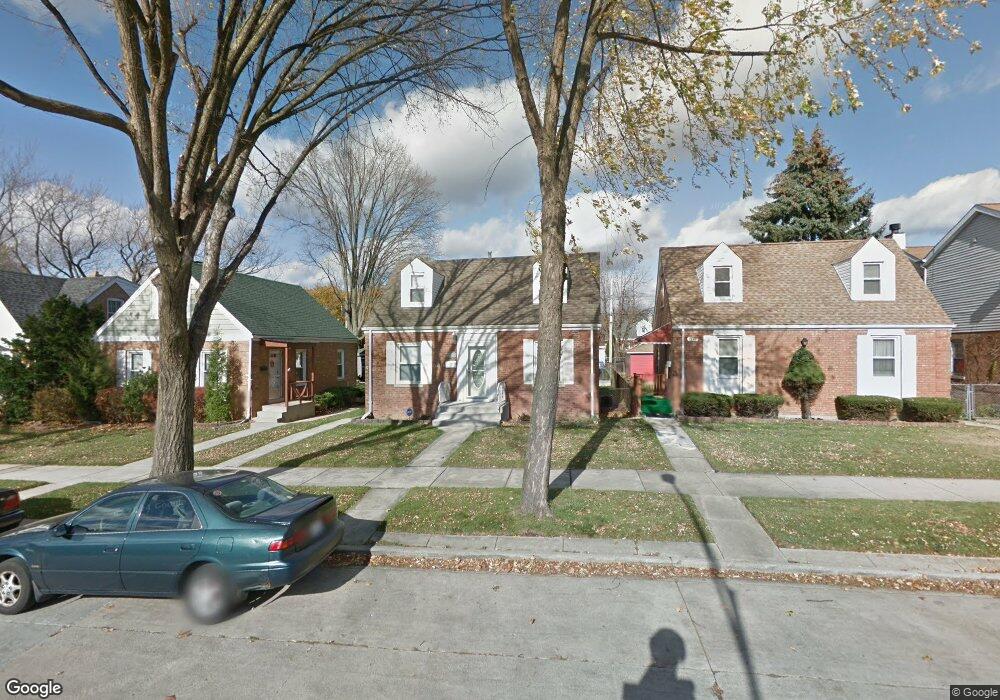

7750 W Farragut Ave Chicago, IL 60656

Norwood Park NeighborhoodEstimated Value: $403,000 - $452,000

3

Beds

2

Baths

1,103

Sq Ft

$387/Sq Ft

Est. Value

About This Home

This home is located at 7750 W Farragut Ave, Chicago, IL 60656 and is currently estimated at $427,151, approximately $387 per square foot. 7750 W Farragut Ave is a home located in Cook County with nearby schools including Oriole Park Elementary School, Taft High School, and St Eugene School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2006

Sold by

Lipsey Michael and Lipsey Mireya G

Bought by

Kataoka Jon S and Kataoka Emily M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$329,600

Outstanding Balance

$196,539

Interest Rate

6.73%

Mortgage Type

Unknown

Estimated Equity

$230,612

Purchase Details

Closed on

Aug 15, 2003

Sold by

Elkin Robert A and Elkin Yvette L

Bought by

Lipsey Michael and Mitchell Mireya G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Interest Rate

6.4%

Mortgage Type

Unknown

Purchase Details

Closed on

Nov 24, 1997

Sold by

Lazzara Kenneth J and Lazzara Carol A

Bought by

Elkin Robert A and Elkin Yvette L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,340

Interest Rate

7.45%

Purchase Details

Closed on

Jan 3, 1994

Sold by

Lazzara Kenneth J and Lazzara Carol A

Bought by

Lazzara Kenneth J and Lazzara Carol A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kataoka Jon S | $412,000 | Heritage Title Company | |

| Lipsey Michael | $315,000 | Agtf Inc | |

| Elkin Robert A | $161,000 | Chicago Title Insurance Co | |

| Lazzara Kenneth J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kataoka Jon S | $329,600 | |

| Previous Owner | Lipsey Michael | $270,000 | |

| Previous Owner | Elkin Robert A | $151,340 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,419 | $33,000 | $12,400 | $20,600 |

| 2023 | $5,261 | $29,000 | $9,920 | $19,080 |

| 2022 | $5,261 | $29,000 | $9,920 | $19,080 |

| 2021 | $5,162 | $29,000 | $9,920 | $19,080 |

| 2020 | $4,512 | $23,356 | $6,200 | $17,156 |

| 2019 | $4,468 | $25,666 | $6,200 | $19,466 |

| 2018 | $4,391 | $25,666 | $6,200 | $19,466 |

| 2017 | $4,677 | $25,100 | $5,456 | $19,644 |

| 2016 | $4,527 | $25,100 | $5,456 | $19,644 |

| 2015 | $4,361 | $26,422 | $5,456 | $20,966 |

| 2014 | $4,197 | $25,189 | $4,960 | $20,229 |

| 2013 | $4,103 | $25,189 | $4,960 | $20,229 |

Source: Public Records

Map

Nearby Homes

- 7805 W Farragut Ave

- 7809 W Farragut Ave

- 7817 W Balmoral Ave

- 5161 N Moreland Ave

- 5134 N Mission Dr

- 7511 W Foster Ave

- 7636 W Strong St

- 4937 N Ozanam Ave

- 8024 W Charmaine Rd

- 8021 W Rascher Ave

- 7632 W Norridge St

- 7501 W Winnemac Ave

- 5605 N Overhill Ave

- 7519 W Argyle St

- 7641 W Ainslie St

- 7502 W Strong St

- 7650 W Lawrence Ave Unit 201

- 7616 W Lawrence Ave Unit 3A

- 7604 W Lawrence Ave Unit 1B

- 8231 W Balmoral Ave

- 7746 W Farragut Ave

- 7754 W Farragut Ave

- 7742 W Farragut Ave

- 7758 W Farragut Ave

- 7738 W Farragut Ave

- 7751 W Berwyn Ave

- 7755 W Berwyn Ave

- 7747 W Berwyn Ave

- 7759 W Berwyn Ave

- 7734 W Farragut Ave

- 7743 W Berwyn Ave

- 7800 W Farragut Ave

- 7739 W Berwyn Ave

- 7751 W Farragut Ave

- 7747 W Farragut Ave

- 7755 W Farragut Ave

- 7730 W Farragut Ave

- 7743 W Farragut Ave

- 7759 W Farragut Ave

- 7735 W Berwyn Ave