Estimated Value: $426,000 - $602,000

3

Beds

3

Baths

1,372

Sq Ft

$401/Sq Ft

Est. Value

About This Home

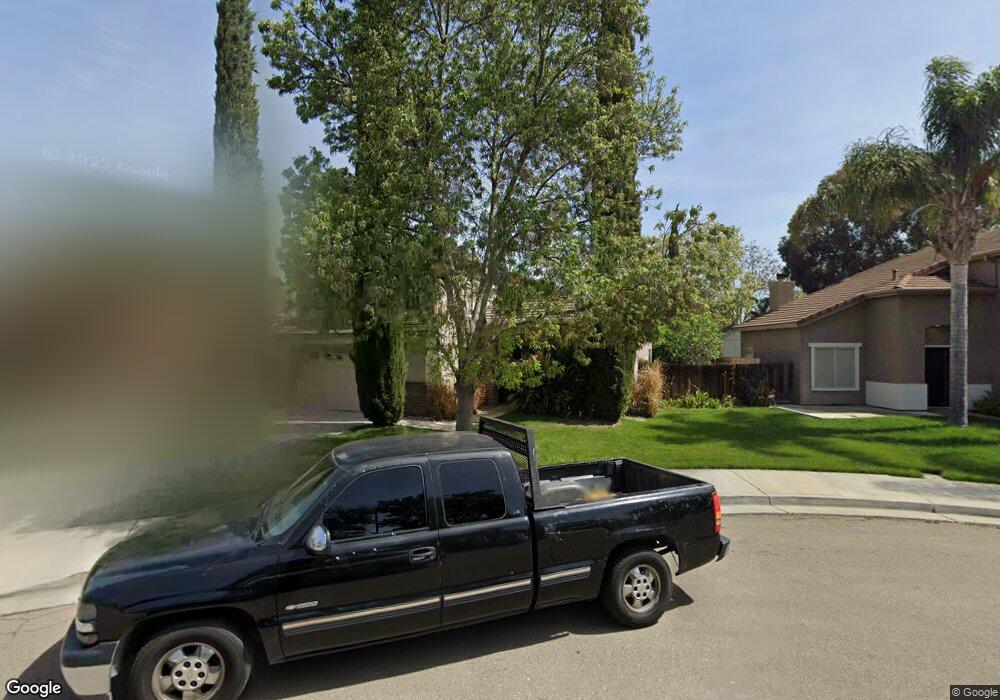

This home is located at 762 Katlin Ct, Tracy, CA 95376 and is currently estimated at $549,938, approximately $400 per square foot. 762 Katlin Ct is a home located in San Joaquin County with nearby schools including Wanda Hirsch Elementary School, Earle E. Williams Middle School, and John C. Kimball High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 26, 2015

Sold by

Diaz Carlos and The Katlin Court Land Trust

Bought by

Wiench Anthony J

Current Estimated Value

Purchase Details

Closed on

Apr 19, 2012

Sold by

Wiench Anthony J and Wiench Dilya O

Bought by

Wiench Anthony J

Purchase Details

Closed on

Sep 28, 2011

Sold by

Wiench Anthony J and Wiench Dilya O

Bought by

Diaz Carlos and The Katlin Court Land Trust

Purchase Details

Closed on

Dec 13, 2002

Sold by

Wiench Anthony J

Bought by

Wiench Anthony J and Wiench Dilya O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,200

Interest Rate

6.03%

Purchase Details

Closed on

Aug 5, 1998

Sold by

Kaufman & Broad Central Valley Inc

Bought by

Wiench Anthony J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,750

Interest Rate

6.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wiench Anthony J | -- | None Available | |

| Wiench Anthony J | -- | None Available | |

| Diaz Carlos | -- | None Available | |

| Wiench Anthony J | -- | Chicago Title Co | |

| Wiench Anthony J | $165,000 | First American Title Co | |

| Wiench Anthony J | -- | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wiench Anthony J | $235,200 | |

| Previous Owner | Wiench Anthony J | $159,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,168 | $258,279 | $94,054 | $164,225 |

| 2024 | $2,928 | $253,215 | $92,210 | $161,005 |

| 2023 | $2,880 | $248,251 | $90,402 | $157,849 |

| 2022 | $2,820 | $243,384 | $88,630 | $154,754 |

| 2021 | $2,784 | $238,613 | $86,893 | $151,720 |

| 2020 | $2,765 | $236,168 | $86,003 | $150,165 |

| 2019 | $2,719 | $231,538 | $84,317 | $147,221 |

| 2018 | $2,914 | $226,999 | $82,664 | $144,335 |

| 2017 | $2,784 | $222,549 | $81,044 | $141,505 |

| 2016 | $2,805 | $218,187 | $79,456 | $138,731 |

| 2014 | $2,579 | $210,699 | $76,729 | $133,970 |

Source: Public Records

Map

Nearby Homes

- 864 Bogetti Ln

- 1601 Spring Ct

- 925 Colonial Ln

- 50 S Hickory Ave

- 1660 Tahoe Cir

- 1745 Parkside Dr

- 1445 Yorkshire Loop

- 1555 Tahoe Cir

- 1703 Egret Dr

- 2055 Tahoe Cir

- 1856 Pelican Ct

- 761 Petrig St

- 1174 Juan Jose Ln

- 1016 Sallie Ln

- 2168 Wellington Dr

- 1990 Harvest Landing Ct

- 145 Machado Ct

- 19843-Parcel 5 Corral Hollow Rd

- 19843-Parcel 6 Corral Hollow Rd

- 1161 Andreas Ln

- 732 Katlin Ct

- 792 Katlin Ct

- 1304 Dolores Ln

- 1294 Dolores Ln

- 722 Katlin Ct

- 1313 Sienna Park Dr

- 1293 Sienna Park Dr

- 1333 Sienna Park Dr

- 1244 Dolores Ln

- 763 Katlin Ct

- 743 Katlin Ct

- 793 Katlin Ct

- 783 Katlin Ct

- 1284 Dolores Ln

- 1273 Sienna Park Dr

- 1353 Sienna Park Dr

- 723 Katlin Ct

- 1354 Dolores Ln

- 1373 Sienna Park Dr

- 1253 Sienna Park Dr

Your Personal Tour Guide

Ask me questions while you tour the home.