755 W Aviary Way Gilbert, AZ 85233

Heritage District NeighborhoodEstimated Value: $504,000 - $567,000

3

Beds

2

Baths

2,149

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 755 W Aviary Way, Gilbert, AZ 85233 and is currently estimated at $537,652, approximately $250 per square foot. 755 W Aviary Way is a home located in Maricopa County with nearby schools including Oak Tree Elementary School, Mesquite Junior High School, and Mesquite High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 12, 2021

Sold by

Kennedy Phillip J and Kennedy Autumn R

Bought by

Beneficiaries Of The Kennedy Revocable Family and Kennedy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Outstanding Balance

$173,208

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$364,444

Purchase Details

Closed on

Feb 2, 2021

Sold by

Kennedy Phillip James and Kennedy Autumn Renee

Bought by

Beneficiaries Of The Kennedy Revocable F and Kennedy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Outstanding Balance

$173,208

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$364,444

Purchase Details

Closed on

Mar 17, 2009

Sold by

Fcdb Snpwl Reo Llc

Bought by

Kennedy Phillip J and Kennedy Autumn R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

5.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 12, 2009

Sold by

Fox David R and Fox Linda E

Bought by

Fcdb Snpwl Reo Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

5.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 17, 2004

Sold by

Fox Linda E and Fox David R

Bought by

Fox David R and Fox Linda E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 25, 1998

Sold by

National Model Homes Inc

Bought by

Fox David and Fox Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,250

Interest Rate

7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 17, 1997

Sold by

Diamond Key Homes Inc

Bought by

National Model Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,000

Interest Rate

9.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Beneficiaries Of The Kennedy Revocable Family | -- | Empire West Title | |

| Kennedy Phillip J | -- | Empire West Title | |

| Beneficiaries Of The Kennedy Revocable F | -- | None Listed On Document | |

| Kennedy Phillip J | $195,000 | First American Title Ins Co | |

| Fcdb Snpwl Reo Llc | $165,000 | None Available | |

| Fox David R | -- | Fidelity National Title | |

| Fox David | $167,000 | Security Title Agency | |

| National Model Homes Inc | $153,000 | Security Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kennedy Phillip J | $195,000 | |

| Previous Owner | Kennedy Phillip J | $175,000 | |

| Previous Owner | Fox David R | $180,000 | |

| Previous Owner | Fox David | $125,250 | |

| Previous Owner | National Model Homes Inc | $153,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,828 | $23,912 | -- | -- |

| 2024 | $1,773 | $22,774 | -- | -- |

| 2023 | $1,773 | $38,110 | $7,620 | $30,490 |

| 2022 | $1,714 | $29,180 | $5,830 | $23,350 |

| 2021 | $1,806 | $27,780 | $5,550 | $22,230 |

| 2020 | $1,779 | $25,170 | $5,030 | $20,140 |

| 2019 | $1,640 | $23,150 | $4,630 | $18,520 |

| 2018 | $1,593 | $21,720 | $4,340 | $17,380 |

| 2017 | $1,538 | $20,260 | $4,050 | $16,210 |

| 2016 | $1,589 | $19,870 | $3,970 | $15,900 |

| 2015 | $1,450 | $19,460 | $3,890 | $15,570 |

Source: Public Records

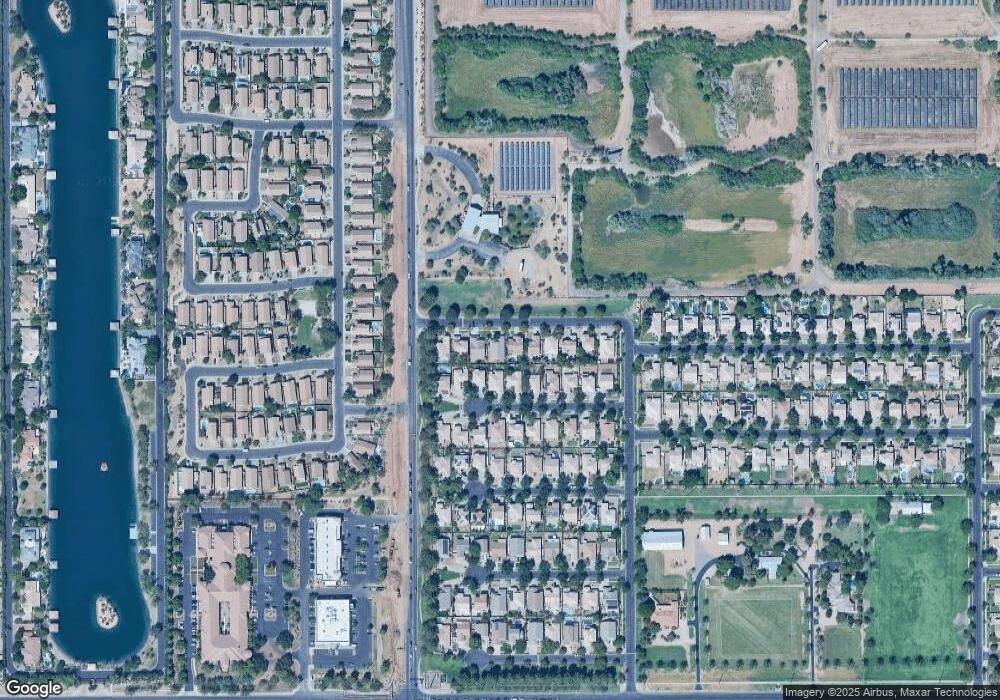

Map

Nearby Homes

- 886 W Windhaven Ave

- 564 W Aviary Way

- 870 W Page Ave

- 638 W Sierra Madre Ave

- 931 W Sierra Madre Ave

- 1072 W Windhaven Ave

- 1051 W Sierra Madre Ave

- 56 S Monterey St

- 513 W Silver Creek Rd

- 1094 W Heather Ave

- 702 W Mesquite St

- 567 W Spur Ave

- 180 N Mondel Dr

- 17 S Cholla St

- 1046 W Tremaine Ave

- 285 W Washington Ave

- 700 N Cooper Rd Unit 101-104

- 113 S Ocean Dr

- 945 W Wendy Way Unit 1068

- 20 S Catalina St

- 765 W Aviary Way

- 745 W Aviary Way

- 754 W Orchard Way

- 764 W Orchard Way

- 735 W Aviary Way

- 775 W Aviary Way

- 744 W Orchard Way

- 774 W Orchard Way

- 734 W Orchard Way

- 725 W Aviary Way

- 785 W Aviary Way

- 724 W Orchard Way

- 784 W Orchard Way

- 715 W Aviary Way

- 714 W Orchard Way

- 755 W Orchard Way

- 745 W Orchard Way

- 765 W Orchard Way

- 705 W Aviary Way

- 735 W Orchard Way