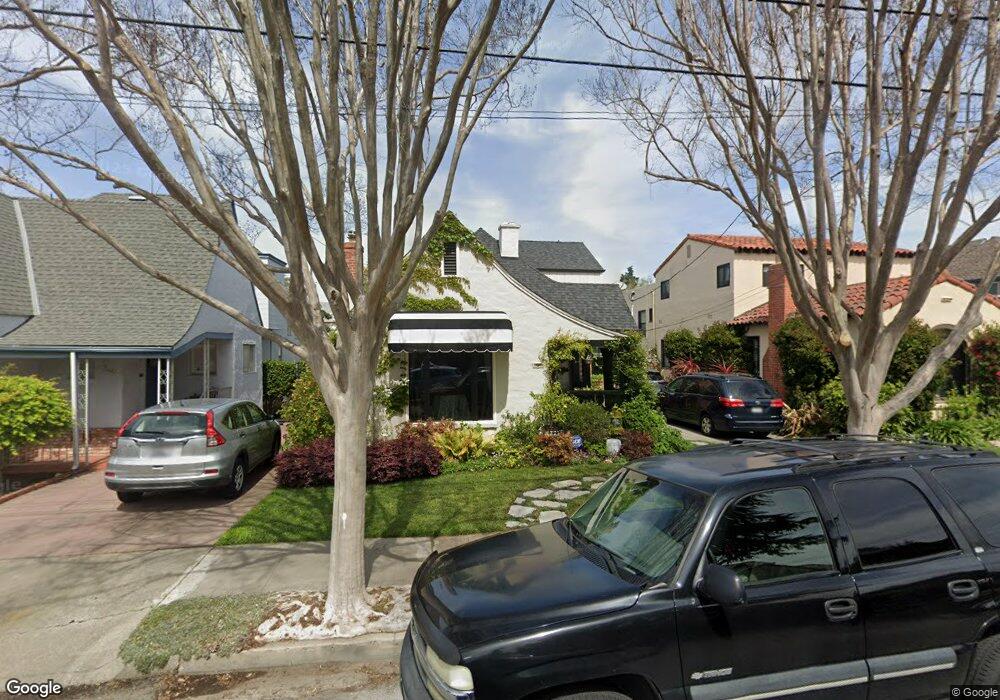

750 Bridge Rd San Leandro, CA 94577

Estudillo Estates-Glen NeighborhoodEstimated Value: $1,314,117 - $1,380,000

5

Beds

3

Baths

2,700

Sq Ft

$494/Sq Ft

Est. Value

About This Home

This home is located at 750 Bridge Rd, San Leandro, CA 94577 and is currently estimated at $1,333,529, approximately $493 per square foot. 750 Bridge Rd is a home located in Alameda County with nearby schools including Roosevelt Elementary School, Bancroft Middle School, and San Leandro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 8, 2022

Sold by

Reynaldo Charles Jr and Reynaldo Elizabeth Odessa

Bought by

Charles Family Trust

Current Estimated Value

Purchase Details

Closed on

Aug 27, 2008

Sold by

Metzler Thomas W and Metzler Leslie C

Bought by

Charles Reynaldo and Charles Odessa Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$643,291

Interest Rate

6.59%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 11, 2005

Sold by

Benson Joel Gene and Benson Debra Kay

Bought by

Metzler Thomas W and Metzler Leslie C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$620,000

Interest Rate

5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Charles Family Trust | -- | Law Offices Of Connie Yi Pc | |

| Charles Reynaldo | $655,000 | Fidelity National Title Co | |

| Metzler Thomas W | $775,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Charles Reynaldo | $643,291 | |

| Previous Owner | Metzler Thomas W | $620,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,037 | $843,423 | $253,027 | $590,396 |

| 2024 | $11,037 | $826,891 | $248,067 | $578,824 |

| 2023 | $10,975 | $810,680 | $243,204 | $567,476 |

| 2022 | $10,670 | $794,790 | $238,437 | $556,353 |

| 2021 | $10,349 | $779,207 | $233,762 | $545,445 |

| 2020 | $10,088 | $771,222 | $231,366 | $539,856 |

| 2019 | $9,790 | $756,105 | $226,831 | $529,274 |

| 2018 | $9,549 | $741,282 | $222,384 | $518,898 |

| 2017 | $9,356 | $726,748 | $218,024 | $508,724 |

| 2016 | $8,866 | $712,501 | $213,750 | $498,751 |

| 2015 | $8,710 | $701,805 | $210,541 | $491,264 |

| 2014 | $8,644 | $688,064 | $206,419 | $481,645 |

Source: Public Records

Map

Nearby Homes

- 1550 Bancroft Ave Unit 112

- 1550 Bancroft Ave Unit 111

- 856 Dolores Ave

- 972 Collier Dr

- 1468 Grand Ave Unit 9

- 1468 Grand Ave Unit 21

- 678 Elsie Ave

- 869 Lee Ave

- 414 Callan Ave

- 821 Lee Ave

- 400 Joaquin Ave

- 775 Elsie Ave

- 1218 Sandelin Ave

- 520 Superior Ave

- 348 Maud Ave

- 1380 E Juana Ave

- 1876 Benedict Dr

- 851 Kenyon Ave

- 470 Bancroft Ave

- 999 Alice Ave