746 Parkgrove Way Unit 746 Lewis Center, OH 43035

Wynstone NeighborhoodEstimated Value: $227,000 - $245,000

2

Beds

3

Baths

1,180

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 746 Parkgrove Way Unit 746, Lewis Center, OH 43035 and is currently estimated at $237,092, approximately $200 per square foot. 746 Parkgrove Way Unit 746 is a home located in Delaware County with nearby schools including Oak Creek Elementary School, Olentangy Orange Middle School, and Orange High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 19, 2011

Sold by

Peng Jiayi

Bought by

Summit Business & Properties

Current Estimated Value

Purchase Details

Closed on

Apr 8, 2011

Sold by

Berndt Michael A and Berndt Kate A

Bought by

Peng Jiayi

Purchase Details

Closed on

May 10, 2007

Sold by

Greenhalge Amy E and Greenhalge James M

Bought by

Berndt Michael A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

6.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 9, 2005

Sold by

Greenhalge Amy E and Greenhalge James M

Bought by

Greenhalge James M and Greenhalge Amy E

Purchase Details

Closed on

May 15, 2001

Sold by

Palmer Susan M

Bought by

Culp Amy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

6.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 1, 1997

Sold by

Qualstan Corp

Bought by

Susan M Palmer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,900

Interest Rate

8.05%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Summit Business & Properties | $93,000 | None Available | |

| Peng Jiayi | $93,000 | First American | |

| Berndt Michael A | $120,000 | Attorney | |

| Greenhalge James M | -- | -- | |

| Culp Amy E | $100,000 | -- | |

| Susan M Palmer | $99,146 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Berndt Michael A | $120,000 | |

| Previous Owner | Culp Amy E | $90,000 | |

| Previous Owner | Susan M Palmer | $95,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,322 | $66,820 | $13,300 | $53,520 |

| 2023 | $3,337 | $66,820 | $13,300 | $53,520 |

| 2022 | $2,993 | $47,740 | $10,080 | $37,660 |

| 2021 | $3,010 | $47,740 | $10,080 | $37,660 |

| 2020 | $3,028 | $47,740 | $10,080 | $37,660 |

| 2019 | $2,482 | $41,160 | $8,400 | $32,760 |

| 2018 | $2,494 | $41,160 | $8,400 | $32,760 |

| 2017 | $2,105 | $30,140 | $8,400 | $21,740 |

| 2016 | $1,938 | $30,140 | $8,400 | $21,740 |

| 2015 | $1,744 | $30,140 | $8,400 | $21,740 |

| 2014 | $1,770 | $30,140 | $8,400 | $21,740 |

| 2013 | $1,955 | $32,550 | $8,400 | $24,150 |

Source: Public Records

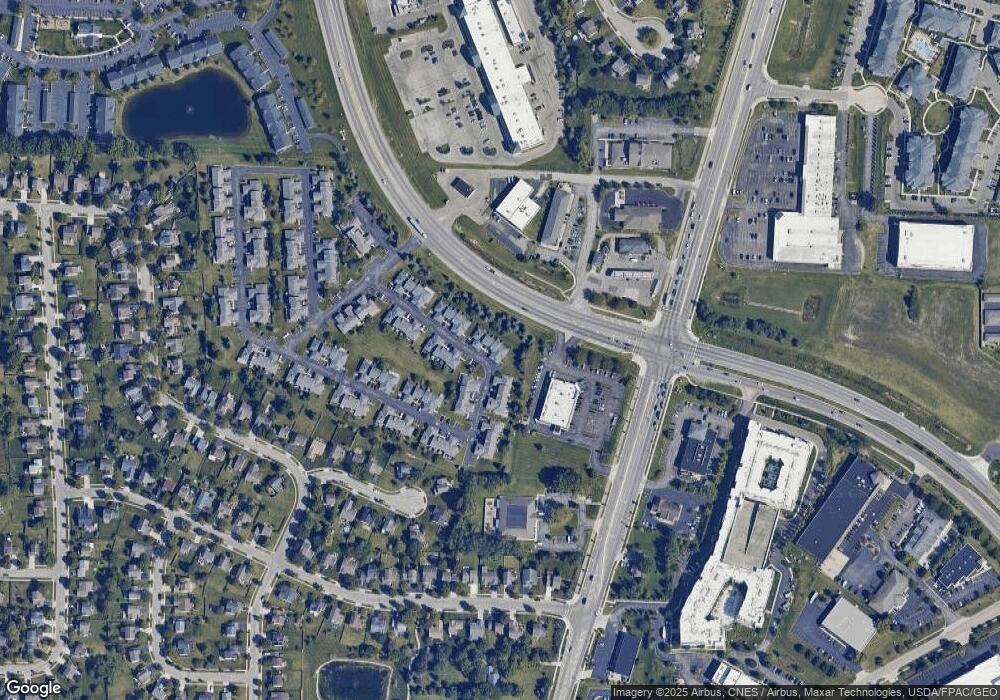

Map

Nearby Homes

- 758 Parkgrove Way Unit 758

- 738 Parkbluff Way Unit 738

- 9123 Parkbury Ln Unit 9123

- 9170 Parkbury Ln

- 8910 Sedona Ct

- 9002 Newmills Ln

- 687 Sanville Dr

- 8749 Paulden Ct

- 975 Adara Dr Unit 6975

- 1520 Aniko Ave

- 1746 E Powell Rd

- 1143 Little Bear Place

- 8322 Aurora Ct

- 8747 Olenbrook Dr

- 1245 Little Bear Loop

- 8824 Rock Dove Rd

- 8749 Olenmead Dr

- 294 Lazelle Place Ln Unit Q294

- 45 Gold Meadow Dr

- 1923 Myrtle St

- 748 Parkgrove Way Unit 748

- 744 Parkgrove Way Unit 744

- 742 Parkgrove Way Unit 742

- 740 Parkgrove Way Unit 740

- 756 Parkgrove Way

- 728 Parkgrove Way

- 761 Parkgrove Way

- 749 Parkgrove Way

- 760 Parkgrove Way Unit 760

- 763 Parkgrove Way

- 747 Parkgrove Way Unit 747

- 726 Parkgrove Way

- 745 Parkgrove Way Unit 745

- 762 Parkgrove Way Unit 762

- 724 Parkgrove Way

- 764 Parkgrove Way Unit 764

- 743 Parkgrove Way

- 767 Parkgrove Way Unit 767

- 722 Parkgrove Way Unit 722

- 741 Parkgrove Way