7423 Linden Terrace Carlsbad, CA 92011

Poinsettia NeighborhoodEstimated Value: $1,354,157 - $1,481,000

3

Beds

3

Baths

1,796

Sq Ft

$790/Sq Ft

Est. Value

About This Home

This home is located at 7423 Linden Terrace, Carlsbad, CA 92011 and is currently estimated at $1,419,039, approximately $790 per square foot. 7423 Linden Terrace is a home located in San Diego County with nearby schools including Aviara Oaks Elementary, Aviara Oaks Middle, and Carlsbad High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2003

Sold by

Patren Neil Edward and Patren Diane Moore

Bought by

Foster Thomas and Foster Georgette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$123,121

Interest Rate

5.6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,295,918

Purchase Details

Closed on

May 25, 1994

Sold by

First Interstate Bank Of California

Bought by

Patren Neil Edward and Patren Diane Moore

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,950

Interest Rate

6.37%

Purchase Details

Closed on

Jan 9, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Foster Thomas | $530,000 | Commonwealth Land Title Co | |

| Patren Neil Edward | $250,000 | Chicago Title Company | |

| First Interstate Bank Of California | -- | Chicago Title Company | |

| -- | $170,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Foster Thomas | $280,000 | |

| Previous Owner | Patren Neil Edward | $224,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,898 | $753,537 | $554,493 | $199,044 |

| 2024 | $7,898 | $738,763 | $543,621 | $195,142 |

| 2023 | $7,858 | $724,278 | $532,962 | $191,316 |

| 2022 | $7,736 | $710,077 | $522,512 | $187,565 |

| 2021 | $7,678 | $696,155 | $512,267 | $183,888 |

| 2020 | $7,627 | $689,018 | $507,015 | $182,003 |

| 2019 | $7,489 | $675,509 | $497,074 | $178,435 |

| 2018 | $7,172 | $662,265 | $487,328 | $174,937 |

| 2017 | $7,053 | $649,280 | $477,773 | $171,507 |

| 2016 | $6,769 | $636,550 | $468,405 | $168,145 |

| 2015 | $6,742 | $626,990 | $461,370 | $165,620 |

| 2014 | $6,629 | $614,709 | $452,333 | $162,376 |

Source: Public Records

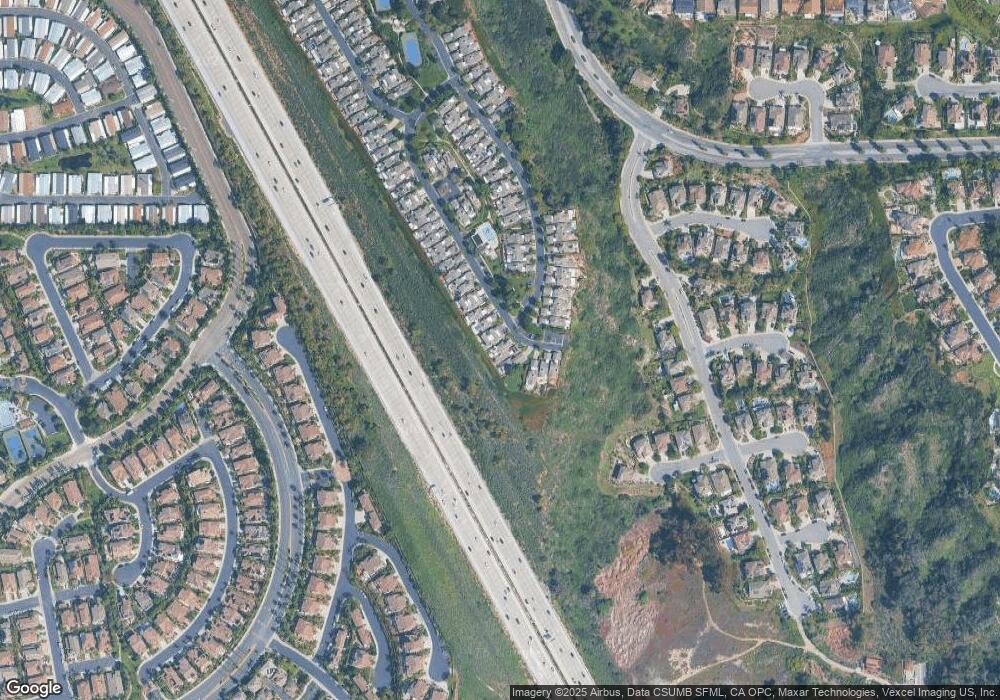

Map

Nearby Homes

- 616 Marlin Ln

- 7219 Linden Terrace

- 513 Halsing Ct

- 7013 Lavender Way

- 7320 San Bartolo St Unit 217

- 7236 San Benito St Unit 355

- 7233 San Bartolo St Unit 376

- 7305 San Bartolo St Unit 374

- 7241 San Luis St

- 7313 Santa Barbara St Unit 294

- 7025 San Bartolo St Unit 42

- 7232 Santa Barbara St Unit 318

- 7221 San Luis St

- 7207 Santa Barbara St Unit 154

- 7016 San Carlos St Unit 61

- 7002 San Bartolo St Unit 30

- 7205 Santa Barbara St Unit 153

- 7027 San Bartolo St Unit 43

- 7024 San Bartolo St Unit 19

- 7023 San Bartolo St Unit 41

- 7425 Linden Terrace

- 7421 Linden Terrace

- 7427 Linden Terrace

- 7419 Linden Terrace

- 7417 Linden Terrace

- 7429 Linden Terrace

- 7415 Linden Terrace

- 7431 Linden Terrace

- 7413 Linden Terrace

- 7433 Linden Terrace

- 7426 Lantana Terrace

- 7411 Linden Terrace

- 7422 Lantana Terrace

- 7409 Linden Terrace

- 7420 Lantana Terrace

- 7407 Linden Terrace

- 7411 Lantana Terrace

- 7405 Linden Terrace

- 7414 Lantana Terrace

- 7409 Lantana Terrace