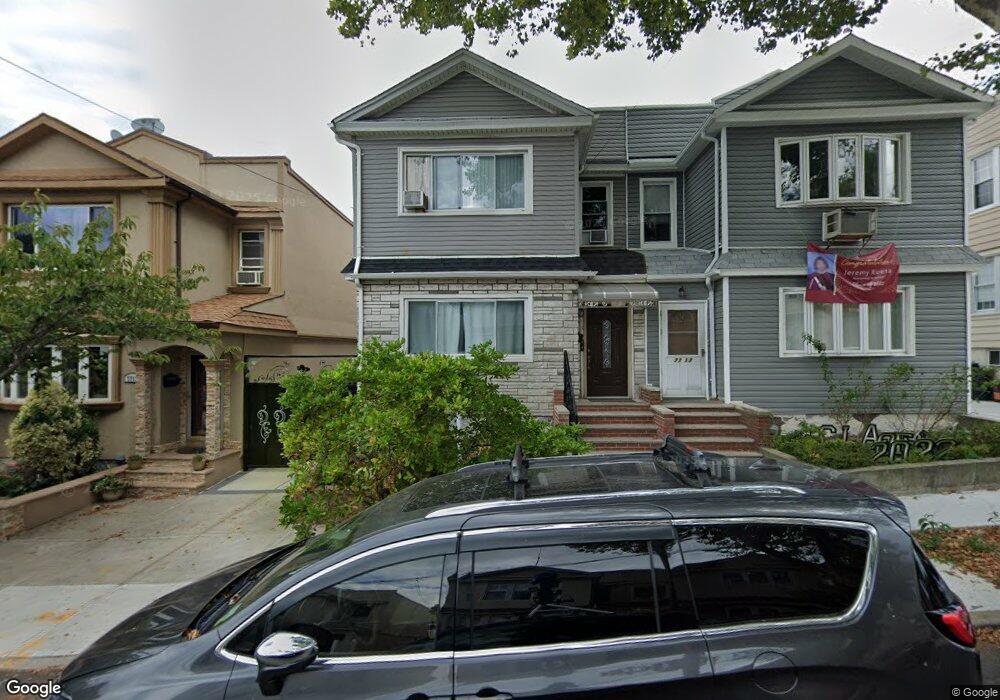

7715 64th St Ridgewood, NY 11385

Glendale NeighborhoodEstimated Value: $973,000 - $1,141,000

Studio

--

Bath

2,280

Sq Ft

$463/Sq Ft

Est. Value

About This Home

This home is located at 7715 64th St, Ridgewood, NY 11385 and is currently estimated at $1,056,707, approximately $463 per square foot. 7715 64th St is a home located in Queens County with nearby schools including P.S. 91 - Richard Arkwright, Joseph F. Quinn Intermediate School 77, and Elm Community Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2006

Sold by

Fernandes Hilda

Bought by

Campoverde Angela and Campoverde Galo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,932

Outstanding Balance

$38,777

Interest Rate

6.34%

Estimated Equity

$1,017,930

Purchase Details

Closed on

Aug 20, 1999

Sold by

Garcia James and Medina Octavio

Bought by

Fernandes Hilda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

8.1%

Purchase Details

Closed on

Apr 4, 1997

Sold by

Distefano Martin and Cuciniello Angela

Bought by

Garcia James and Medina Octavio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Interest Rate

7.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campoverde Angela | $680,000 | -- | |

| Campoverde Angela | $680,000 | -- | |

| Fernandes Hilda | $270,000 | Lawyers Title Insurance Corp | |

| Fernandes Hilda | $270,000 | Lawyers Title Insurance Corp | |

| Garcia James | $180,000 | Commonwealth Land Title Ins | |

| Garcia James | $180,000 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Campoverde Angela | $67,932 | |

| Closed | Campoverde Angela | $67,932 | |

| Open | Campoverde Angela | $544,000 | |

| Closed | Campoverde Angela | $544,000 | |

| Previous Owner | Fernandes Hilda | $170,000 | |

| Previous Owner | Garcia James | $171,000 |

Source: Public Records

Map

Nearby Homes

- 647 Cooper Ave

- 7520 64th Place

- 75-16 62nd St

- 78-14 64th Place

- 7817 64th St

- 62-16 80th Ave

- 7818 65th St

- 74-40 65th St

- 60-38 78th Ave

- 7505 60th Place

- 72-34 61st St

- 6027 78th Ave

- 60-27 Saint Felix Ave

- 62-53 80th Rd

- 60-48 80th Ave

- 65 Cooper Square Unit 3C

- 7714 Cypress Hills St

- 6020 Saint Felix Ave

- 64-39 74th Ave

- 8018 64th Ln

- 7717 64th St

- 7713 64th St

- 7721 64th St

- 7723 64th St

- 64-10 Cooper Ave

- 6408 Cooper Ave

- 6406 Cooper Ave

- 64-04 Cooper Ave Unit 2

- 64-04 Cooper Ave Unit 2fl

- 6410 Cooper Ave

- 7716 64th Place

- 7714 64th Place

- 7718 64th Place

- 6404 Cooper Ave

- 7712 64th Place

- 6412 Cooper Ave

- 7720 64th Place

- 77-20 64th Place

- 7722 64th Place

- 6414 Cooper Ave

Your Personal Tour Guide

Ask me questions while you tour the home.