76 8th St West Point, IA 52656

Estimated Value: $231,000 - $387,096

5

Beds

5

Baths

1,865

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 76 8th St, West Point, IA 52656 and is currently estimated at $314,774, approximately $168 per square foot. 76 8th St is a home located in Lee County with nearby schools including Fort Madison High School, Holy Trinity Catholic Elementary, and Holy Trinity Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2025

Sold by

Stuekerjuergen Daniel B and Stuekerjuergen Alicia M

Bought by

Stuekerjuergen Daniel B and Stuekerjuergen Alicia M

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2023

Sold by

Stuekerjuergen Vivian M

Bought by

Stuekerjuergen Daniel B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

7.49%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Nov 19, 2021

Sold by

Binkley James L

Bought by

Binkley James L and Binkley Mary

Purchase Details

Closed on

Nov 9, 2021

Sold by

Lee County Clerk

Bought by

Lee County Of Clark

Purchase Details

Closed on

Aug 10, 2009

Sold by

Sanders Bradley P and Sanders Cara C

Bought by

Stuekerjuergen Robert F and Stuekerjuergen Vivian M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stuekerjuergen Daniel B | -- | None Listed On Document | |

| Stuekerjuergen Daniel B | -- | None Listed On Document | |

| Stuekerjuergen Daniel B | $250,000 | None Listed On Document | |

| Binkley James L | -- | None Available | |

| Lee County Of Clark | -- | None Available | |

| Stuekerjuergen Robert F | $249,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stuekerjuergen Daniel B | $250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,320 | $442,740 | $23,750 | $418,990 |

| 2024 | $6,320 | $365,810 | $23,750 | $342,060 |

| 2023 | $5,732 | $365,810 | $23,750 | $342,060 |

| 2022 | $4,238 | $279,590 | $23,750 | $255,840 |

| 2021 | $4,238 | $279,590 | $23,750 | $255,840 |

| 2020 | $4,348 | $271,620 | $25,180 | $246,440 |

| 2019 | $4,136 | $271,620 | $25,180 | $246,440 |

| 2018 | $4,260 | $256,240 | $0 | $0 |

| 2017 | $4,356 | $256,240 | $0 | $0 |

| 2016 | $4,078 | $256,240 | $0 | $0 |

| 2015 | $4,078 | $256,240 | $0 | $0 |

| 2014 | -- | $256,240 | $0 | $0 |

Source: Public Records

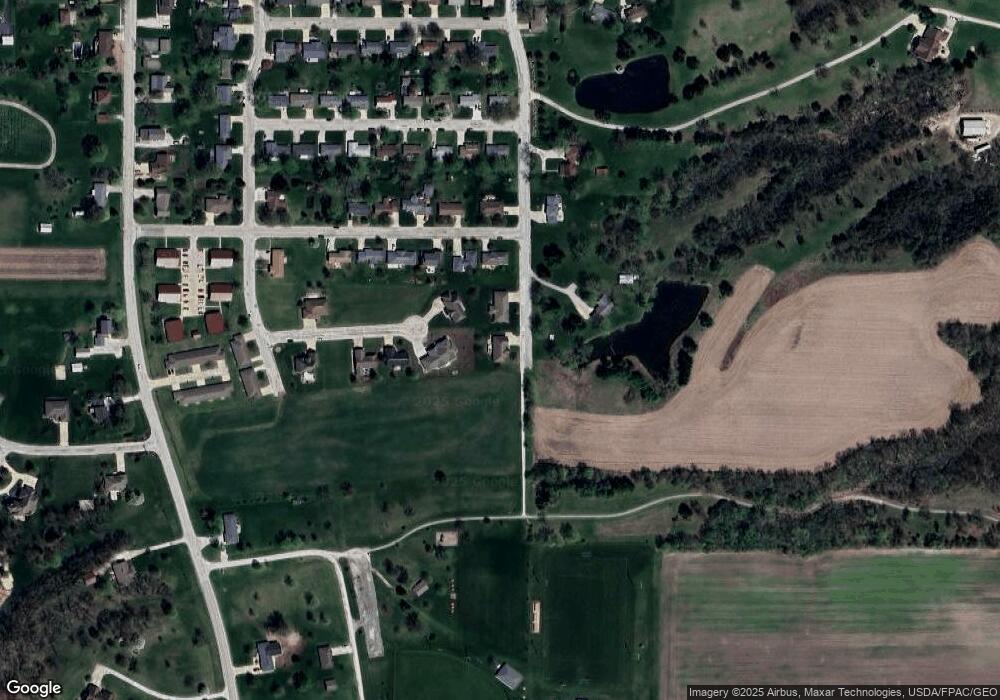

Map

Nearby Homes

- 53 5th St

- 2280 Windmill Way

- 2257 Burt Rd

- 306 Franklin 5th St

- 2042 St Paul 2nd St

- 809 Houston Ave

- 0 Blues Highway & Bluff Rd

- 4991 Bluff Rd

- 2229 235th St

- 2794 221st St

- 2078 290th Ave

- 1794 150th St

- 4601 River Bend Sub Lot 4

- 6119 Reve Ct

- 4945 Grand View Ln Unit 4945

- 2329 263rd Ave

- RR Woodland Heights Ct

- 1123 48th St Unit 20

- 0 N Hillview Vil

- 4315 Avenue L