735 24 3/4 Rd Grand Junction, CO 81505

North Grand Junction NeighborhoodEstimated Value: $298,000 - $373,000

2

Beds

1

Bath

624

Sq Ft

$536/Sq Ft

Est. Value

About This Home

This home is located at 735 24 3/4 Rd, Grand Junction, CO 81505 and is currently estimated at $334,439, approximately $535 per square foot. 735 24 3/4 Rd is a home located in Mesa County with nearby schools including Appleton Elementary School, Redlands Middle School, and Fruita 8/9 School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 3, 1999

Sold by

Dipaola Tracy R Dipaola Mark

Bought by

Barnes Michael D and Barnes Chris D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,064

Outstanding Balance

$22,958

Interest Rate

6.91%

Mortgage Type

FHA

Estimated Equity

$311,481

Purchase Details

Closed on

Jul 7, 1994

Sold by

Steele Tracy R

Bought by

Barnes Michael D

Purchase Details

Closed on

Sep 13, 1989

Sold by

Mcginnis L O

Bought by

Barnes Michael D

Purchase Details

Closed on

Sep 3, 1989

Sold by

Mcginnis Leland

Bought by

Barnes Michael D

Purchase Details

Closed on

Oct 16, 1891

Sold by

Pomona Park

Bought by

Barnes Michael D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barnes Michael D | $88,200 | Western Colorado Title Compa | |

| Barnes Michael D | -- | -- | |

| Barnes Michael D | $15,000 | -- | |

| Barnes Michael D | $15,000 | -- | |

| Barnes Michael D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barnes Michael D | $88,064 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,399 | $19,340 | $12,270 | $7,070 |

| 2023 | $1,399 | $19,340 | $12,270 | $7,070 |

| 2022 | $1,289 | $17,480 | $11,120 | $6,360 |

| 2021 | $1,257 | $17,980 | $11,440 | $6,540 |

| 2020 | $861 | $12,610 | $6,440 | $6,170 |

| 2019 | $784 | $12,610 | $6,440 | $6,170 |

| 2018 | $726 | $10,500 | $5,760 | $4,740 |

| 2017 | $724 | $10,500 | $5,760 | $4,740 |

| 2016 | $658 | $10,760 | $6,370 | $4,390 |

| 2015 | $663 | $10,760 | $6,370 | $4,390 |

| 2014 | $501 | $8,140 | $4,780 | $3,360 |

Source: Public Records

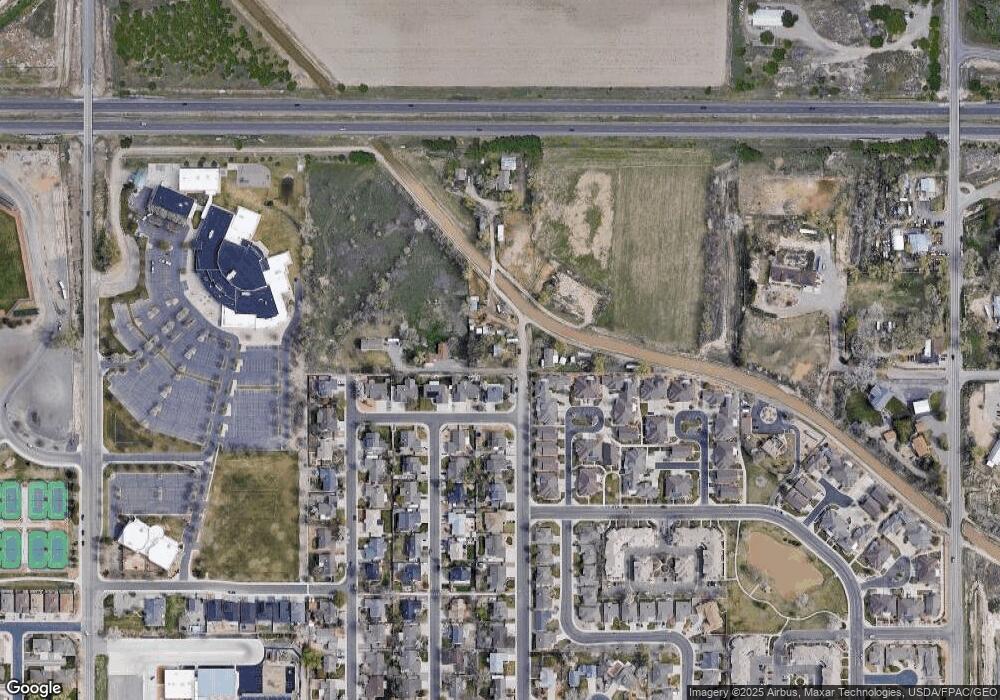

Map

Nearby Homes

- 0 Roaring Fork Dr

- 2472 Roaring Fork Dr

- 2470 Roaring Fork Dr

- 735 Scoters Cir Unit B

- 735 Scoters Cir Unit C

- 735 Scoters Cir Unit A

- 735 Scoters Cir Unit U62

- 735 Scoters Cir Unit U61

- 735 Scoters Cir Unit U59

- 735 Scoters Cir Unit U59 (D)

- 735 Scoters Cir Unit D

- 735 1/2 24 3/4 Rd

- 733 24 3/4 Rd

- 733 24 3 4 Rd

- 733 Scoters Cir Unit U63

- 732 N Valley Dr

- 2466 Roaring Fork Dr

- 737 Scoters Cir Unit B

- 737 Scoters Cir Unit U58

- 737 Scoters Cir Unit U57