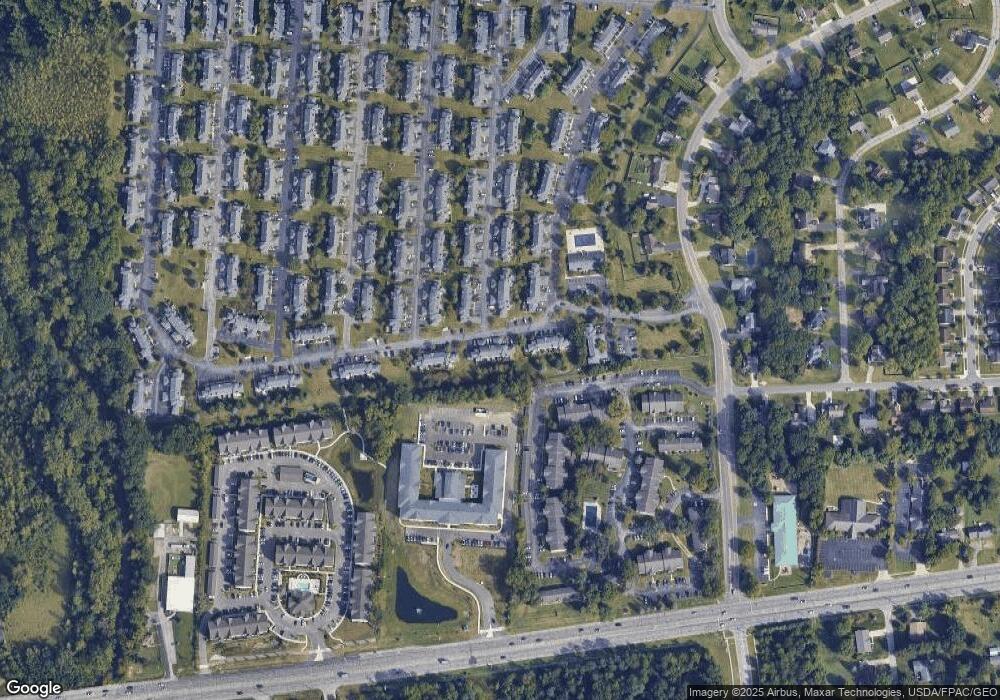

7403 Kirkdale Dr Blacklick, OH 43004

East Broad NeighborhoodEstimated Value: $170,000 - $192,810

2

Beds

3

Baths

1,024

Sq Ft

$181/Sq Ft

Est. Value

About This Home

This home is located at 7403 Kirkdale Dr, Blacklick, OH 43004 and is currently estimated at $184,953, approximately $180 per square foot. 7403 Kirkdale Dr is a home located in Franklin County with nearby schools including Olde Orchard Elementary School, Sherwood Middle School, and Walnut Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2014

Sold by

Smith Janie B

Bought by

Barry Valerie J

Current Estimated Value

Purchase Details

Closed on

Oct 9, 2013

Sold by

Roach Randal W

Bought by

Smith Janie B

Purchase Details

Closed on

Sep 29, 2006

Sold by

Sheets Rosemary

Bought by

Sheets Rosemary and The Rosemary Sheets Trust

Purchase Details

Closed on

Apr 5, 1999

Sold by

Currie Deric J

Bought by

Sheets Rosemary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,900

Interest Rate

6.89%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 4, 1996

Sold by

Kubik Laura S

Bought by

Currie Deric J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,009

Interest Rate

8.23%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 14, 1994

Sold by

Qualstan Corp

Bought by

Kubik Laura S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,100

Interest Rate

8.6%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barry Valerie J | -- | None Available | |

| Smith Janie B | $57,500 | Talon Title P | |

| Sheets Rosemary | -- | None Available | |

| Sheets Rosemary | $71,500 | Midland Title Security Inc | |

| Currie Deric J | $82,000 | -- | |

| Kubik Laura S | $73,350 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sheets Rosemary | $67,900 | |

| Previous Owner | Currie Deric J | $80,009 | |

| Previous Owner | Kubik Laura S | $71,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,378 | $52,990 | $9,450 | $43,540 |

| 2023 | $2,348 | $52,990 | $9,450 | $43,540 |

| 2022 | $1,652 | $31,860 | $3,820 | $28,040 |

| 2021 | $1,655 | $31,860 | $3,820 | $28,040 |

| 2020 | $1,657 | $31,860 | $3,820 | $28,040 |

| 2019 | $1,247 | $20,550 | $2,450 | $18,100 |

| 2018 | $622 | $20,550 | $2,450 | $18,100 |

| 2017 | $1,246 | $20,550 | $2,450 | $18,100 |

| 2016 | $1,324 | $19,990 | $2,730 | $17,260 |

| 2015 | $601 | $19,990 | $2,730 | $17,260 |

| 2014 | $1,205 | $19,990 | $2,730 | $17,260 |

| 2013 | $439 | $23,520 | $3,220 | $20,300 |

Source: Public Records

Map

Nearby Homes

- 154 Hawkins Ln

- 170 Malloy Ln Unit 24C

- 184 Malloy Ln Unit 25D

- 186 Malloy Ln Unit 25c

- 167 MacEnroe Dr Unit 32B

- 208 Glenkirk Dr Unit 104B

- 184 MacAndrews Way Unit 44E

- 7204 Kirkdale Dr Unit 36C

- 201 MacEnroe Dr Unit 66C

- 240 MacEnroe Dr Unit 71D

- 7452 Call Rd Unit 99F

- 160 Strathsprey Dr

- 192 Strathsprey Dr

- 7589 Swindon St

- 7344 Serenoa Dr

- 273 Shallotte Dr

- 7288 Serenoa Dr

- 489 Stone Shadow Dr

- 417 Hannifin Dr

- 108 Kingsmeadow Ln

- 7403 Kirkdale Dr Unit 2b

- 7405 Kirkdale Dr

- 7401 Kirkdale Dr Unit 2C

- 7399 Kirkdale Dr Unit 2D

- 7397 Kirkdale Dr

- 7397 Kirkdale Dr Unit 2E

- 7395 Kirkdale Dr Unit 2F

- 7423 Kirkdale Dr

- 7425 Kirkdale Dr

- 7425 Kirkdale Dr Unit 3E

- 7427 Kirkdale Dr

- 7427 Kirkdale Dr Unit 3D

- 150 Hawkins Ln Unit 6F

- 147 Hawkins Ln Unit 7A

- 152 Hawkins Ln

- 7429 Kirkdale Dr Unit 3C

- 7367 Kirkdale Dr Unit 12A

- 149 Hawkins Ln Unit B

- 151 Hawkins Ln

- 151 Glenkirk Dr Unit 4A