7765 Skyview Cir Unit 21301 Cincinnati, OH 45248

Estimated Value: $250,000 - $278,000

2

Beds

2

Baths

1,645

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 7765 Skyview Cir Unit 21301, Cincinnati, OH 45248 and is currently estimated at $265,309, approximately $161 per square foot. 7765 Skyview Cir Unit 21301 is a home located in Hamilton County with nearby schools including Charles W Springmyer Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2023

Sold by

Rosado Wilmer J and Rosado Marieli

Bought by

Christy Family Trust and Stansell

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$238,500

Outstanding Balance

$233,035

Interest Rate

6.78%

Mortgage Type

New Conventional

Estimated Equity

$32,274

Purchase Details

Closed on

Dec 29, 2020

Sold by

Lipps Christina M and Corcoran Christina M

Bought by

Rosado Wilmer J and Rosado Marieli

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,750

Interest Rate

2.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 27, 2015

Sold by

Frye Suzanne Frances

Bought by

Corcoran Christina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,000

Interest Rate

4.08%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 7, 2013

Sold by

Fischer Attached Homes Ii Llc

Bought by

Frye Suzanne Frances

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,000

Interest Rate

4%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christy Family Trust | $265,000 | None Listed On Document | |

| Christy Family Trust | $265,000 | None Listed On Document | |

| Rosado Wilmer J | $205,000 | Premier Service Ttl Agcy Llc | |

| Corcoran Christina M | $154,000 | Attorney | |

| Frye Suzanne Frances | $163,990 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Christy Family Trust | $238,500 | |

| Closed | Christy Family Trust | $238,500 | |

| Previous Owner | Rosado Wilmer J | $194,750 | |

| Previous Owner | Corcoran Christina M | $114,000 | |

| Previous Owner | Frye Suzanne Frances | $132,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,472 | $68,446 | $8,750 | $59,696 |

| 2023 | $3,475 | $68,446 | $8,750 | $59,696 |

| 2022 | $3,243 | $54,146 | $8,348 | $45,798 |

| 2021 | $2,911 | $54,146 | $8,348 | $45,798 |

| 2020 | $2,949 | $54,146 | $8,348 | $45,798 |

| 2019 | $3,049 | $51,079 | $7,875 | $43,204 |

| 2018 | $3,053 | $51,079 | $7,875 | $43,204 |

| 2017 | $2,876 | $51,079 | $7,875 | $43,204 |

| 2016 | $2,936 | $52,091 | $6,580 | $45,511 |

| 2015 | $3,155 | $55,587 | $6,580 | $49,007 |

| 2014 | $3,165 | $55,587 | $6,580 | $49,007 |

| 2013 | $3,032 | $54,562 | $7,000 | $47,562 |

Source: Public Records

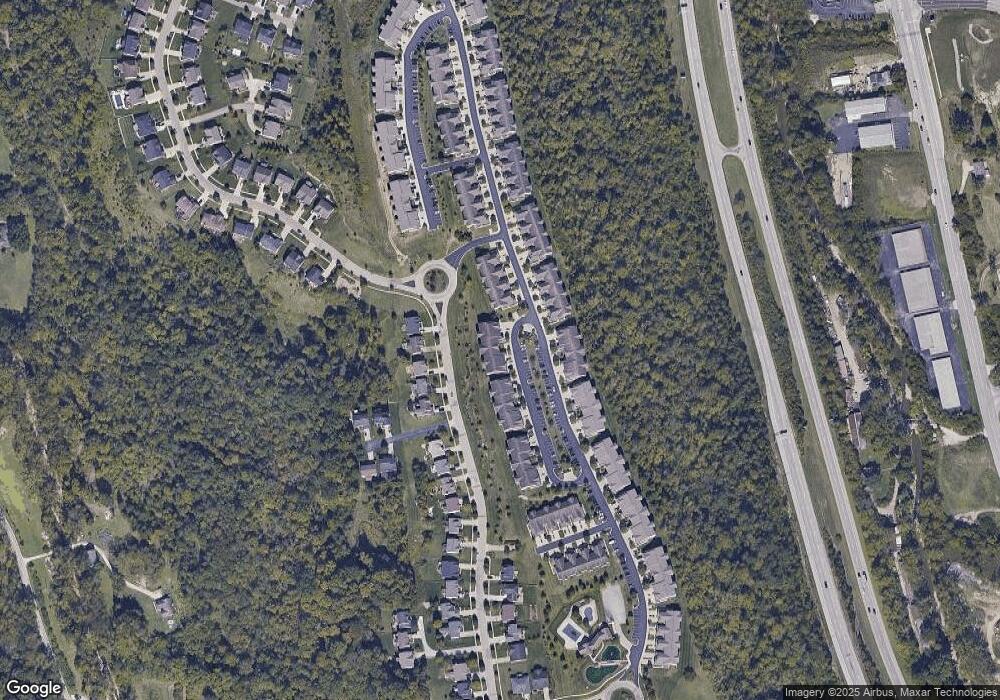

Map

Nearby Homes

- 7787 Skyview Cir

- 7601 Skyview Cir

- 7981 Oakbridge Way

- 8001 Oakbridge Way

- 6998 Harrison Ave

- 5414 Jamies Oak Ct

- 5556 Sarahs Oak Dr

- 6764 Verde Ridge Dr Unit 19A

- 6911 Ruwes Oak Dr

- 6994 Mullen Rd

- BENNETT Plan at Janson Woods

- ASH LAWN Plan at Janson Woods

- BRENNAN Plan at Janson Woods

- VANDERBURGH Plan at Janson Woods

- STRATTON Plan at Janson Woods

- BUCHANAN Plan at Janson Woods

- ALDEN Plan at Janson Woods

- LYNDHURST Plan at Janson Woods

- SHELBURN Plan at Janson Woods

- QUENTIN Plan at Janson Woods

- 7785 Skyview Cir Unit 21-30

- 7789 Skyview Cir

- 7777 Skyview Cir

- 7773 Skyview Cir Unit 21102

- 7775 Skyview Cir Unit 21202

- 7785 Skyview Cir Unit 21304

- 7777 Skyview Cir Unit 21203

- 7775 Skyview Cir

- 7763 Skyview Cir

- 7773 Skyview Cir

- 7765 Skyview Cir

- 7769 Skyview Cir

- 7783 Skyview Cir

- 7779 Skyview Cir

- 7781 Skyview Cir

- 7771 Skyview Cir Unit 21302

- 7761 Skyview Cir Unit 21201

- 7779 Skyview Cir Unit 21103

- 7781 Skyview Cir Unit 21303

- 7771 Skyview Cir