Mtn Rd

- 1540 Shaffer Mountain Rd

- 105 Baltimore St

- 0 S Folino Rd Unit 1696893

- 734 Hillegass Rd

- 734 Hillegass Rd

- 712 Hillegass Rd

- Off Hillegass Rd

- 624 Hillegass Rd

- 849 Skipback Rd

- 888 Hillegass Rd

- 888 Hillegass Rd

- 930 Hillegass Rd

- 3776 Boozer Rd

- 3564 Boozer Rd

- 3502 Boozer Rd

- 221 Falkland Ln

- 565 Mill Rd

- 3473 Boozer Rd

- 3413 Boozer Rd

- 611 Mill Rd

- 611 Mill Rd

- 250 Hillegass Rd

- 3369 Boozer Rd

Your Personal Tour Guide

Ask me questions while you tour the home.