741 Acorn Ct Unit C2 Bartlett, IL 60103

Estimated Value: $196,000 - $241,000

2

Beds

2

Baths

387,700

Sq Ft

$1/Sq Ft

Est. Value

About This Home

This home is located at 741 Acorn Ct Unit C2, Bartlett, IL 60103 and is currently estimated at $223,084, approximately $0 per square foot. 741 Acorn Ct Unit C2 is a home located in Cook County with nearby schools including Bartlett Elementary School, Eastview Middle School, and South Elgin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2008

Sold by

Skrobish Douglas E and Gray Tommy J

Bought by

Hochstetter Brian J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,174

Outstanding Balance

$80,689

Interest Rate

5.79%

Mortgage Type

FHA

Estimated Equity

$142,395

Purchase Details

Closed on

Jun 17, 2006

Sold by

Skrobish Douglas E

Bought by

Skrobish Douglas E and Gray Tommy J

Purchase Details

Closed on

Nov 4, 2002

Sold by

Behrens Debra L and Estate Of Raymond H Huss

Bought by

Skrobish Douglas E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,000

Interest Rate

6.1%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hochstetter Brian J | $131,000 | Multiple | |

| Skrobish Douglas E | -- | Cti | |

| Skrobish Douglas E | $120,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hochstetter Brian J | $129,174 | |

| Previous Owner | Skrobish Douglas E | $96,000 | |

| Closed | Skrobish Douglas E | $18,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,049 | $12,794 | $519 | $12,275 |

| 2023 | $3,913 | $12,794 | $519 | $12,275 |

| 2022 | $3,913 | $12,794 | $519 | $12,275 |

| 2021 | $3,377 | $9,087 | $441 | $8,646 |

| 2020 | $3,332 | $9,087 | $441 | $8,646 |

| 2019 | $3,348 | $10,211 | $441 | $9,770 |

| 2018 | $2,429 | $6,794 | $389 | $6,405 |

| 2017 | $2,388 | $6,794 | $389 | $6,405 |

| 2016 | $2,230 | $6,794 | $389 | $6,405 |

| 2015 | $1,931 | $5,445 | $337 | $5,108 |

| 2014 | $1,907 | $5,445 | $337 | $5,108 |

| 2013 | $1,833 | $5,445 | $337 | $5,108 |

Source: Public Records

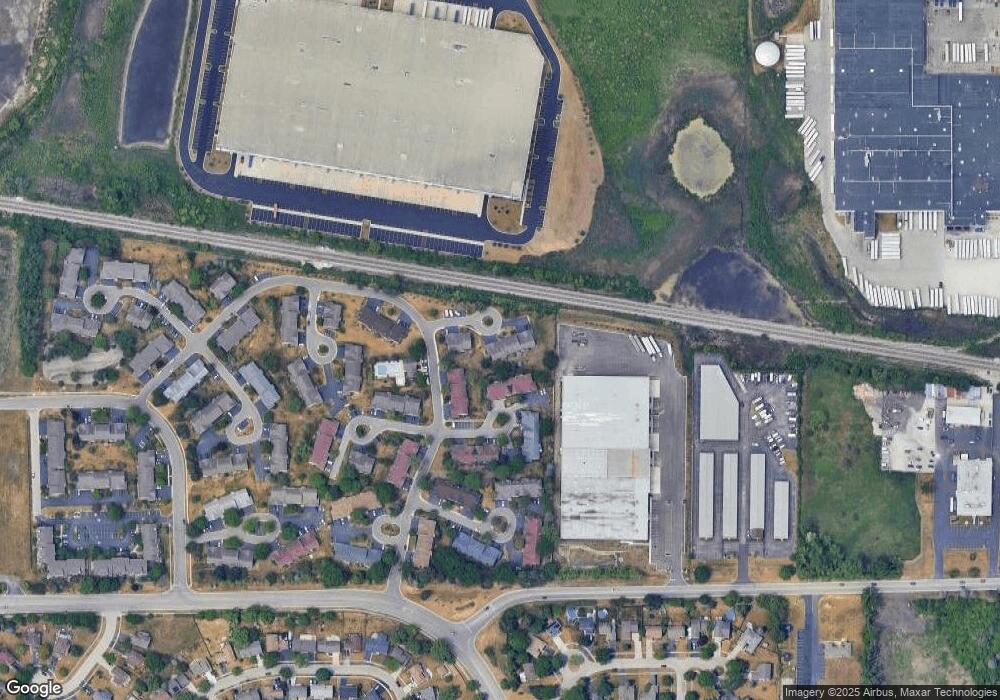

Map

Nearby Homes

- 748 Sterling Ct Unit A2

- 652 Mallard Ct Unit C1

- 387 Wilmington Dr Unit C

- 747 Cove Ct

- 853 Voyager Dr

- 145 Ann Ct Unit A

- 27W607 Devon Ave

- 334 Joan Ct Unit B

- 179 Rita Ct Unit D

- 119 E Railroad Ave

- 923 Capistrano Terrace

- 937 Sandpiper Ct

- 2187 Walnut Ave

- 110 N Chase Ave

- 6881 Hickory St

- 6551 Center Ave

- 6988 Plumtree Ln

- 275 E Railroad Ave Unit 301

- 275 E Railroad Ave Unit 101

- 271 E Railroad Ave Unit 302

- 741 Acorn Ct Unit D1

- 741 Acorn Ct Unit D2

- 741 Acorn Ct Unit C1

- 749 Acorn Ct Unit 16B21

- 749 Acorn Ct Unit 16B11

- 749 Acorn Ct Unit A1

- 749 Acorn Ct

- 748 Sterling Ct Unit B1

- 748 Sterling Ct Unit 13B21

- 748 Sterling Ct Unit B2

- 748 Sterling Ct

- 748 Sterling Ct Unit 1A

- 756 Sterling Ct

- 756 Sterling Ct Unit 13B22

- 756 Sterling Ct Unit C1

- 756 Sterling Ct Unit D2

- 756 Sterling Ct Unit D1

- 756 Sterling Ct Unit C2

- 333 Newport Ln Unit A2

- 333 Newport Ln Unit 14A11