7508 Sugar Bend Dr Unit 508 Orlando, FL 32819

Dr. Phillips NeighborhoodEstimated Value: $293,478 - $317,000

2

Beds

2

Baths

1,075

Sq Ft

$284/Sq Ft

Est. Value

About This Home

This home is located at 7508 Sugar Bend Dr Unit 508, Orlando, FL 32819 and is currently estimated at $305,620, approximately $284 per square foot. 7508 Sugar Bend Dr Unit 508 is a home located in Orange County with nearby schools including Dr. Phillips Elementary School, Dr. Phillips High School, and Southwest Middle.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2020

Sold by

Segarra Thomas and Segarra Vionet

Bought by

Segarra Vionet and The Vionet Segarra Revocable T

Current Estimated Value

Purchase Details

Closed on

Jul 24, 2020

Sold by

7508 Sugar Bend Llc

Bought by

Segarra Thomas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,000

Outstanding Balance

$85,489

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$220,131

Purchase Details

Closed on

May 5, 2011

Sold by

Karp Gerald and Karp Patrice

Bought by

7508 Sugar Bend Llc

Purchase Details

Closed on

Aug 3, 2009

Sold by

Federal National Mortgage Association

Bought by

Karp Gerald and Karp Patrice

Purchase Details

Closed on

Jul 20, 2009

Sold by

Ascencio Marcelino

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Dec 10, 2007

Sold by

Sanctuary Bay Hill Llc

Bought by

Ascencio Marcelino and Menjivar Ana J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$299,900

Interest Rate

6.05%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Segarra Vionet | -- | Accommodation | |

| Segarra Thomas | $221,000 | Watson Title Services Inc | |

| 7508 Sugar Bend Llc | -- | Attorney | |

| Karp Gerald | $89,000 | Attorney | |

| Federal National Mortgage Association | -- | None Available | |

| Ascencio Marcelino | $299,900 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Segarra Thomas | $121,000 | |

| Previous Owner | Ascencio Marcelino | $299,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,936 | $275,400 | -- | $275,400 |

| 2024 | $3,384 | $257,549 | -- | -- |

| 2023 | $3,384 | $225,800 | $45,160 | $180,640 |

| 2022 | $3,009 | $193,500 | $38,700 | $154,800 |

| 2021 | $2,898 | $182,800 | $36,560 | $146,240 |

| 2020 | $2,639 | $172,000 | $34,400 | $137,600 |

| 2019 | $2,605 | $161,300 | $32,260 | $129,040 |

| 2018 | $2,387 | $145,100 | $29,020 | $116,080 |

| 2017 | $2,308 | $138,700 | $27,740 | $110,960 |

| 2016 | $2,285 | $134,400 | $26,880 | $107,520 |

| 2015 | $2,222 | $129,000 | $25,800 | $103,200 |

| 2014 | $2,032 | $114,700 | $22,940 | $91,760 |

Source: Public Records

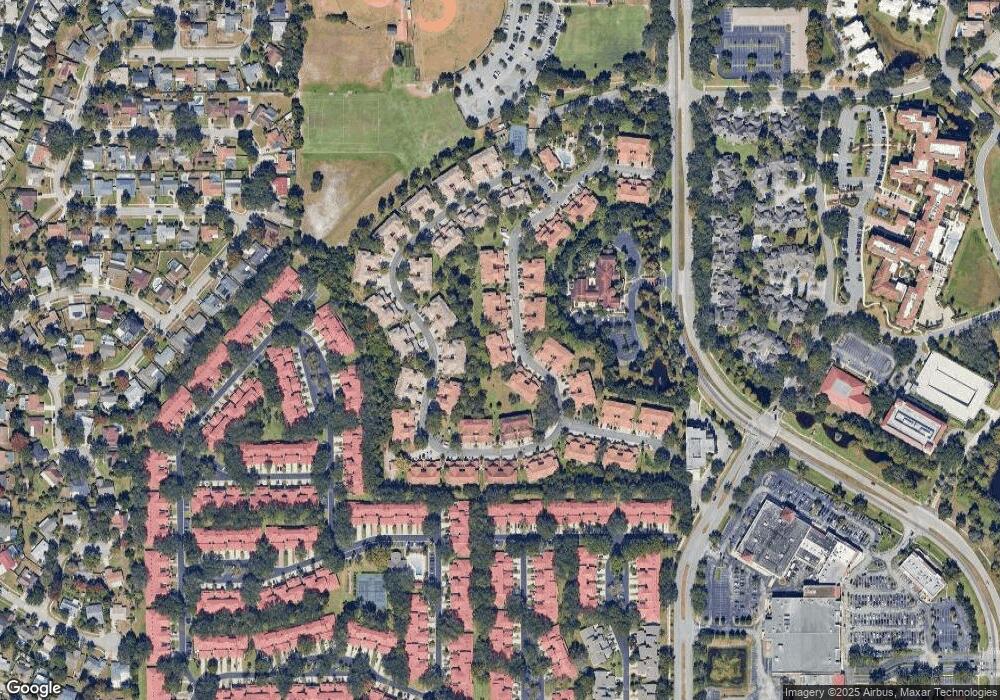

Map

Nearby Homes

- 7654 Sugar Bend Dr Unit 7654

- 7713 Sugar Bend Dr Unit 7713

- 7711 Sugar Bend Dr Unit 7711

- 7667 Sugar Bend Dr Unit 7667

- 7421 Sugar Bend Dr Unit 7421

- 7768 Sugar Bend Dr Unit 7768

- 7807 Sugar Brook Ct Unit 7811

- 7863 Sugar Bend Dr Unit 7863

- 7736 Windbreak Rd

- 8210 Ambrose Cove Way

- 8217 Breeze Cove Ln

- 8394 Via Vittoria Way

- 7039 Della Dr Unit 55

- 8382 Via Vittoria Way

- 8376 Via Vittoria Way

- 7021 Della Dr Unit 51

- 8113 Via Vittoria Way

- 8364 Via Vittoria Way

- 7325 Wethersfield Dr

- 7700 Carriage Homes Dr Unit 4

- 7512 Sugar Bend Dr Unit 1

- 7504 Sugar Bend Dr Unit 504

- 7504 Sugar Bend Dr Unit 7504

- 7512 Sugar Bend Dr Unit 7512

- 7508 Sugar Bend Dr Unit 7508

- 7510 Sugar Bend Dr

- 7516 Sugar Bend Dr

- 7502 Sugar Bend Dr

- 7506 Sugar Bend Dr Unit 7506

- 7514 Sugar Bend Dr Unit 7514

- 7502 Sugar Bend Dr Unit 7502

- 7502 Sugar Bend Dr Unit 502

- 7400 Sugar Bend Dr Unit 7864

- 7456 Sugar Bend Dr Unit 7456

- 7470 Sugar Bend Dr Unit 7470

- 7468 Sugar Bend Dr Unit 7468

- 7462 Sugar Bend Dr

- 7464 Sugar Bend Dr Unit 7464

- 7458 Sugar Bend Dr Unit 7458

- 7522 Sugar Bend Dr Unit 7522