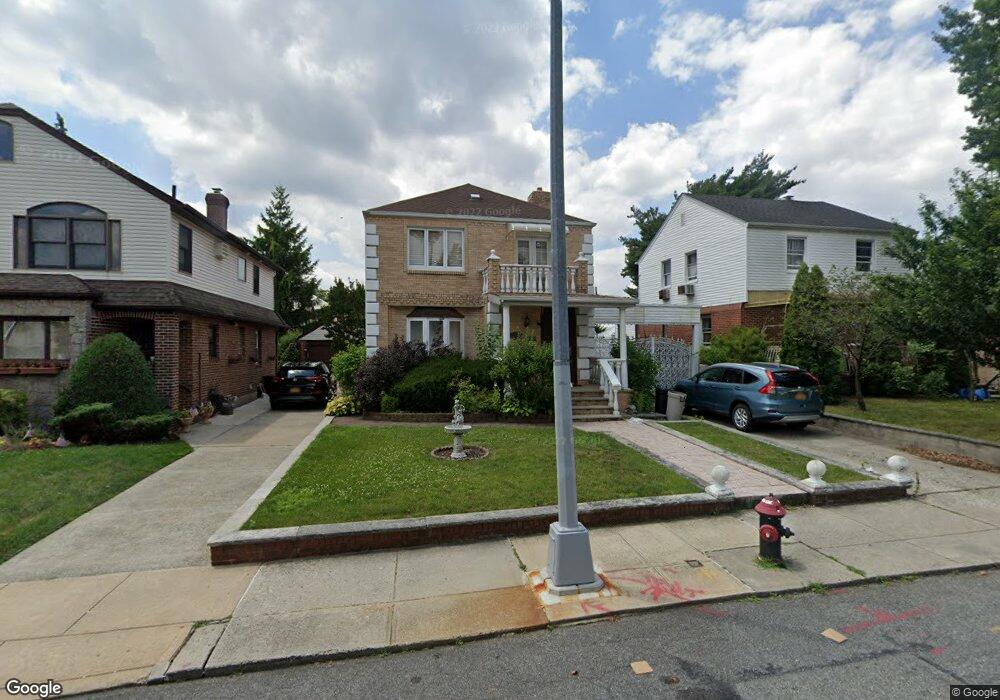

7552 185th St Fresh Meadows, NY 11366

Fresh Meadows NeighborhoodEstimated Value: $1,399,000 - $2,330,000

Studio

--

Bath

1,886

Sq Ft

$973/Sq Ft

Est. Value

About This Home

This home is located at 7552 185th St, Fresh Meadows, NY 11366 and is currently estimated at $1,835,533, approximately $973 per square foot. 7552 185th St is a home located in Queens County with nearby schools including P.S. I.S. 178 The Holliswood School, George J. Ryan Middle School 216, and Holy Family School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 9, 2022

Sold by

Fernandez Olivia Kay and Kirilyuk Deceased

Bought by

Fernandez Olivia Kay

Current Estimated Value

Purchase Details

Closed on

Mar 12, 2013

Sold by

Ilyayev Vyachesiav and Ilyayeva Tatyana

Bought by

Kirilyuk Olga and Kirilyuk Viacheslav

Purchase Details

Closed on

Oct 6, 1999

Sold by

Mochari Eliahu and Mochari Adamarion

Bought by

Ilyayev Vyachesiav and Ilyayeva Tatyana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$286,400

Interest Rate

7.68%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 20, 1995

Sold by

Muhlendorf Emanuel

Bought by

Mochari Eliahu and Mochari Adamarion

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fernandez Olivia Kay | -- | -- | |

| Kirilyuk Olga | $955,000 | -- | |

| Ilyayev Vyachesiav | $358,000 | -- | |

| Mochari Eliahu | $210,000 | Stewart Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ilyayev Vyachesiav | $286,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,373 | $65,298 | $17,157 | $48,141 |

| 2024 | $12,373 | $61,603 | $16,238 | $45,365 |

| 2023 | $11,748 | $58,493 | $16,552 | $41,941 |

| 2022 | $8,758 | $83,220 | $24,720 | $58,500 |

| 2021 | $12,139 | $72,780 | $24,720 | $48,060 |

| 2020 | $11,518 | $70,860 | $24,720 | $46,140 |

| 2019 | $10,739 | $70,680 | $24,720 | $45,960 |

| 2018 | $10,197 | $48,744 | $16,834 | $31,910 |

| 2017 | $9,936 | $48,744 | $20,002 | $28,742 |

| 2016 | $9,609 | $48,744 | $20,002 | $28,742 |

| 2015 | -- | $45,346 | $24,262 | $21,084 |

Source: Public Records

Map

Nearby Homes

- 75-56 184th St

- 8046 Chevy Chase St

- 18547 80th Rd

- 8012 188th St

- 186-35 80th Dr

- 7358 189th St

- 80-47 188th St

- 7516 180th St

- 81-22 Haddon St

- 73-50 190th St

- 80-48 190th St

- 6967 181st St

- 8064 Surrey Place

- 179-04 80th Dr

- 18108 69th Ave

- 183-19 69th Ave

- 81-48 192nd St

- 8019 Utopia Pkwy

- 18631 Radnor Rd

- 186-31 Radnor Rd