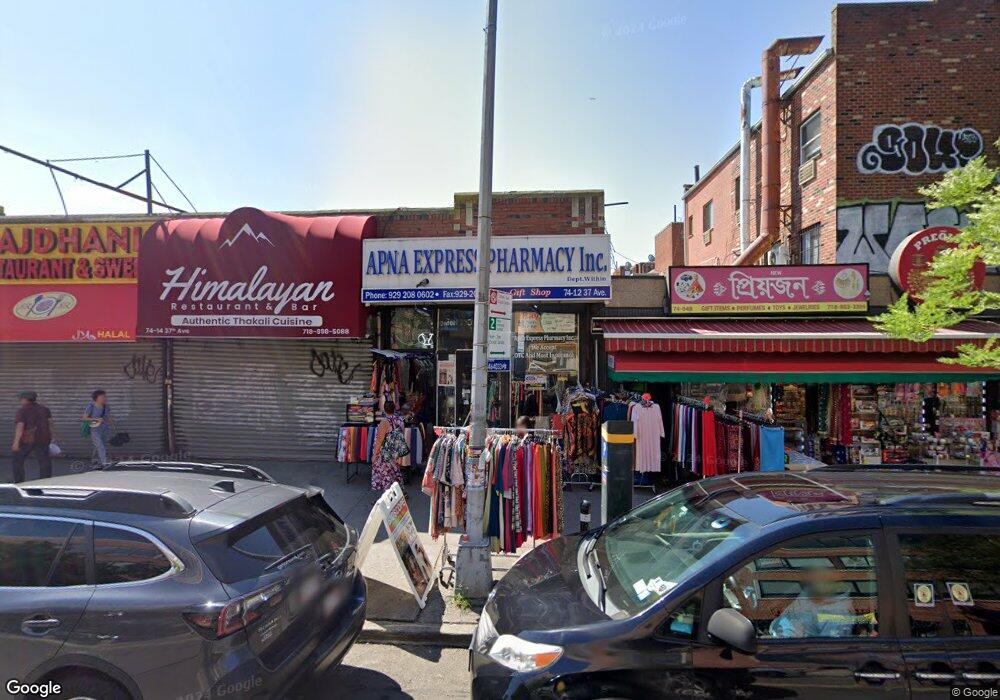

7412 37th Ave Flushing, NY 11372

Jackson Heights NeighborhoodEstimated Value: $19,762,454

--

Bed

--

Bath

8,563

Sq Ft

$2,308/Sq Ft

Est. Value

About This Home

This home is located at 7412 37th Ave, Flushing, NY 11372 and is currently estimated at $19,762,454, approximately $2,307 per square foot. 7412 37th Ave is a home located in Queens County with nearby schools including P.S. 69 Jackson Heights, I.S. 230, and William Cullen Bryant High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 22, 2023

Sold by

Estate Of Fazlur Khan and Estate Of Fazlur R Khan

Bought by

3258 Botli Llc

Current Estimated Value

Purchase Details

Closed on

Mar 29, 2018

Sold by

37 Yee'S Family Limited Partnership

Bought by

Estate Of Fazlur Khan and Shahanara Khan Executrix

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$7,750,000

Interest Rate

4.4%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 27, 1996

Sold by

Yee Kok Dun and Yee Chui King

Bought by

37 Yees Family Ltd Partnership

Purchase Details

Closed on

Mar 7, 1996

Sold by

Sonali Management Co Inc

Bought by

Yee Kok Dun and Yee Chui King

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,800,000

Interest Rate

7.31%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 3258 Botli Llc | -- | -- | |

| 3258 Botli Llc | -- | -- | |

| Estate Of Fazlur Khan | $16,000,000 | -- | |

| Estate Of Fazlur Khan | $16,000,000 | -- | |

| 37 Yees Family Ltd Partnership | -- | -- | |

| 37 Yees Family Ltd Partnership | -- | -- | |

| Yee Kok Dun | -- | -- | |

| Yee Kok Dun | -- | -- | |

| Yee Kok Dun | $2,575,000 | Commonwealth Land Title Ins | |

| Yee Kok Dun | $2,575,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Estate Of Fazlur Khan | $7,750,000 | |

| Previous Owner | Yee Kok Dun | $1,800,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $192,658 | $1,880,460 | $472,500 | $1,407,960 |

| 2024 | $192,658 | $1,818,900 | $472,500 | $1,346,400 |

| 2023 | $189,369 | $1,787,850 | $472,500 | $1,315,350 |

| 2022 | $178,771 | $1,880,100 | $472,500 | $1,407,600 |

| 2021 | $164,205 | $1,720,800 | $472,500 | $1,248,300 |

| 2020 | $150,405 | $1,738,350 | $472,500 | $1,265,850 |

| 2019 | $137,132 | $1,667,700 | $472,500 | $1,195,200 |

| 2018 | $124,348 | $1,182,688 | $472,500 | $710,188 |

| 2017 | $119,645 | $1,137,958 | $472,500 | $665,458 |

| 2016 | $120,946 | $1,137,958 | $472,500 | $665,458 |

| 2015 | $57,534 | $1,154,248 | $472,500 | $681,748 |

| 2014 | $57,534 | $1,138,498 | $472,500 | $665,998 |

Source: Public Records

Map

Nearby Homes

- 3540 75th St Unit 5B

- 35-38 75th St Unit 2F

- 35-38 75th St Unit 4C

- 3535 75th St Unit 208

- 3535 75th St Unit 123

- 35-35 75th St Unit 522

- 35-35 75th St Unit 122

- 3745 75th St

- 35-40 75th St Unit 6-E

- 35-40 75th St Unit 1B

- 35-55 76th St Unit 52

- 3747 76th St

- 3550 73rd St

- 73-12 35th Ave Unit C24

- 72-15 37th Ave Unit 4B

- 72-15 37th Ave Unit 3H

- 35-27 76th St Unit 21

- 35-30 73rd St Unit 6-A

- 35-30 73rd St Unit 1 F

- 3530 73rd St Unit 6A

- 74-12 37th Ave

- 7412 37th Ave

- 74-20 37th Ave

- 37-12 75th St

- 3712 75th St

- 3712 75th St

- 7404 37th Ave

- 3707 74th St

- 3703 74th St

- 7427 37th Ave

- 74-27 37th Ave

- 3718 75th St

- 3711 74th St

- 37-11 74th St

- 37-11 74th St Unit F2

- 37-11 74th St Unit R2

- 37-11 74th St Unit R1

- 37-11 74th St Unit F1

- 3711 74th St

- 3711 74th St