7390 N Chestnut Commons Dr Unit 9B Mentor, OH 44060

Estimated Value: $168,155 - $190,000

2

Beds

3

Baths

640

Sq Ft

$281/Sq Ft

Est. Value

About This Home

This home is located at 7390 N Chestnut Commons Dr Unit 9B, Mentor, OH 44060 and is currently estimated at $179,539, approximately $280 per square foot. 7390 N Chestnut Commons Dr Unit 9B is a home located in Lake County with nearby schools including Bellflower Elementary School, Shore Middle School, and Mentor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2004

Sold by

Tilton Jacqueline and Tilton William E

Bought by

Stanley Marcella E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,363

Outstanding Balance

$57,622

Interest Rate

6.46%

Mortgage Type

FHA

Estimated Equity

$121,917

Purchase Details

Closed on

Jun 19, 2001

Sold by

Manning Jennifer L and Manning Jennifer L

Bought by

Mikula Jacqueline

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,600

Interest Rate

7.11%

Purchase Details

Closed on

Dec 8, 1989

Bought by

Luke Sharon A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stanley Marcella E | $117,900 | Enterprise Title | |

| Mikula Jacqueline | $101,000 | Enterprise Title Agency Inc | |

| Luke Sharon A | $60,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stanley Marcella E | $114,363 | |

| Previous Owner | Mikula Jacqueline | $60,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $49,400 | $7,060 | $42,340 |

| 2023 | $3,946 | $37,970 | $6,370 | $31,600 |

| 2022 | $1,749 | $37,970 | $6,370 | $31,600 |

| 2021 | $1,754 | $37,970 | $6,370 | $31,600 |

| 2020 | $1,539 | $29,210 | $4,900 | $24,310 |

| 2019 | $1,541 | $29,210 | $4,900 | $24,310 |

| 2018 | $1,536 | $26,340 | $3,780 | $22,560 |

| 2017 | $1,456 | $26,340 | $3,780 | $22,560 |

| 2016 | $1,447 | $26,340 | $3,780 | $22,560 |

| 2015 | $1,320 | $26,340 | $3,780 | $22,560 |

| 2014 | $1,339 | $26,340 | $3,780 | $22,560 |

| 2013 | $1,340 | $26,340 | $3,780 | $22,560 |

Source: Public Records

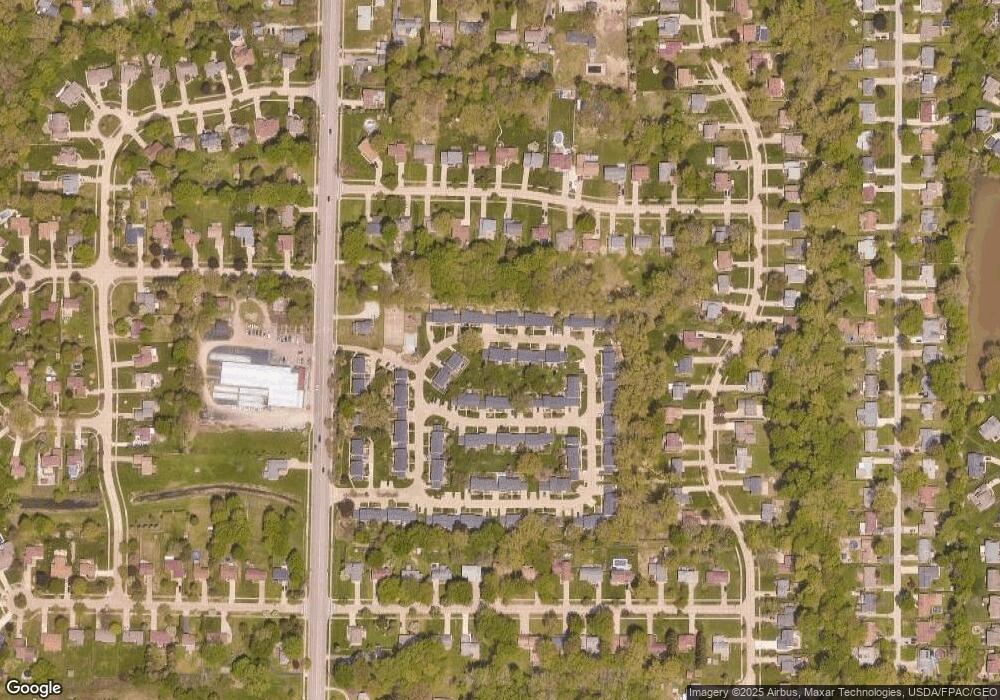

Map

Nearby Homes

- 7401 Faye Ln

- 6542 Inland Shores Dr

- 6672 Reynolds Rd

- 6430 S Cedarwood Rd

- 6335 S Cedarwood Rd

- 6195 Thunderbird Dr

- 6452 Brooks Blvd

- 6416 Seneca Trail

- 7514 Brambleside Ln

- 1109 Cherokee Trail

- 7722 Rutland Dr

- 6495 Meadowbrook Dr

- 6312 Dunbar Dr

- 6143 Seminole Trail

- 700 Cherokee Trail

- 6870 Georgetown Dr

- 6086 Seminole Trail

- 6625 Pear Tree Ln

- 7379 Larkspur Dr

- 6306 Mentor Park Blvd

- 7388 N Chestnut Commons Dr

- 7392 N Chestnut Commons Dr Unit 9C

- 7392 N Chestnut Commons Dr Unit C

- 7394 N Chestnut Commons Dr

- 7396 N Chestnut Commons Dr Unit 9E

- 7411 N Chestnut Commons Dr

- 7409 S Chestnut Commons Dr Unit 13D

- 7409 N Chestnut Commons Dr Unit 7F

- 7398 N Chestnut Commons Dr

- 7413 N Chestnut Commons Dr Unit 7D

- 7407 N Chestnut Commons Dr

- 7386 N Chestnut Commons Dr Unit 8D

- 7415 N Chestnut Commons Dr

- 7405 N Chestnut Commons Dr

- 7385 Willow Run Dr

- 7385 Willow Run Dr Unit A

- 7400 N Chestnut Commons Dr

- 7381 Willow Run Dr

- 7384 N Chestnut Commons Dr

- 7417 N Chestnut Commons Dr Unit 7B