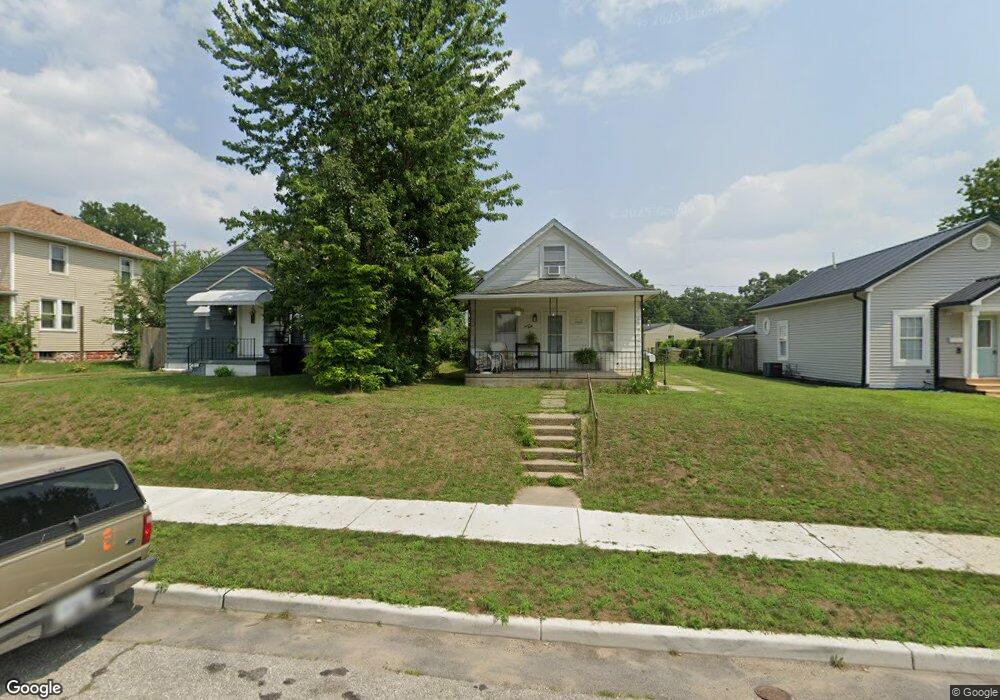

740 S 36th St South Bend, IN 46615

River Park NeighborhoodEstimated Value: $135,000 - $178,466

4

Beds

1

Bath

988

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 740 S 36th St, South Bend, IN 46615 and is currently estimated at $161,117, approximately $163 per square foot. 740 S 36th St is a home located in St. Joseph County with nearby schools including Nuner Fine Arts Academy, Jefferson Intermediate Traditional School, and Adams High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2025

Sold by

Madou Home Rentals Llc

Bought by

Great Lakes Growth Capital Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,000

Outstanding Balance

$139,067

Interest Rate

6.27%

Mortgage Type

Seller Take Back

Estimated Equity

$22,050

Purchase Details

Closed on

Jul 14, 2005

Sold by

Madou Steven E and Madou Kevin T

Bought by

Madou Home Rentals Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,000

Interest Rate

5.74%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Jan 13, 2005

Sold by

Beasley Brian L

Bought by

Madou Steven E and Madou Kevin T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Great Lakes Growth Capital Llc | -- | Metropolitan Title | |

| Madou Home Rentals Llc | -- | None Available | |

| Madou Steven E | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Great Lakes Growth Capital Llc | $149,000 | |

| Previous Owner | Madou Home Rentals Llc | $86,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,698 | $71,000 | $6,400 | $64,600 |

| 2023 | $1,655 | $69,400 | $6,400 | $63,000 |

| 2022 | $1,665 | $69,400 | $6,400 | $63,000 |

| 2021 | $1,543 | $62,500 | $4,900 | $57,600 |

| 2020 | $1,538 | $62,300 | $4,900 | $57,400 |

| 2019 | $1,281 | $61,900 | $4,500 | $57,400 |

| 2018 | $1,542 | $62,800 | $4,500 | $58,300 |

| 2017 | $1,562 | $60,900 | $4,500 | $56,400 |

| 2016 | $1,541 | $58,800 | $2,400 | $56,400 |

| 2014 | $1,513 | $57,900 | $2,400 | $55,500 |

Source: Public Records

Map

Nearby Homes

- 741 S 36th St

- 809 S 36th St

- 1105 S 35th St

- 821 S 34th St

- 734 S 33rd St

- 515 S Logan St

- 3312 Mishawaka Ave

- 540 Webster St

- 625 S 32nd St

- 609 S 32nd St

- 626 S 30th St

- 910 W Borley Ave

- 3413 Northside Blvd

- 1229 S 34th St

- 3401 Northside Blvd

- 525 S 28th St

- 1213 Lincolnway W

- 110 S 33rd St

- 324 W Mishawaka Ave

- 610 S 27th St