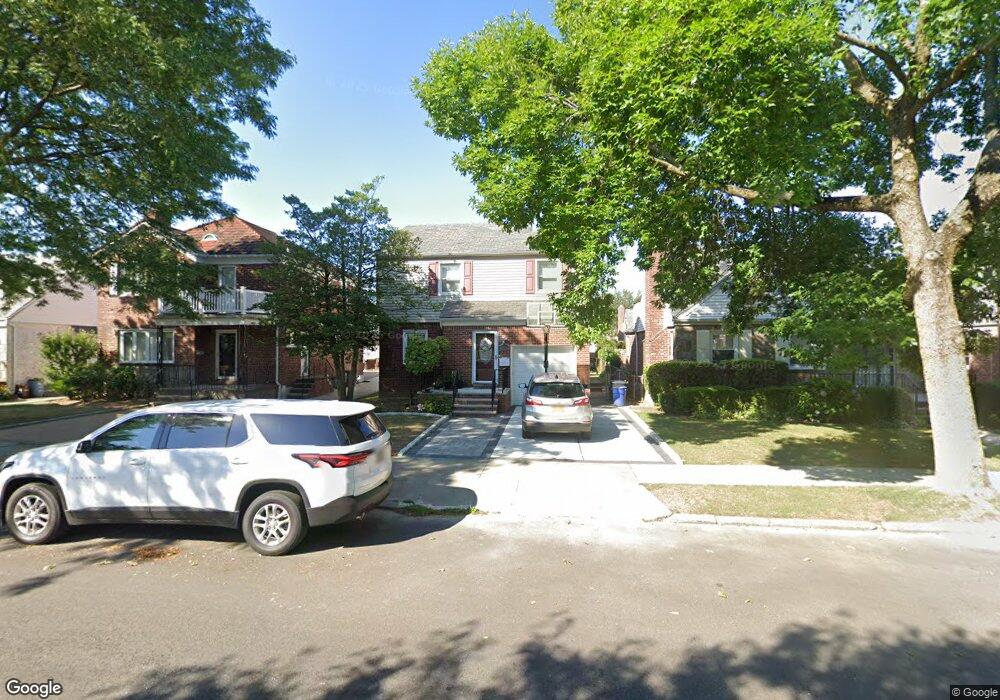

7352 193rd St Fresh Meadows, NY 11366

Fresh Meadows NeighborhoodEstimated Value: $996,859 - $1,184,000

--

Bed

--

Bath

1,208

Sq Ft

$901/Sq Ft

Est. Value

About This Home

This home is located at 7352 193rd St, Fresh Meadows, NY 11366 and is currently estimated at $1,088,215, approximately $900 per square foot. 7352 193rd St is a home located in Queens County with nearby schools including P.S. 26 Rufus King School, George J. Ryan Middle School 216, and Yeshiva Primary/Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 30, 2006

Sold by

Clara E Gilbert Living Trust and Gilbert Trustee Clara E

Bought by

Klaus Maria Gloria and Klaus Robert

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$195,595

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$892,620

Purchase Details

Closed on

Sep 11, 2003

Sold by

Leviev Mikhail and Vayser Alex

Bought by

A-A-U-M Llc

Purchase Details

Closed on

Jun 12, 1997

Sold by

Gilbert Clara E and Gilbert Carl F

Bought by

Gilbert Clara E and Klaus Elaine C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Klaus Maria Gloria | $450,000 | -- | |

| Klaus Maria Gloria | $450,000 | -- | |

| A-A-U-M Llc | -- | -- | |

| A-A-U-M Llc | -- | -- | |

| Gilbert Clara E | -- | -- | |

| Gilbert Clara E | -- | -- | |

| Gilbert Clara E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Klaus Maria Gloria | $350,000 | |

| Closed | Klaus Maria Gloria | $350,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,289 | $49,024 | $14,221 | $34,803 |

| 2024 | $9,289 | $46,249 | $12,882 | $33,367 |

| 2023 | $8,763 | $43,632 | $13,449 | $30,183 |

| 2022 | $8,398 | $49,440 | $15,960 | $33,480 |

| 2021 | $9,073 | $52,860 | $15,960 | $36,900 |

| 2020 | $8,647 | $54,120 | $15,960 | $38,160 |

| 2019 | $8,062 | $54,840 | $15,960 | $38,880 |

| 2018 | $7,412 | $36,360 | $10,782 | $25,578 |

| 2017 | $7,324 | $35,928 | $11,404 | $24,524 |

| 2016 | $7,182 | $35,928 | $11,404 | $24,524 |

| 2015 | $4,088 | $34,045 | $14,035 | $20,010 |

| 2014 | $4,088 | $32,118 | $15,898 | $16,220 |

Source: Public Records

Map

Nearby Homes

- 73-48 193rd St

- 73-55 194th St

- 73-50 190th St

- 73-48 195th St

- 7548 195th St

- 80-03 192nd St

- 75-23 196th St

- 75-59 195th St

- 80-11 190th St

- 73-08 187th St

- 196-53 73rd Ave Unit 1st Floor

- 196-32 69th Ave Unit 1st Fl

- 73-60 198th St

- 196-19 69th Ave Unit 2

- 6957 197th St

- 8012 188th St

- 80-48 190th St

- 75-22 186th St

- 18547 80th Rd

- 80-50 189th St