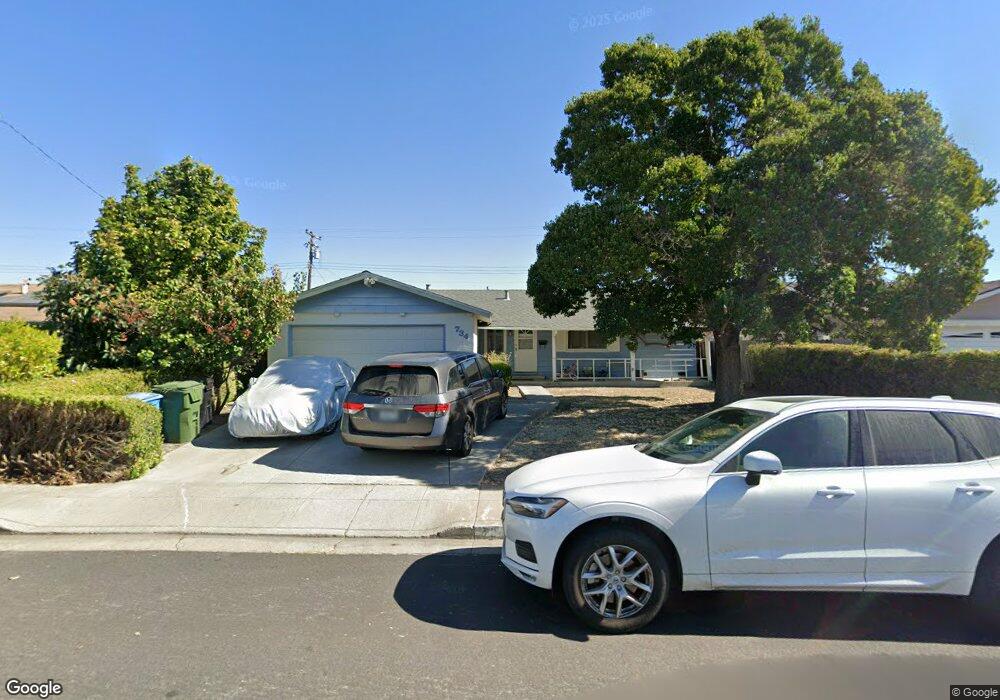

734 Orkney Ave Santa Clara, CA 95054

North Santa Clara NeighborhoodEstimated Value: $1,366,741 - $1,655,000

3

Beds

2

Baths

1,280

Sq Ft

$1,137/Sq Ft

Est. Value

About This Home

This home is located at 734 Orkney Ave, Santa Clara, CA 95054 and is currently estimated at $1,455,435, approximately $1,137 per square foot. 734 Orkney Ave is a home located in Santa Clara County with nearby schools including Montague Elementary School, Buchser Middle School, and Santa Clara High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2016

Sold by

Yeung Christopher and Leung Kityuk J

Bought by

Yeung Christopher and Leung Kityuk J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,000

Outstanding Balance

$266,154

Interest Rate

3.47%

Mortgage Type

New Conventional

Estimated Equity

$1,189,281

Purchase Details

Closed on

Jan 3, 2012

Sold by

Brown Carol L and Lewerenz James C

Bought by

Yeung Christopher and Leung Kityuk J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$372,000

Interest Rate

3.96%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 13, 2000

Sold by

Lewerenz Mary A

Bought by

Lewerenz Mary Ann

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yeung Christopher | -- | Chicago Title Company | |

| Yeung Christopher | $465,000 | Chicago Title Company | |

| Lewerenz Mary Ann | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yeung Christopher | $331,000 | |

| Closed | Yeung Christopher | $372,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,794 | $584,050 | $350,431 | $233,619 |

| 2024 | $6,794 | $572,599 | $343,560 | $229,039 |

| 2023 | $6,726 | $561,373 | $336,824 | $224,549 |

| 2022 | $6,624 | $550,367 | $330,220 | $220,147 |

| 2021 | $6,597 | $539,577 | $323,746 | $215,831 |

| 2020 | $6,476 | $534,045 | $320,427 | $213,618 |

| 2019 | $6,470 | $523,575 | $314,145 | $209,430 |

| 2018 | $6,057 | $513,310 | $307,986 | $205,324 |

| 2017 | $6,027 | $503,247 | $301,948 | $201,299 |

| 2016 | $5,926 | $493,380 | $296,028 | $197,352 |

| 2015 | $5,903 | $485,970 | $291,582 | $194,388 |

| 2014 | $5,607 | $476,452 | $285,871 | $190,581 |

Source: Public Records

Map

Nearby Homes

- 920 Clyde Ave

- 930 Clyde Ave

- 783 Laurie Ave

- 3901 Lick Mill Blvd Unit 358

- 3901 Lick Mill Blvd Unit 430

- 3901 Lick Mill Blvd Unit 312

- 4012 Fitzpatrick Way Unit 3

- 1752 Beech St

- 1900 Chestnut St

- 1883 Agnew Rd Unit 301

- 1883 Agnew Rd Unit 341

- 1883 Agnew Rd Unit 367

- 4464 Laird Cir

- 1898 Garzoni Place

- 1901 Garzoni Place Unit 405

- 2200 Agnew Rd Unit 212

- 2200 Agnew Rd Unit 118

- 4503 Cheeney St

- 4699 Snead Dr

- 4676 Wilcox Ave