7496 Oxford Cir Unit 35 Dublin, CA 94568

Estimated Value: $781,000 - $890,000

3

Beds

2

Baths

1,383

Sq Ft

$614/Sq Ft

Est. Value

About This Home

This home is located at 7496 Oxford Cir Unit 35, Dublin, CA 94568 and is currently estimated at $849,422, approximately $614 per square foot. 7496 Oxford Cir Unit 35 is a home located in Alameda County with nearby schools including Frederiksen Elementary School, Wells Middle School, and Dublin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2010

Sold by

Lucila Danilo V

Bought by

Lucila Danilo V and Lucila Leticia M

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2002

Sold by

Naccachian Krikor and Naccachian Stacy

Bought by

Lucila Danilo V

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$84,800

Interest Rate

6.78%

Estimated Equity

$764,622

Purchase Details

Closed on

Jul 25, 2000

Sold by

Hillman Peter M and Hillman Kimberly M

Bought by

Naccachian Krikor and Naccachian Stacy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

8.25%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Dec 1, 1998

Sold by

Medel Alfonso B & Mary Trust and Alfonso B

Bought by

Hillman Peter and Hillman Kimberly M

Purchase Details

Closed on

Jul 28, 1993

Sold by

Medel Alfonso B and Medel Mary

Bought by

Medel Al and Medel Mary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lucila Danilo V | -- | None Available | |

| Lucila Danilo V | $355,000 | Old Republic Title Company | |

| Lucila Danilo V | -- | Old Republic Title Company | |

| Naccachian Krikor | $325,000 | American Title Co | |

| Hillman Peter | -- | -- | |

| Medel Al | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lucila Danilo V | $205,000 | |

| Previous Owner | Naccachian Krikor | $260,000 | |

| Closed | Naccachian Krikor | $48,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,656 | $524,405 | $157,321 | $367,084 |

| 2024 | $7,656 | $514,124 | $154,237 | $359,887 |

| 2023 | $7,572 | $504,046 | $151,214 | $352,832 |

| 2022 | $7,439 | $494,163 | $148,249 | $345,914 |

| 2021 | $7,337 | $484,474 | $145,342 | $339,132 |

| 2020 | $6,858 | $479,508 | $143,852 | $335,656 |

| 2019 | $6,813 | $470,108 | $141,032 | $329,076 |

| 2018 | $6,627 | $460,892 | $138,267 | $322,625 |

| 2017 | $6,558 | $451,857 | $135,557 | $316,300 |

| 2016 | $5,995 | $443,000 | $132,900 | $310,100 |

| 2015 | $5,787 | $436,347 | $130,904 | $305,443 |

| 2014 | $5,782 | $427,803 | $128,341 | $299,462 |

Source: Public Records

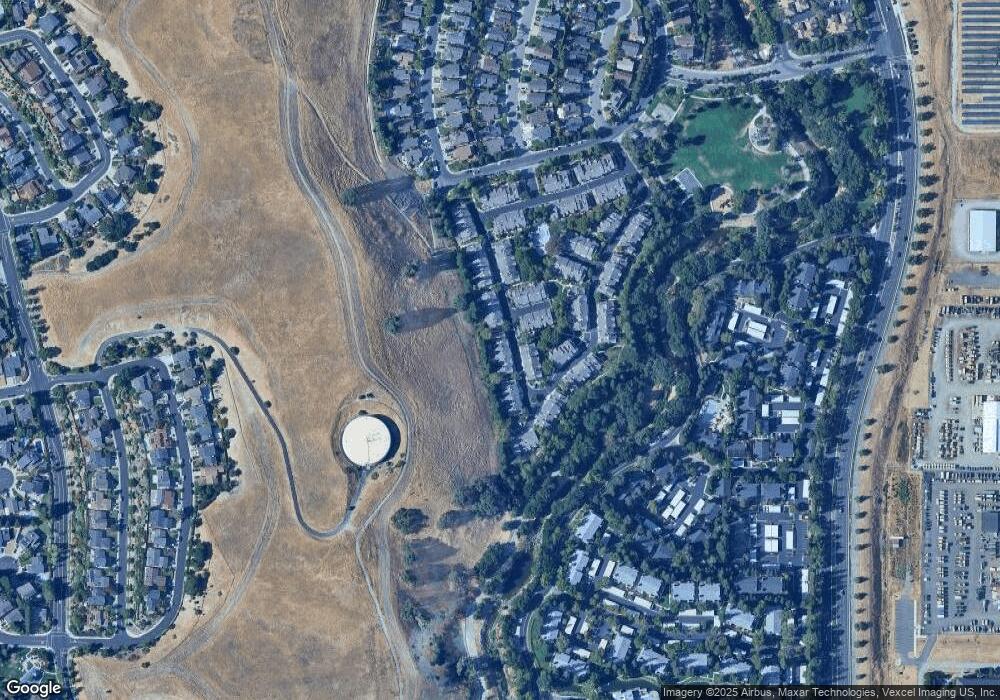

Map

Nearby Homes

- 7813 Shady Creek Rd

- 6746 Sapphire St

- 7653 Turquoise St

- 7120 Cross Creek Cir Unit D

- 7092 N Mariposa Ct

- 7148 Dublin Meadows St Unit E

- 7063 Dublin Meadows St Unit H

- 8043 Crossridge Rd

- 7054 Dublin Meadows St Unit D

- 6983 Alamo Creek Trail

- 6574 Conestoga Ln Unit 63

- 1725 SW Wren

- 7020 Stagecoach Rd Unit A

- 2141 Bent Creek Dr

- 9048 Craydon Cir

- 9054 Craydon Cir

- 9104 Craydon Cir

- 9014 Craydon Cir

- 6630 S Mariposa Ln

- 8351 Mulberry Place

- 7490 Oxford Cir

- 7492 Oxford Cir Unit 37

- 7494 Oxford Cir

- 7498 Oxford Cir Unit 34

- 7500 Oxford Cir Unit 33

- 7494 Oxford CI

- 7499 Oxford Cir Unit 106

- 7497 Oxford Cir

- 7495 Oxford Cir Unit 104

- 7493 Oxford Cir Unit 103

- 7491 Oxford Cir

- 7480 Oxford Cir

- 7482 Oxford Cir Unit 42

- 7484 Oxford Cir Unit 41

- 7486 Oxford Cir Unit 40

- 7488 Oxford Cir

- 7502 Oxford Cir Unit 32

- 7504 Oxford Cir

- 7506 Oxford Cir

- 7508 Oxford Cir Unit 29