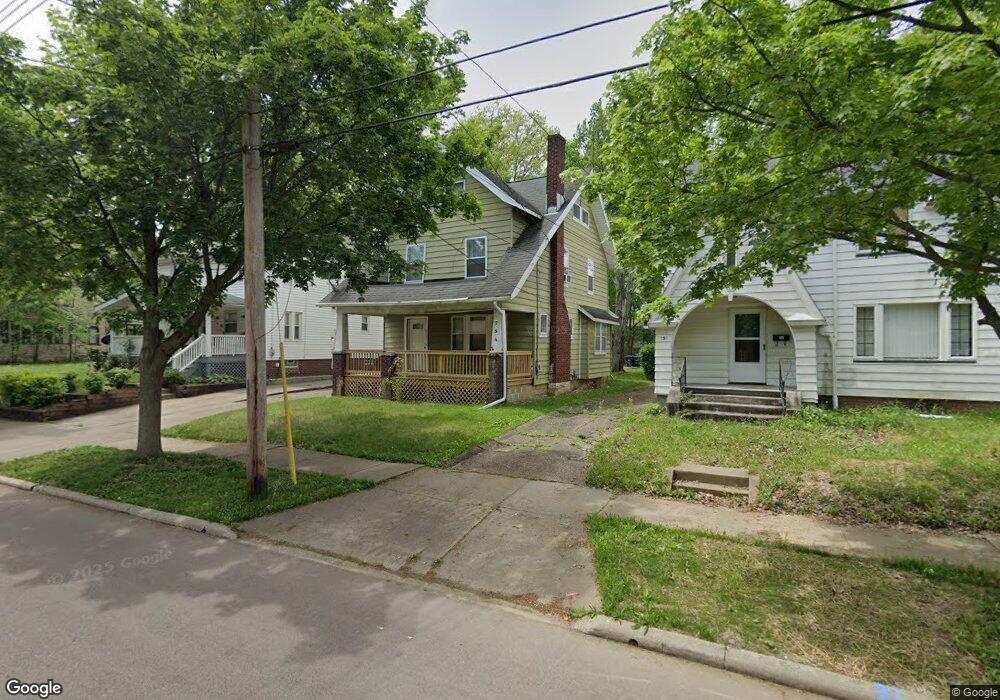

754 Noah Ave Akron, OH 44320

West Akron NeighborhoodEstimated Value: $73,622 - $103,000

3

Beds

1

Bath

1,331

Sq Ft

$69/Sq Ft

Est. Value

About This Home

This home is located at 754 Noah Ave, Akron, OH 44320 and is currently estimated at $91,906, approximately $69 per square foot. 754 Noah Ave is a home located in Summit County with nearby schools including Emmanuel Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2020

Sold by

Hamilton Harold L

Bought by

Hamilton Harold J

Current Estimated Value

Purchase Details

Closed on

Oct 11, 2017

Sold by

Jackson Orlando Thomas

Bought by

Hamilton Harold L

Purchase Details

Closed on

Dec 17, 2008

Sold by

Secretary Of Housing & Urban Development

Bought by

Allman Randall S

Purchase Details

Closed on

Jan 23, 2008

Sold by

Allman Randall S

Bought by

Jackson Orlando T

Purchase Details

Closed on

Aug 21, 2006

Sold by

Kewis Brian K

Bought by

Hud

Purchase Details

Closed on

Sep 11, 2002

Sold by

Wolfe Sandra M

Bought by

Lewis Brian K and Lewis Stephanie D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,897

Interest Rate

6.39%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hamilton Harold J | -- | None Available | |

| Hamilton Harold L | -- | None Available | |

| Allman Randall S | $1,550 | Lakeside Title & Escrow Agen | |

| Jackson Orlando T | $2,500 | None Available | |

| Hud | $38,000 | None Available | |

| Lewis Brian K | $64,900 | Falls Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lewis Brian K | $63,897 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,403 | $25,950 | $6,227 | $19,723 |

| 2023 | $1,403 | $25,950 | $6,227 | $19,723 |

| 2022 | $873 | $12,250 | $3,773 | $8,477 |

| 2021 | $874 | $12,250 | $3,773 | $8,477 |

| 2020 | $1,083 | $15,720 | $3,770 | $11,950 |

| 2019 | $934 | $12,160 | $3,750 | $8,410 |

| 2018 | $922 | $12,160 | $3,750 | $8,410 |

| 2017 | $1,055 | $12,160 | $3,750 | $8,410 |

| 2016 | $1,011 | $12,370 | $3,750 | $8,620 |

| 2015 | $1,055 | $12,370 | $3,750 | $8,620 |

| 2014 | $1,062 | $13,210 | $3,750 | $9,460 |

| 2013 | $1,106 | $14,140 | $3,750 | $10,390 |

Source: Public Records

Map

Nearby Homes

- 881 Stoner St

- 957 Mercer Ave

- 892-894 Storer Ave

- 970 Mercer Ave

- 849 Glenn St

- 1040 Mercer Ave

- 1041 Diagonal Rd

- 852 Storer Ave

- 801 Storer Ave

- VL Mercer Ave

- 615 Noah Ave

- 616 Noble Ave

- 1088 Packard Dr

- 575 Noble Ave

- 926 Winton Ave

- 614 East Ave

- 1225 Belleflower Rd

- 985 Diana Ave

- 776 Krause Ct

- 1074 Hartford Ave

Your Personal Tour Guide

Ask me questions while you tour the home.