76901 Danith Place Unit 72 Palm Desert, CA 92211

Estimated Value: $416,000 - $549,000

3

Beds

2

Baths

1,787

Sq Ft

$282/Sq Ft

Est. Value

About This Home

This home is located at 76901 Danith Place Unit 72, Palm Desert, CA 92211 and is currently estimated at $504,502, approximately $282 per square foot. 76901 Danith Place Unit 72 is a home located in Riverside County with nearby schools including Ronald Reagan Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2009

Sold by

Mcbride Clifford Ray and Mcbride Patricia

Bought by

Mcbride Clifford and Mc Bride Patricia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,300

Outstanding Balance

$135,950

Interest Rate

5.31%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$368,552

Purchase Details

Closed on

Jul 17, 2009

Sold by

Mcbride Clifford and Mc Bride Patricia

Bought by

Mcbride Clifford Ray and Mcbride Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,300

Outstanding Balance

$135,950

Interest Rate

5.31%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$368,552

Purchase Details

Closed on

May 9, 1997

Sold by

The Oasis Llc

Bought by

Mcbride Clif and Mcbride Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

8.13%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcbride Clifford | -- | First American Title Company | |

| Mcbride Clifford Ray | -- | First American Title Company | |

| Mcbride Clif | $171,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcbride Clifford Ray | $208,300 | |

| Closed | Mcbride Clif | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,702 | $278,466 | $65,125 | $213,341 |

| 2023 | $3,702 | $267,655 | $62,598 | $205,057 |

| 2022 | $3,516 | $262,408 | $61,371 | $201,037 |

| 2021 | $3,430 | $257,264 | $60,168 | $197,096 |

| 2020 | $3,370 | $254,628 | $59,552 | $195,076 |

| 2019 | $3,310 | $249,636 | $58,385 | $191,251 |

| 2018 | $3,251 | $244,742 | $57,241 | $187,501 |

| 2017 | $3,209 | $239,944 | $56,119 | $183,825 |

| 2016 | $3,155 | $235,240 | $55,019 | $180,221 |

| 2015 | $3,166 | $231,709 | $54,194 | $177,515 |

| 2014 | $3,117 | $227,173 | $53,134 | $174,039 |

Source: Public Records

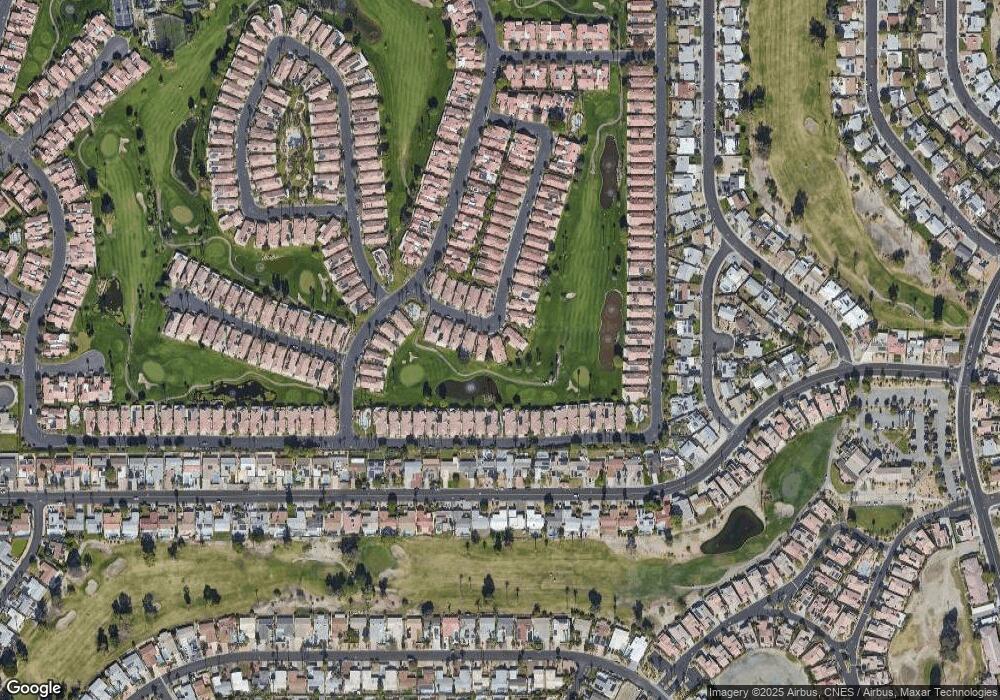

Map

Nearby Homes

- 76886 Danith Place

- 42706 Liolios Dr

- 42635 Adalin Way

- 76804 Kybar Rd

- 76788 Kybar Rd

- 42915 Wisconsin Ave

- 76914 Scimitar Way

- 42591 Saladin Dr

- 43035 Tennessee Ave

- 42535 Saladin Dr

- 42600 Wisconsin Ave

- 42451 Saladin Dr

- 76911 Ascalon Ave

- 76849 Maresh Ct

- 42405 Turqueries Ave

- 42872 Scirocco Rd

- 76835 Oklahoma Ave

- 77178 California Dr

- 42585 Iowa St

- 76895 Morocco Rd

- 76893 Danith Place Unit 73

- 76893 Danith Place

- 76909 Danith Place

- 76885 Danith Place

- 42844 Adalin Way

- 76877 Danith Place

- 42828 Adalin Way

- 76894 Danith Place

- 76869 Danith Place

- 42812 Adalin Way

- 76861 Danith Place Unit 77

- 76878 Danith Place

- 76870 Danith Place

- 42796 Adalin Way Unit 67

- 76932 Kybar Rd

- 76900 Kybar Rd

- 76940 Kybar Rd

- 42779 Adalin Way

- 76862 Danith Place

- 42780 Adalin Way Unit 54