7508 Parkway Dr Unit 205 La Mesa, CA 91942

Estimated Value: $359,000 - $400,357

1

Bed

1

Bath

646

Sq Ft

$581/Sq Ft

Est. Value

About This Home

This home is located at 7508 Parkway Dr Unit 205, La Mesa, CA 91942 and is currently estimated at $375,089, approximately $580 per square foot. 7508 Parkway Dr Unit 205 is a home located in San Diego County with nearby schools including Maryland Avenue Elementary School, Parkway Academy, and Grossmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2017

Sold by

Jopek Ewa

Bought by

Tang Jason Jianxun

Current Estimated Value

Purchase Details

Closed on

Feb 4, 2003

Sold by

Johnson Michael R and Johnson Michael

Bought by

Jopek Ewa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,200

Interest Rate

5.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 20, 1994

Sold by

Federal Deposit Insurance Corporation

Bought by

Johnson Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,600

Interest Rate

8.61%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 18, 1994

Sold by

Fsla New West

Bought by

Federal Deposit Insurance Corporation

Purchase Details

Closed on

Feb 3, 1994

Sold by

Standard Trust Deed Service Company

Bought by

Fsla New West

Purchase Details

Closed on

Aug 13, 1990

Purchase Details

Closed on

Mar 25, 1983

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tang Jason Jianxun | $189,000 | Fidelity Natl Title Co Sd | |

| Jopek Ewa | $149,000 | First American Title | |

| Johnson Michael R | -- | First American Title | |

| Johnson Michael | $46,000 | Southland Title Corporation | |

| Federal Deposit Insurance Corporation | -- | Southland Title Corporation | |

| Fsla New West | $44,108 | World Title Company | |

| -- | $52,500 | -- | |

| -- | $54,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jopek Ewa | $119,200 | |

| Previous Owner | Johnson Michael | $45,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,587 | $219,343 | $91,048 | $128,295 |

| 2024 | $2,587 | $215,043 | $89,263 | $125,780 |

| 2023 | $2,514 | $210,827 | $87,513 | $123,314 |

| 2022 | $2,484 | $206,695 | $85,798 | $120,897 |

| 2021 | $2,454 | $202,643 | $84,116 | $118,527 |

| 2020 | $2,378 | $200,566 | $83,254 | $117,312 |

| 2019 | $2,345 | $196,634 | $81,622 | $115,012 |

| 2018 | $2,300 | $192,779 | $80,022 | $112,757 |

| 2017 | $1,830 | $159,000 | $66,000 | $93,000 |

| 2016 | $1,759 | $155,000 | $65,000 | $90,000 |

| 2015 | $1,596 | $140,000 | $59,000 | $81,000 |

| 2014 | $1,360 | $120,000 | $51,000 | $69,000 |

Source: Public Records

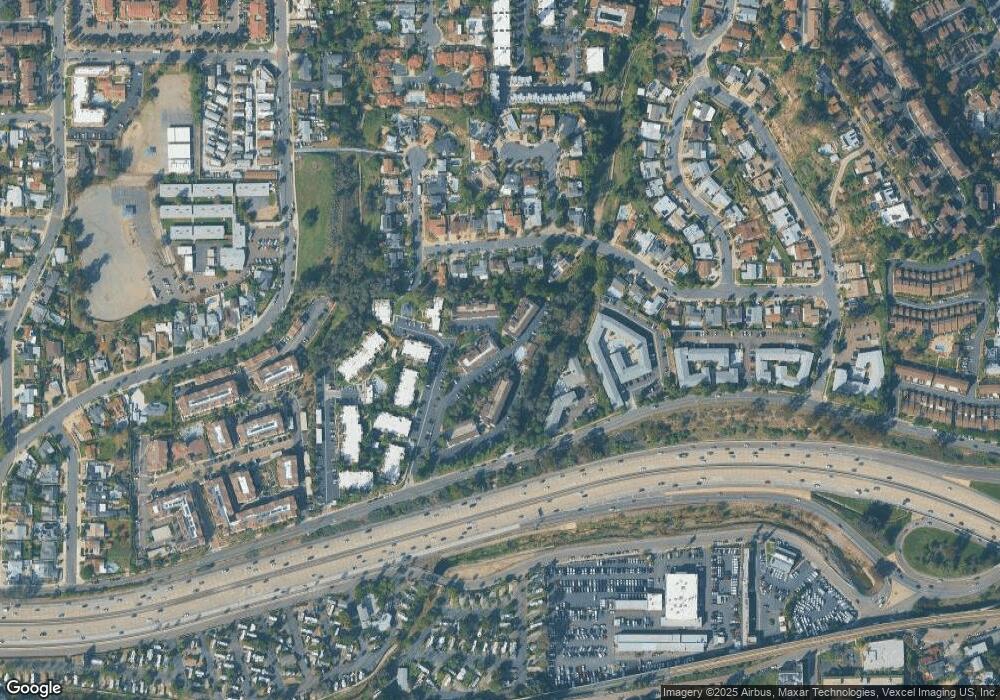

Map

Nearby Homes

- 7506 Parkway Dr Unit 202

- 7506 Parkway Dr Unit 104

- 7500 Parkway Dr Unit 306

- 7495 Oakland Rd Unit 33

- 7495 Oakland Rd Unit 23

- 7700 Parkway Dr Unit 17

- 5430 Baltimore Dr Unit 51

- 5590 Shasta Ln

- 5470 Baltimore Dr Unit 8

- 7240 Baldrich St

- 5450 Kiowa Dr Unit 81

- 5440 Baltimore Dr Unit 90

- 5440 Baltimore Dr Unit 178

- 7780 Parkway Dr Unit 304

- 7195 Macquarie St

- 5350 Baltimore Dr Unit 47

- 5350 Baltimore Dr Unit 20

- 5015 Comanche Dr

- Lot 48 Guava

- 5092 Guava Ave Unit 130

- 7506 Parkway Dr Unit 101

- 7506 Parkway Dr Unit 100

- 7510 Parkway Dr Unit 120

- 7508 Parkway Dr Unit 211

- 7508 Parkway Dr Unit 209

- 7508 Parkway Dr Unit 208

- 7508 Parkway Dr Unit 207

- 7508 Parkway Dr Unit 206

- 7508 Parkway Dr Unit 204

- 7508 Parkway Dr Unit 203

- 7506 Parkway Dr Unit 207

- 7506 Parkway Dr Unit 206

- 7506 Parkway Dr Unit 205

- 7506 Parkway Dr Unit 204

- 7506 Parkway Dr Unit 203

- 7506 Parkway Dr Unit 201

- 7506 Parkway Dr Unit 200

- 7506 Parkway Dr Unit 109

- 7506 Parkway Dr Unit 108

- 7506 Parkway Dr Unit 107