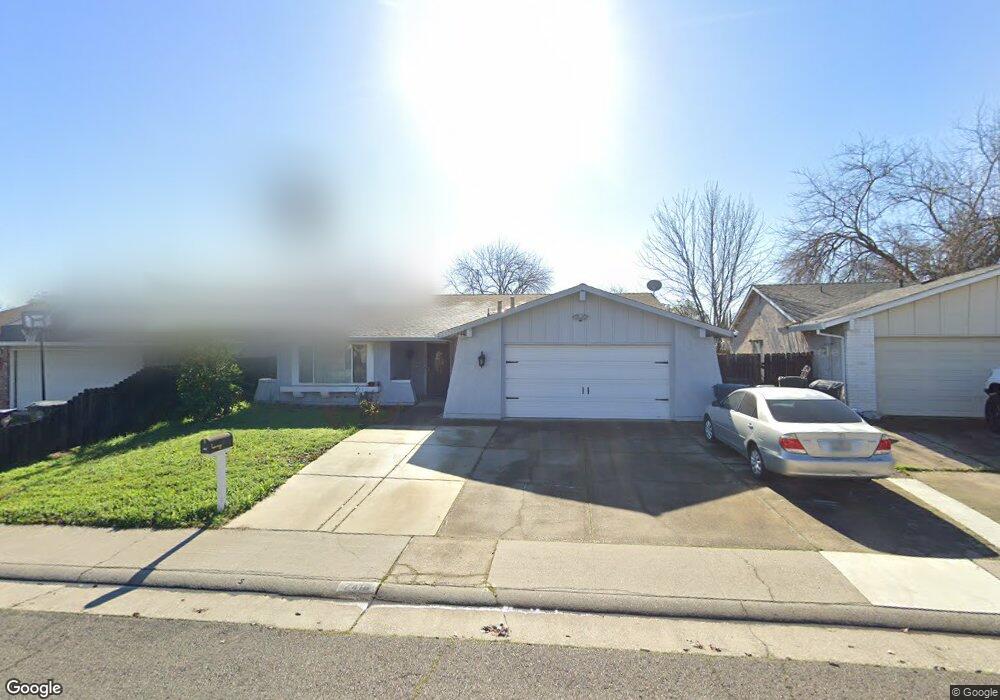

7416 Parkvale Way Citrus Heights, CA 95621

Estimated Value: $325,000 - $485,000

4

Beds

2

Baths

1,502

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 7416 Parkvale Way, Citrus Heights, CA 95621 and is currently estimated at $435,354, approximately $289 per square foot. 7416 Parkvale Way is a home located in Sacramento County with nearby schools including Grand Oaks Elementary School, Sylvan Middle School, and Mesa Verde High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2021

Sold by

Kolak Anthony

Bought by

Kolak Anthony and The Kolak 2021 Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2021

Sold by

Kolak Anthony and Estate Of Susy Andrea Kolak

Bought by

Kolak Anthony

Purchase Details

Closed on

Jul 27, 2009

Sold by

Nunez Jody R and Nunez Candace C

Bought by

Kolak Susy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,884

Outstanding Balance

$110,674

Interest Rate

5.31%

Mortgage Type

FHA

Estimated Equity

$324,680

Purchase Details

Closed on

Jul 20, 2001

Sold by

Aylwin Ethel C and Ruth G Carlson Living Trust

Bought by

Nunez Jody R and Nunez Candace C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,580

Interest Rate

7.15%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 15, 2000

Sold by

Carlson Ruth G

Bought by

Carlson Ruth G and The Ruth G Carlson Living Trus

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kolak Anthony | -- | None Available | |

| Kolak Anthony | -- | None Available | |

| Kolak Susy A | $172,000 | Placer Title Company | |

| Nunez Jody R | $156,000 | Alliance Title Company | |

| Carlson Ruth G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kolak Susy A | $168,884 | |

| Previous Owner | Nunez Jody R | $153,580 | |

| Closed | Nunez Jody R | $9,345 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,638 | $222,008 | $109,714 | $112,294 |

| 2024 | $2,638 | $217,656 | $107,563 | $110,093 |

| 2023 | $2,572 | $213,389 | $105,454 | $107,935 |

| 2022 | $2,559 | $209,206 | $103,387 | $105,819 |

| 2021 | $2,517 | $205,105 | $101,360 | $103,745 |

| 2020 | $2,470 | $203,003 | $100,321 | $102,682 |

| 2019 | $2,336 | $199,023 | $98,354 | $100,669 |

| 2018 | $2,308 | $195,122 | $96,426 | $98,696 |

| 2017 | $2,284 | $191,297 | $94,536 | $96,761 |

| 2016 | $2,133 | $187,547 | $92,683 | $94,864 |

| 2015 | $2,096 | $184,731 | $91,291 | $93,440 |

| 2014 | $2,051 | $181,113 | $89,503 | $91,610 |

Source: Public Records

Map

Nearby Homes

- 7401 Springvale Way

- 7448 Blackthorne Way

- 7439 Saybrook Dr

- 6004 Windlass Ct

- 7449 Mar Vista Way

- 7225 Catamaran Dr

- 7516 Scaup Ln

- 6133 Glenhurst Way

- 7128 Parkvale Way

- 7101 Schooner Way

- 7533 Pintail Cir

- 6501 Navion Dr

- 7600 Golden Eye Ln Unit 43

- 6508 Skylane Dr

- 5832 Alameda Ln Unit 138

- 7428 White River Ln Unit 175

- 7032 Sunburst Way

- 6020 Cackler Ln

- 6336 Twin Wood Way

- 6008 Cackler Ln Unit 88

- 7412 Parkvale Way

- 7420 Parkvale Way

- 6109 Tupelo Dr

- 6115 Tupelo Dr

- 7408 Parkvale Way

- 6101 Tupelo Dr

- 6121 Tupelo Dr

- 7413 Parkvale Way

- 7419 Parkvale Way

- 6039 Tupelo Dr

- 7409 Parkvale Way

- 7404 Parkvale Way

- 7431 Parkvale Way

- 7435 Parkvale Way

- 7423 Parkvale Way

- 7427 Parkvale Way

- 6035 Tupelo Dr

- 7405 Parkvale Way

- 7439 Parkvale Way

- 7400 Parkvale Way