7606 76th Way Unit 74B West Palm Beach, FL 33407

Spencer Lakes NeighborhoodEstimated Value: $267,000 - $280,000

2

Beds

2

Baths

1,236

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 7606 76th Way Unit 74B, West Palm Beach, FL 33407 and is currently estimated at $273,893, approximately $221 per square foot. 7606 76th Way Unit 74B is a home located in Palm Beach County with nearby schools including Egret Lake Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 2, 1997

Sold by

Falk Paul T and Falk Valerie E

Bought by

Manucy Karen D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,836

Outstanding Balance

$9,524

Interest Rate

7.95%

Mortgage Type

FHA

Estimated Equity

$264,369

Purchase Details

Closed on

Jul 31, 1995

Sold by

Lombardo Joseph and Lombardo Carol Ann

Bought by

Falk Paul T and Falk Valerie E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,869

Interest Rate

7.5%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Manucy Karen D | $70,000 | -- | |

| Falk Paul T | $68,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Manucy Karen D | $69,836 | |

| Previous Owner | Falk Paul T | $67,869 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,110 | $73,735 | -- | -- |

| 2023 | $1,089 | $71,587 | $0 | $0 |

| 2022 | $1,053 | $69,502 | $0 | $0 |

| 2021 | $1,041 | $67,478 | $0 | $0 |

| 2020 | $1,020 | $66,546 | $0 | $0 |

| 2019 | $1,022 | $65,050 | $0 | $0 |

| 2018 | $911 | $63,837 | $0 | $0 |

| 2017 | $872 | $62,524 | $0 | $0 |

| 2016 | $864 | $61,238 | $0 | $0 |

| 2015 | $868 | $60,812 | $0 | $0 |

| 2014 | $872 | $60,329 | $0 | $0 |

Source: Public Records

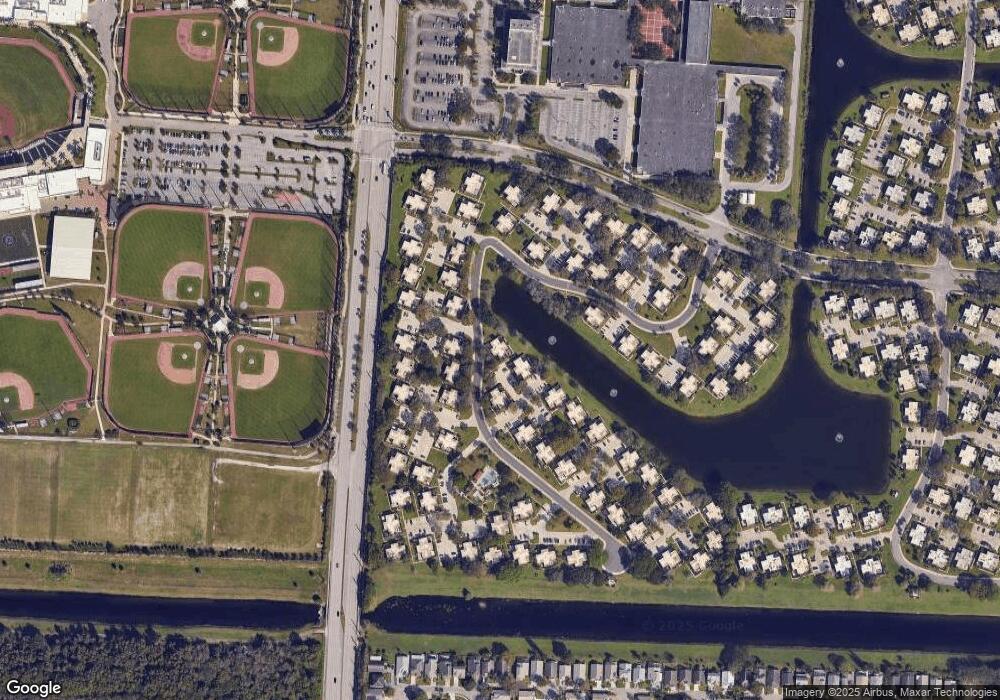

Map

Nearby Homes

- 7520 75th Way

- 7409 74th Way Unit 7409

- 7305 73rd Way

- 7311 73rd Way

- 7617 76th Way

- 7315 73rd Way

- 7105 71st Way

- 7715 77th Way

- 8025 80th Way

- 6905 69th Way

- 2409 24th Way

- 2410 24th Way

- 4583 Palmbrooke Cir

- 3231 32nd Way

- 5012 Victoria Cir

- 3202 32nd Way

- 5002 Victoria Cir

- 2610 26th Way

- 2905 29th Way

- 3819 38th Way

- 7605 76th Way

- 7607 76th Way Unit 74C

- 7608 76th Way Unit 74D

- 7609 76th Way

- 7610 76th Way Unit 7610

- 7610 76th Way Unit 73

- 7610 76th Way

- 7402 74th Way

- 7612 76th Way Unit 73D

- 7611 76th Way Unit 73C

- 7403 74th Way

- 7401 74th Way

- 7406 74th Way

- 7423 74th Way

- 7602 76th Way Unit 75B

- 7422 74th Way

- 7404 74th Way

- 7405 74th Way

- 7601 76th Way

- 7424 74th Way