7508 Oxford Cir Unit 29 Dublin, CA 94568

Estimated Value: $834,000 - $893,000

3

Beds

3

Baths

1,383

Sq Ft

$622/Sq Ft

Est. Value

About This Home

This home is located at 7508 Oxford Cir Unit 29, Dublin, CA 94568 and is currently estimated at $859,932, approximately $621 per square foot. 7508 Oxford Cir Unit 29 is a home located in Alameda County with nearby schools including Frederiksen Elementary School, Wells Middle School, and Dublin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 8, 2008

Sold by

Fredrickson Erin T and Fredrickson Andrea Sue

Bought by

Fredrickson Erin T and Fredrickson Andrea Sue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Outstanding Balance

$154,474

Interest Rate

6.47%

Mortgage Type

New Conventional

Estimated Equity

$705,458

Purchase Details

Closed on

Feb 24, 1999

Sold by

Jeffrey Langbaum and Jeffrey Stephanie

Bought by

Fredrickson Erin T and Fredrickson Andrea Sue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.78%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fredrickson Erin T | -- | First American Title Company | |

| Fredrickson Erin T | $238,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fredrickson Erin T | $230,000 | |

| Closed | Fredrickson Erin T | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,723 | $366,093 | $111,928 | $261,165 |

| 2024 | $5,723 | $358,778 | $109,733 | $256,045 |

| 2023 | $5,655 | $358,608 | $107,582 | $251,026 |

| 2022 | $5,541 | $344,577 | $105,473 | $246,104 |

| 2021 | $5,451 | $337,685 | $103,405 | $241,280 |

| 2020 | $5,094 | $341,151 | $102,345 | $238,806 |

| 2019 | $5,033 | $334,463 | $100,339 | $234,124 |

| 2018 | $4,881 | $327,906 | $98,372 | $229,534 |

| 2017 | $4,831 | $321,477 | $96,443 | $225,034 |

| 2016 | $4,423 | $315,175 | $94,552 | $220,623 |

| 2015 | $4,272 | $310,441 | $93,132 | $217,309 |

| 2014 | $4,259 | $304,361 | $91,308 | $213,053 |

Source: Public Records

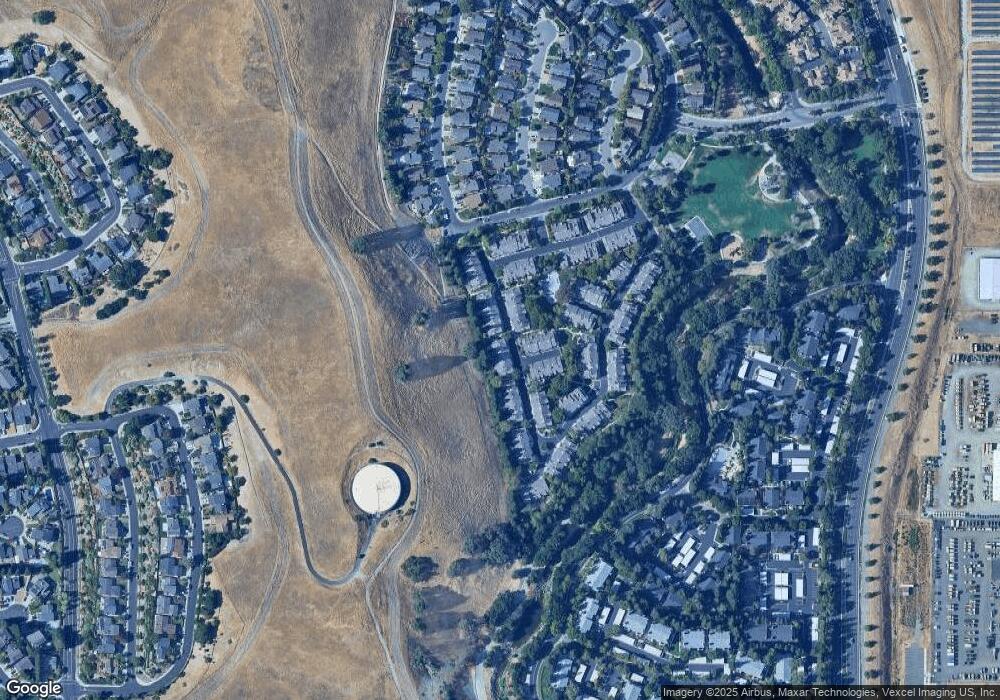

Map

Nearby Homes

- 7813 Shady Creek Rd

- 6746 Sapphire St

- 7653 Turquoise St

- 7120 Cross Creek Cir Unit D

- 8043 Crossridge Rd

- 7092 N Mariposa Ct

- 7148 Dublin Meadows St Unit E

- 7063 Dublin Meadows St Unit H

- 7054 Dublin Meadows St Unit D

- 6983 Alamo Creek Trail

- 1725 SW Wren

- 7020 Stagecoach Rd Unit A

- 2141 Bent Creek Dr

- 9054 Craydon Cir

- 9048 Craydon Cir

- 9104 Craydon Cir

- 9014 Craydon Cir

- 8351 Mulberry Place

- 6630 S Mariposa Ln

- 6350 Monterey Way

- 7502 Oxford Cir Unit 32

- 7504 Oxford Cir

- 7506 Oxford Cir

- 7510 Oxford Cir

- 6540 Nottingham Place Unit 114

- 6520 Nottingham Place Unit 112

- 6560 Nottingham Place Unit 116

- 6550 Nottingham Place Unit 115

- 6540 Nottingham Place

- 6530 Nottingham Place Unit 113

- 6520 Nottingham Place

- 7516 Oxford CI

- 7512 Oxford Cir Unit 27

- 7514 Oxford Cir

- 7516 Oxford Cir

- 7518 Oxford Cir

- 7520 Oxford Cir

- 7522 Oxford Cir Unit 22

- 7490 Oxford Cir

- 7492 Oxford Cir Unit 37