7766 Georgetown Chase Roswell, GA 30075

Roswell Historic District NeighborhoodEstimated Value: $676,005 - $754,000

3

Beds

3

Baths

2,574

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 7766 Georgetown Chase, Roswell, GA 30075 and is currently estimated at $705,501, approximately $274 per square foot. 7766 Georgetown Chase is a home located in Fulton County with nearby schools including Roswell North Elementary School, Crabapple Middle School, and Roswell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2010

Sold by

Junod Michael L

Bought by

Ciontea John

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.03%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 30, 1999

Sold by

John Wieland Homes Inc

Bought by

Junodo Michael L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,200

Interest Rate

7.85%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ciontea John | $260,000 | -- | |

| Junodo Michael L | $305,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Ciontea John | $100,000 | |

| Previous Owner | Junodo Michael L | $275,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $945 | $291,440 | $64,760 | $226,680 |

| 2023 | $945 | $284,800 | $61,360 | $223,440 |

| 2022 | $5,618 | $213,520 | $31,720 | $181,800 |

| 2021 | $6,601 | $207,280 | $30,800 | $176,480 |

| 2020 | $7,644 | $233,440 | $31,360 | $202,080 |

| 2019 | $1,027 | $207,280 | $30,640 | $176,640 |

| 2018 | $4,549 | $161,160 | $53,440 | $107,720 |

| 2017 | $3,847 | $131,840 | $45,560 | $86,280 |

| 2016 | $3,847 | $131,840 | $45,560 | $86,280 |

| 2015 | $4,582 | $131,840 | $45,560 | $86,280 |

| 2014 | $4,041 | $131,840 | $45,560 | $86,280 |

Source: Public Records

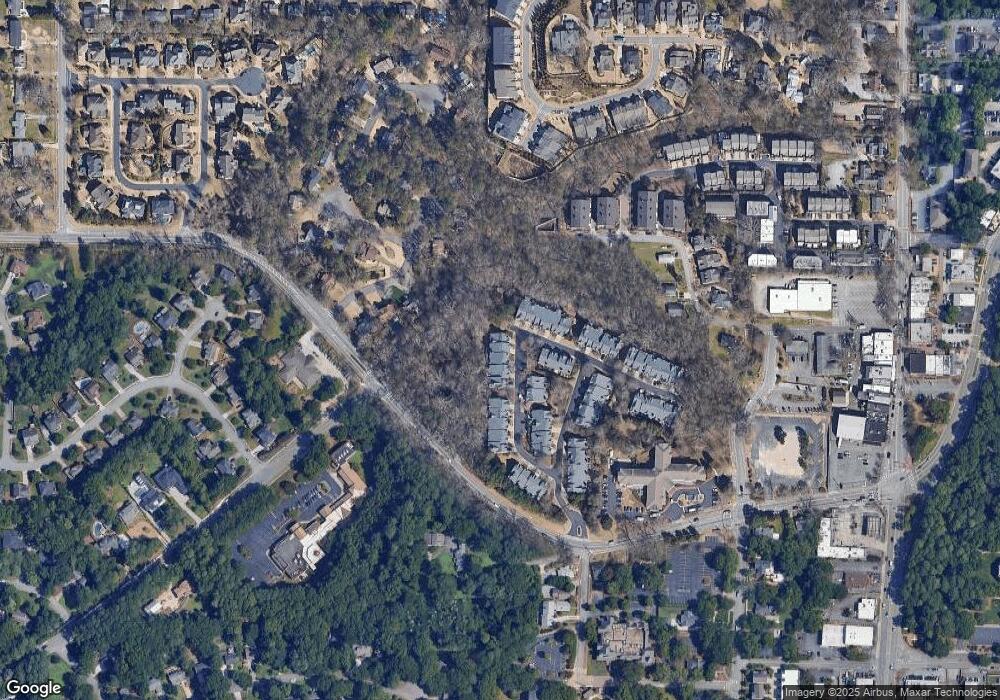

Map

Nearby Homes

- 85 Webb St

- 810 Camp Ave

- 1070 Stonegrove Ln

- 735 Camp Ave

- 410 Canton Walk

- 385 Roswell Farms Rd Unit 2

- 5060 Magnolia Walk

- 82 Wood Place

- 8040 Magnolia Way

- 180 Thompson Place

- 1144 Canton St Unit 205

- 963 Forrest St

- Brayton Plan at The Groves at Myrtle

- Blake Plan at The Groves at Myrtle

- 9760 Loblolly Ln

- 117 Bridgecrest Rd

- 121 Bridgecrest Rd

- 121 Bridgecrest Rd Unit 26

- 1130 Lake Dr

- 7764 Georgetown Chase

- 7768 Georgetown Chase

- 7770 Georgetown Chase Unit 7770

- 7772 Georgetown Chase

- 7762 Georgetown Chase Unit 7762

- 7757 Georgetown Chase

- 7757 Georgetown Chase Unit 7757

- 7760 Georgetown Chase

- 7760 Georgetown Chase Unit 7760

- 7758 Georgetown Chase

- 7773 Georgetown Chase Unit 7704

- 7755 Georgetown Chase

- 7755 Georgetown Chase Unit 7755

- 7774 Georgetown Chase

- 7756 Georgetown Chase

- 7753 Georgetown Chase Unit 7753

- 125 Pine Grove Rd

- 7776 Georgetown Chase

- 7751 Georgetown Chase

- 7752 Georgetown Chase